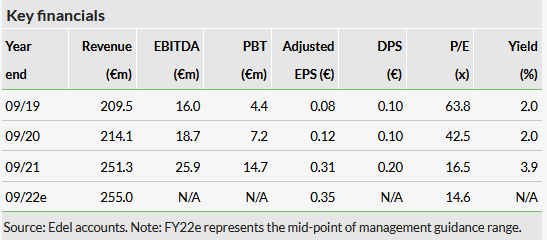

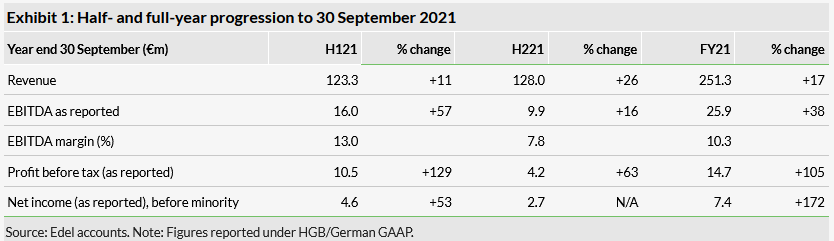

Edel’s FY21 results (to 30 September) showed the benefits of continuing strong demand for the group’s wide range of digital content, alongside the sustained demand for physical vinyl. H221 revenue was 26% ahead of the prior year, delivering overall FY21 revenue growth of 17% to €251m, well ahead of management’s guided range of €220–230m. Inflation and supply chain issues ate into H221 margins and this is set to be an ongoing feature through FY22, with guidance on revenue and net income broadly flat year-on-year. The very strong 12-month share price performance has eroded, but not closed, the discount to Edel’s publishing and entertainment peers.

Universal agreement extension

The group’s range of activities, with a strategic focus on music, have allowed it to ride the turbulent consumer markets through the pandemic with relatively little negative impact. Working with all the major streaming platforms, Kontor New Media has benefited from strong end-user demand for digital content, while the continuing popularity of vinyl supports strong demand at optimal media. Here, additional investment has been made (€9.2m in FY21, likely further spend in FY22, as yet unquantified) to scale up for the full, extended Universal Music Group (AS:UMG) contract, which came into effect in January 2022. This covers warehousing, manufacture and a broader range of territories, as well as logistics, which it has been handling since 2017. Competition in other physical carrier production (CDs, DVDs, Blu-ray) remains high as producers scrap in a declining market, with the implication that the competitive position will adjust in time.

Outlook: Flat to modest growth

Management guidance is for FY22 revenues in the €250–260m range, delivering net income of €7.0–9.0m. This indicates a degree of conservatism on the top line assumptions, given the reasonable underlying trading conditions. No guidance is given at the EBITDA level, so it is difficult to draw conclusions about operating margins, but we assume that inflationary pressures for physical product at optimal media may be offset by efficiency gains through an internal restructure, given that the range for FY22 net income encompasses the FY21 figure.

Valuation: Continued discount to content, publishing

We have maintained the same valuation approach as previously, comparing Edel’s rating with the global media subsectors of entertainment content and publishing. The shares trade at a significant discount on EV/sales, most likely reflecting the manufacturing element. While the P/E multiple is at a premium, the discount on historical EV/EBITDA remains substantial at 49%.

Financials

Edel published its full year report to end September 2021 in late January

Revenue growth remained strong in H221, with demand both in digital, where music streaming retains its positive trends, and in vinyl, where the attractions of high-quality reproduction are supporting further progress. Edel reports in two segments: Manufacturing and logistics (equates to optimal media) and Marketing and sales, which wraps in all the group’s interests across books, music and entertainment. For the year just reported, both elements increased by 17%, leaving the split unchanged at 47%:53% respectively.

There was far more change in respect of the geographic distribution of revenues, which we assume relates to the stepping up in the remit of the Universal Music Group contract. The most marked difference is in revenues generated in the UK, which rose 94% on the prior year, lifting the percentage of group revenue to 37% from 22% in FY20. Germany (+13% on the prior year) remains the most important territory, at 38% of group, from 40% in FY20.

Personnel costs rose by less than revenues (+14%), while the other operating costs line benefited from the reduction in pandemic-restricted travel costs, rising just 3%. There was a larger uplift in fee and licence expenses, which mostly relate to the digital music platform at Kontor New Media.

The income statement accounts for potential tax liabilities that may arise from the application of trade taxes on additional licences and from the treatment of revenues derived from pursuing those that have illegally abused rights, as previously guided. Minority interests of €0.8m, up from €0.2m, stem from the physical side of the group, reflecting the continuing good performance, both in vinyl and in book publishing.

EBITDA converted to cash at a rate of 92% (down from 126% in the previous year), supporting investment of €11.5m, up from €7.0m reflecting the upgrading and extension of facilities to support the Universal Music contract. We anticipate further spending here in the current year, but with the bulk of the investment outlay having fallen into FY21. €0.6m of shares were bought back in the period.

Net debt at the year end was €34.5m, consisting of cash and cash equivalents of €8.8m, less financial liabilities of €43.3m, down from €56.8m at the end of the prior year. There is considerable additional flexibility in the balance sheet, with credit lines undrawn at end September of a further €37.6m.

FY22 guidance and outlook

FY22 guidance is for sales in a range of €250–260m versus the €251m achieved in FY21. Given that the extended Universal Music contract started in January 2022, this implies an element of caution over top line growth from the remainder of the business, which is perhaps understandable given the uncertainty over the outlook for consumer spending across Europe in the face of rising household overheads.

Input cost inflation is also a key consideration for the physical production side of the group. To date, the group has been successful at passing the bulk of the increase through to customers, but there will doubtless be a limit to the success of this strategy.

The group’s concentration on the high-quality end of the market looks sensible, with pricing far less of an issue for premium packaged box sets, for example. Competition has been very intense in the production of CDs, DVDs and Blu-ray in Europe, where the remaining producers are scrapping in a structurally declining market. We would anticipate some consolidation and/or withdrawal of some players from the market here.

On the digital distribution side, Edel has trading relationships with all the major streaming providers (Spotify, Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) etc), and an increasing number of emerging channels, so it is less exposed to vacillations in market share between them.

The FY21 report refers to some structural simplification at a group level, with all the book publishers merged into Edel Verlagsgruppe.

Valuation

Our valuation framework for Edel is unchanged from our previous note. Analysis is complicated by the range of the company’s activities, from pressing CDs for third parties through children’s animated TV, to being the market-leading publisher of cookery books and handling logistics and services for the world’s largest music publishers. Any peer group comparison is therefore inevitably limited. Given these constraints, rather than selecting a set of inadequate peers, we have looked globally across the main subsectors in which Edel operates, particularly entertainment content and publishing, to examine key valuation metrics based on consensus forecasts. We have stripped out unprofitable companies from our EV/EBITDA and P/E calculations, as well as any obvious distortive outliers.

Click on the PDF below to read the full report: