By Kathy Lien, Managing Director of BK Asset Management.

2015 has been a great year for the U.S. dollar but with only 5 trading days left many investors are wondering if being long dollars in 2016 is still a smart trade. December has been a difficult month for the greenback with dollar bulls struggling to maintain control. The Federal Reserve raised interest rates for the first time since June 2006 but instead of appreciating, the dollar erased nearly all of November's gains. Now many investors are wondering that if a rate hike and hawkish forward guidance can't lift the dollar, is it foolish to be buying greenbacks in 2016. To answer that question we have to understand why investors sold dollars in December. The bet that the dollar would rise in 2015 was one of the world's most crowded trades and according to the CFTC's Commitment of Traders report, forex futures traders were busy adjusting positions ahead of the December 16 FOMC meeting. The biggest changes were in euro and yen where investors aggressively cut their short euro and short yen positions. This means that investors started to unwind their long dollar trades ahead of FOMC and based on the price action after the meeting, liquidated further after the rate hike. Buying dollars became a very crowded trade in 2016 and a lot of money moved to the sidelines at the end of the year.

This means there's money to put back into play in 2016

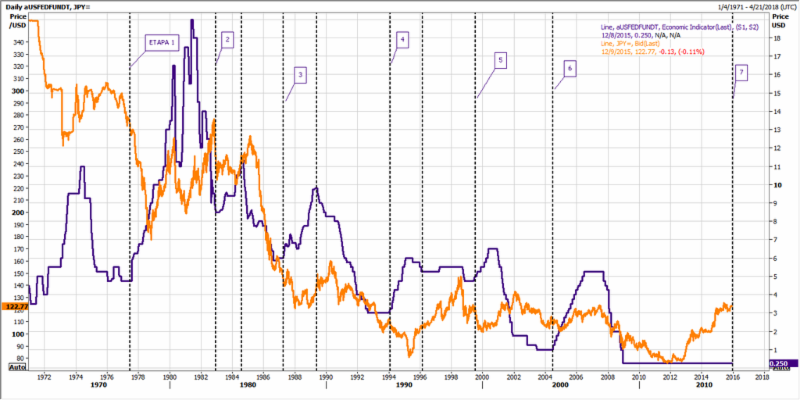

Yet positioning was not the only reason why investors bailed out of the greenback. According to the following chart past tightening cycles have not been good for the dollar and this scared many investors. While USD/JPY generally appreciated leading up to the rate hike, on a number of occasions it reversed course after tightening but this cycle is different because the first few months of the year will be good for the U.S. economy and the dollar. The warm El Nino weather and low gas prices will boost consumer consumption, which is already supported by steady job creation, wage growth and consumer borrowing. The Fed also welcomes new hawks to their roster of FOMC voters.

But first lets be clear, the Fed's rate hikes will not cause a recession. It may slow the economy in the second half of the year but contraction is highly unlikely. Some investors are worried that the recent move by the Fed could trigger a recession but there are very few indicators and low {{|oil prices}} have never caused a downturn in the U.S. Of course that could change as the Fed raises interest rates if they move too quickly. One of the greatest challenges is that higher interest rates do not hit the economy in predictable ways. They take time to percolate and it is difficult to predict the point at which the impact shifts from mild to severe. The quarter point hike is only a small tweak in rates and even if the Fed hikes by another 50 to 75bp next year (which is our preferred scenario), the impact on consumer spending and investment will be limited by the fact that most American mortgages are fixed rate, unlike Europe. Also businesses could view the Fed's tightening as a sign of confidence in the economy and they could be slow to adjust their investments. So at the onset the biggest impact will be on the U.S. dollar.

More Hawks in the Birdcage in 2016 - The performance of dollar hinges on when the Federal Reserve will raise interest rates again. The next meeting is on January 26-27 and as there's zero chance that rates will be increased in the first few weeks of the New Year, consolidation in the dollar is likely. However if the Fed maintains an optimistic view on the economy, expectations for a rate hike in March will grow, leading to renewed strength for the greenback. It is important to understand that with each new year comes a new group of Fed Presidents and in 2016 4 votes rotate. Four hawks and 1 dove will replace 1 hawk, 1 dove and 2 neutrals. So the balance swings in favor of more consistent tightening. So while the dollar is rich, we believe the path of least resistance is still in higher in the first half of the year. Our outlook changes in the second half of 2016 when we believe rate hikes and the strong dollar will force the Fed to slow their pace of tightening marking the top for the greenback and the bottom for other major currencies.

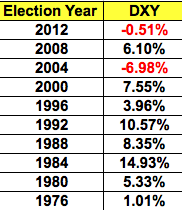

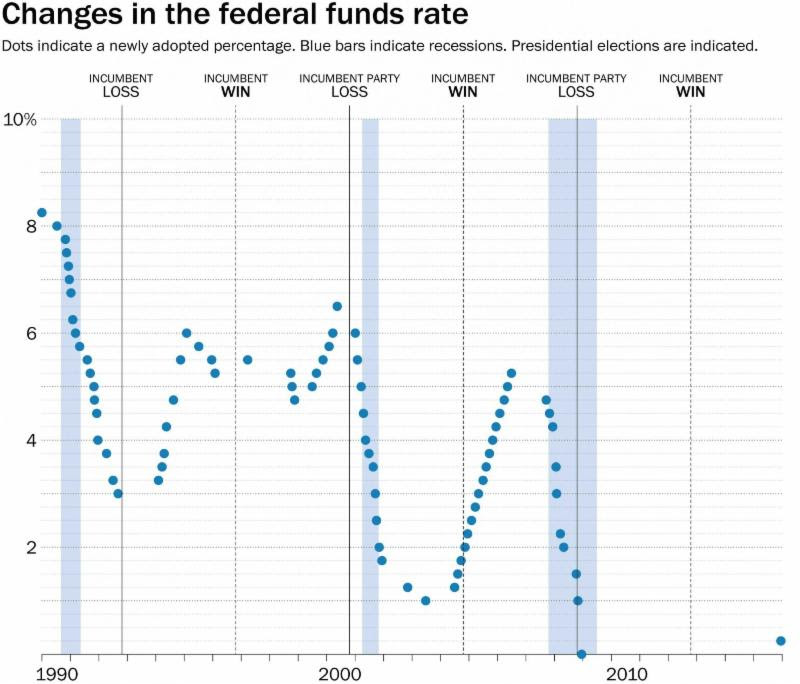

Election years are good for the dollar. The table below shows that the Dollar Index increased an average of 5% during an election year with the index rising 8 out of the last 10 periods. In 1 of the 2 years that the Dollar Index declined, the greenback lost approximately 0.5%. While it can be argued that Fed policy is not affected by elections, the time of major monetary policy shifts has often coincided with presidential elections. The second chart was created by the Washington Post and while their data only covers 6 election cycles, there's definitely a notable trend.

Technically there appears to be a double top forming in the Dollar Index. However 96 is a fairly significant support level that should hold and we expect the index to make another run for 100 after which it should test the 61.8% Fibonacci retracement of the 2001 to 2008 decline near 102.