- Tech titans Amazon and Apple are set to report earnings next week.

- In this piece, we will take a look at what to expect from their reports.

- Alongside those two companies, we will also discuss a couple more companies set to report in the same week.

- Use the MASTERPRO coupon to get a spectacular discount on your InvestingPro subscription by clicking on this link.

- Revenue: $90.614 billion (-4.45%)

- Earnings Per Share (EPS): $1.51 (-0.67%)

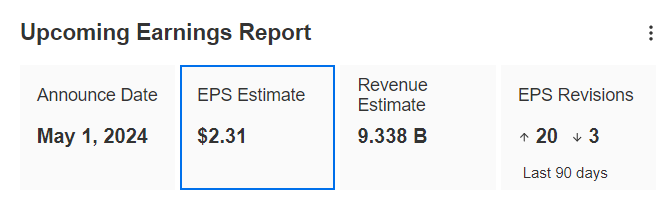

- Revenue: $9.338 billion (+0.76%)

- Earnings Per Share (EPS): $2.31 (+7.44%)

Q1 earnings season heats up next week as tech giants Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) step into the spotlight to deliver their quarterly reports. This will mark the sixth out of the seven Magnificent companies to unveil their financial performance, with the tech sector so far exceeding expectations.

This week saw Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Microsoft (NASDAQ:MSFT) ignite investor enthusiasm, with the stocks soaring 11% and 4% respectively in after-hours trading on surpassing analyst estimates.

Meta Platforms (NASDAQ:META), however, presented a contrasting story. Despite exceeding projections, the company's stock plummeted around 11% after issuing weak guidance for the second quarter and outlining plans for increased spending on AI development.

Adding to the week's mix of surprises, Tesla (NASDAQ:TSLA) stock jumped despite underperforming in its Q1 financial performance. Although the EV giant's figures fell short of forecasts, the announcement of accelerated production and launch plans for lower-cost vehicles in the latter half of 2025 propelled its stock price up by 12%.

All eyes now turn to Amazon and Apple next week, as investors eagerly await their earnings reports and the potential for further positive surprises in the tech sector.

What to Expect From Apple, Amazon Earnings?

Amazon

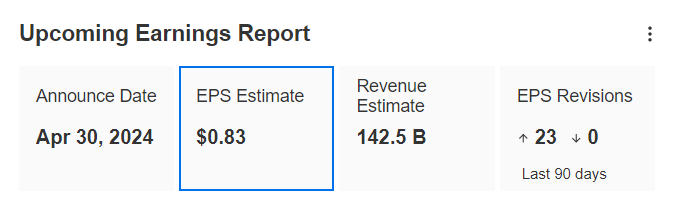

Get ready for a potentially explosive earnings report from Amazon. Analysts are projecting double-digit revenue growth of 11.85% to $142.5 billion, and even more impressive, a triple-digit increase in earnings per share (EPS) of 167.7% to $0.83.

Source: InvestingPro

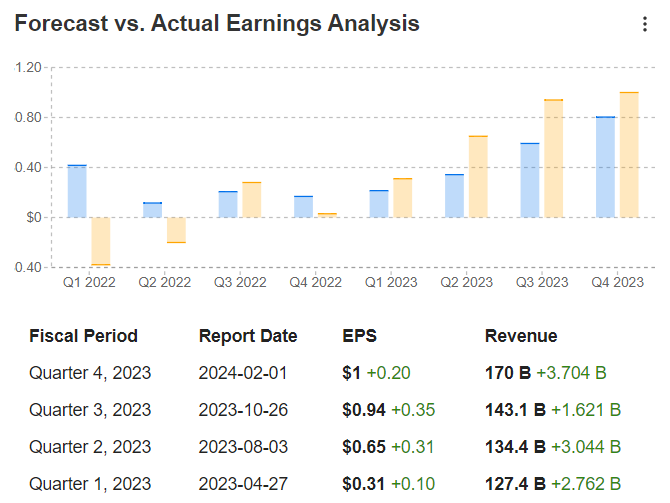

Amazon has a proven track record of exceeding expectations, boasting a streak of 4 consecutive quarters where it has surpassed analyst projections for both revenue and earnings. Additionally, the market has historically responded favorably, with Amazon's stock price typically rising on the day following earnings reports.

