Ebiquity (LON:EBQ) has had a good first half, with a 20% uplift in revenues and a return to operating profit, with an underlying operating margin of 7%. Our expectations for the full year and for FY22e are edged up, although there remain notes of caution around prospects in some sectors in H2. Ebiquity is making good progress with its digital activities and product solutions, which we expect to support the medium-term growth. The share price performance year-to-date has been strong (up 194%), but the valuation remains at a sizeable discount to peers.

Share Price Performance

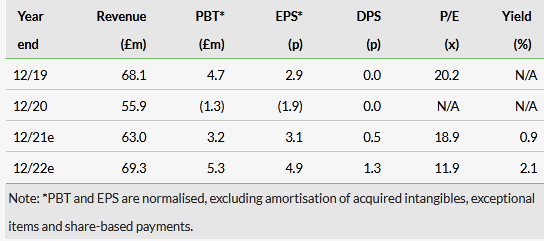

FY21e and FY22e numbers edged ahead

Ebiquity’s good first half reflects a stronger underlying market as advertising spend has rebounded, with an element of catch-up from work delayed from FY20 and enhanced by the growth from the group’s newer digital media solutions. Ebiquity also had the benefit of new business won in Q421 and the full year effect of work won post Accenture’s withdrawal from the market. Most sectors have recovered strongly, bar the obvious such as transport and tourism, but management notes that supply chain issues in the broader global economy are curbing the recovery in advertising spend in sectors such as automotive and consumer electronics. This slight caution is reflected in our revised forecasts, where we have raised FY21e revenue expectations from £61m to £63m, with £32m achieved in H121. For FY22e, the figure rises by £1m to £69.3m. Adjusted operating profit rises from £3.5m to £4.1m for FY21e and from £5.9m to £6.2m for FY22e, indicating a good uplift in operating margin to 6.5% for the current year and to 8.9% for the next.

Broadening out the geographic profile

Ebiquity’s client roster is of high quality, particularly in the UK and Europe. Management is tackling its under-weighted exposure to the United States (8.4% of FY20 revenues) and new business wins of a leading food and beverage company alongside global business from Amazon (NASDAQ:AMZN) should shift the dial here. Progress is also being made in Asia-Pacific, where ‘significant’ business has been won with Huawei and MengNiu in China. The group plans to start to offer services in India in H221.

Valuation: Sizeable discount remains

In the year to date, Ebiquity’s shares are up by 194%, having bottomed at 18.4p in February. Marketing services peers have gained 82% on average as the outlook for advertising spend has firmed up. Parity with these peers for FY22 across P/E, EV/EBITDA and EV/EBIT multiples would suggest a value of 98p. This is a good uplift on the 77p cited in our last report, reflecting the strong sector performance.

Good progress in H121

Media comprises the main part of revenues (84% of H121). Within this segment, the agency pitch environment was particularly busy, with many selection processes for major brands having been carried over from FY20. New review mandate business was won from Unilever (LON:ULVR), Ferrero, BMW (DE:BMWG) and Daimler (DE:DAIGn), among others. There was also an element of catch-up in the Contract Compliance activity, with the collation of data and on-site audits made easier by loosening COVID-19 restrictions.

Digital media solutions are starting to make more of an impression, which should be more apparent when progress on the key operational metrics is given for the full year.

The emphasis on growing the revenues from key clients cross-selling more products is also starting to bear fruit, with a 28% uplift in revenues from global, multi-market media projects.

With the prospect of the re-emergence of inflation, clients are especially keen to ensure that they achieve a good return on their marketing spend.

Click on the PDF below to read the full report: