Drought pushes grain prices up

Great plains district in the US suffers from drought that can affect the grain crops. The grains futures prices started rising. For how long will this trend last?

Dry weather can affect the wheat crops not only in the US, but in Ukraine and Russia as well. For instance, grain production in Ukraine can contract by 10%. On CBOT exchange, the net short position in soy, wheat and corn is held, according to Commodity Futures Trading Commission. This means that major market participants expect the further decline in prices. In our opinion, the scenario can develop in case weather improves. Let’s study the Personal Composite Instrument (PCI) chart.

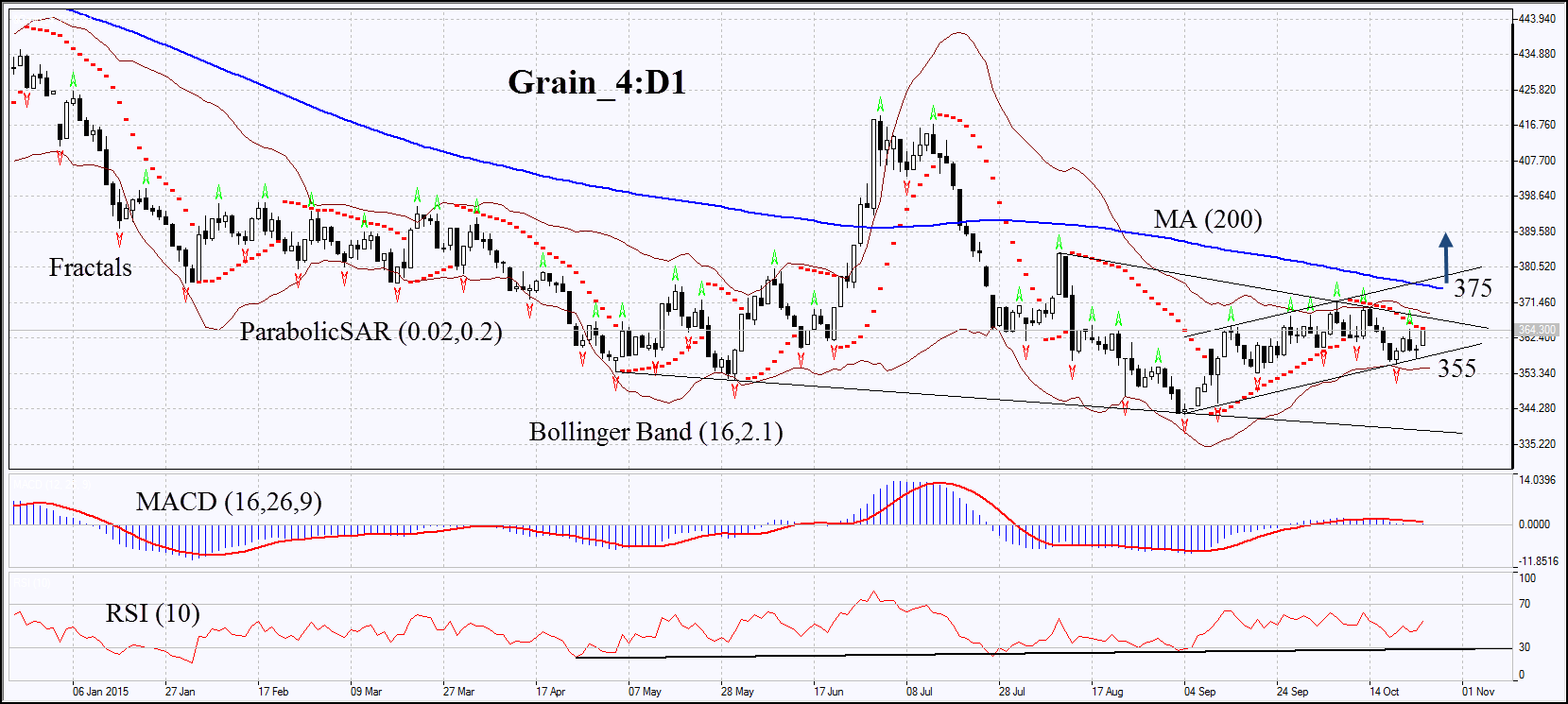

On the daily chart, the PCI Grain_4:D1 is in downtrend. All indicators give sell signals except for RSI, which has formed the positive divergence and exceeded the level of 50. The Bollinger Bands® contracted, which can mean lower volatility. The bullish momentum can develop in case PCI surpasses three last upper fractals and its 200-day moving average and the Bollinger Band at 375. The level can serve the point of entry. The initial risk limit is possible below the last lower fractal and the lower Bollinger Band at 355. Having opened the pending order, we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss, moving it in the direction of the trade. If the price meets the stop-loss level at 355 without reaching the order at 375, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Position Buy Buy stop above 375 Stop loss below 355