Source: InvestingPro

Based on these trends, investors have reason to be optimistic about Amazon's upcoming report. All signs point towards a strong performance that could further propel the stock.

Apple

In contrast to the optimism surrounding other tech giants, Apple faces a more pessimistic outlook as analysts revise their forecasts downward, anticipating a drop in both revenue and earnings for the second quarter.

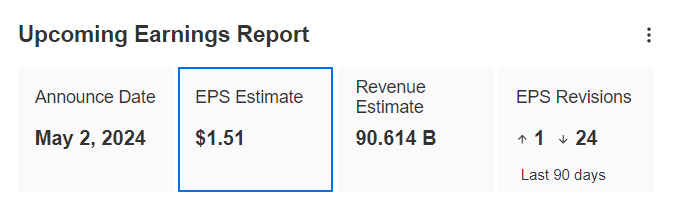

Projected Results:

Source: InvestingPro

This shift in sentiment is mostly due to a recent report from IDC. The report revealed a concerning 6.6% decline in smartphone shipments to China, a key market for Apple. This news, coupled with Apple losing its leading position in the region to competitor Huawei, has fueled the pessimistic outlook.

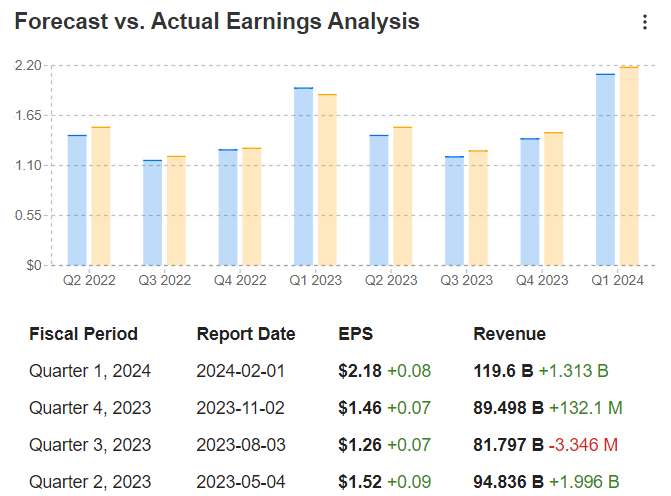

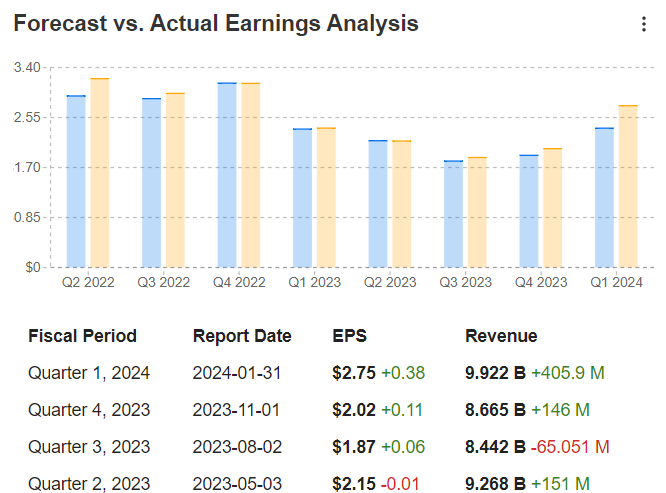

However, it's important to consider Apple's historical performance. The company boasts a strong track record of exceeding analyst expectations for earnings. In fact, data from InvestingPro shows that Apple has surpassed projections in three out of its last four quarterly reports.

Apple investors have demonstrably rewarded the company for exceeding revenue expectations in past reports. Despite the current market pessimism surrounding Apple, a positive earnings surprise could significantly improve investor sentiment. This is especially important considering Apple's stock price has declined by 11.7% year-to-date in 2024.

Bonus - 2 More Tech Companies Report: AMD, Qualcomm

AMD

Analysts are tempering expectations for Advanced Micro Devices (NASDAQ:AMD) despite the company's position as a potential leader in the AI boom alongside NVIDIA (NASDAQ:NVDA). Forecasts predict moderate revenue and earnings growth for AMD in the first quarter.

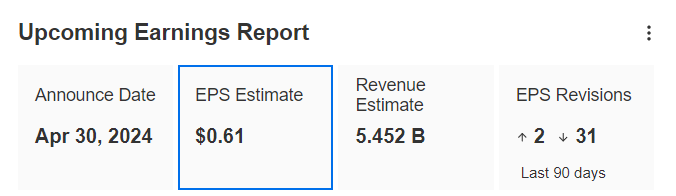

Specifically, analysts anticipate revenue of $5.452 billion, reflecting a modest increase of 1.85%. Earnings per share (EPS) are also expected to see a moderate rise, projected to reach $0.61, representing a 1.67% growth.

Source: InvestingPro

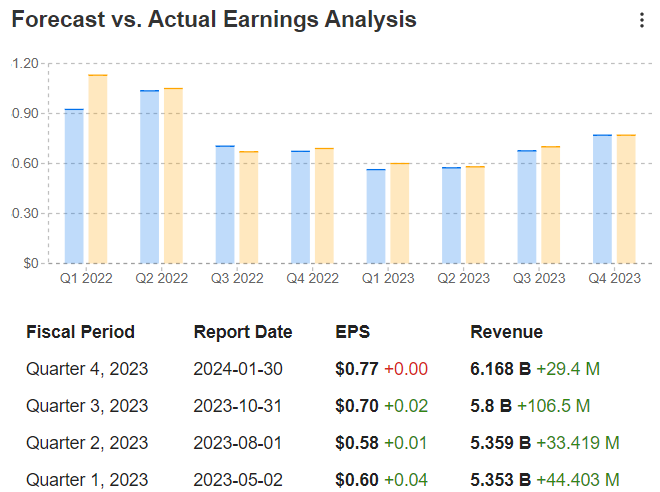

However, AMD's historical performance presents a mixed picture. While the company has a track record of exceeding analyst forecasts, market reactions paint a different story. According to data from InvestingPro, markets have reacted negatively to AMD's earnings reports in 3 out of the last 4 quarters. This negativity likely stems from AMD's tendency to offer underwhelming future guidance during these reports.

Source: InvestingPro

AMD faces a double whammy: not only does it compete with giants like Nvidia and Intel (NASDAQ:INTC), but new Chinese government guidelines restrict the use of US-made microprocessors in government computers. These regulations, issued last month, raise concerns for AMD's future in the Chinese market.

Despite this headwind, AMD's stock price has surprisingly surged by 4.2%. This upcoming earnings report will be crucial for investors to gauge whether the booming Artificial Intelligence (AI) market can offset the negative impact of the Chinese regulations.

Qualcomm

Qualcomm (NASDAQ:QCOM), the microprocessor manufacturer, is placing a strategic bet on artificial intelligence (AI) for smartphones and wearable devices. However, despite this strategic move, analysts are only predicting marginal growth in the company's quarterly revenue.

Qualcomm heads into its meeting with Wall Street boasting a two-quarter streak of exceeding analyst expectations. However, investor sentiment remains mixed. After the company signaled a loss of market share in China during its last earnings report, the stock price dipped despite exceeding expectations.

The company's performance this quarter will be closely examined to address two critical questions. Firstly, investors are anxious to determine if Qualcomm is losing its grip on its primary market. The outlook provided for the quarter will be a key indicator of any challenges the chipmaker might be facing in its core business.

Secondly, the report will shed light on whether Qualcomm's strategic investments in Artificial Intelligence (AI) are paying off. With the company's stock price already up nearly 13% year-to-date, AI presents a potential catalyst for further growth.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This content, which is prepared purely for educational purposes, cannot be considered as investment advice. We also do not provide investment advisory services.