- Walt Disney will publish its quarterly results on Wednesday, February 7, after the US stock market closes.

- Results from Disney+ and other streaming services will be closely watched.

- This will be a key test for the bulls as the stock outperformed in January.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: Experience AI-managed stock portfolios with a proven track record of performance.

- ProTips: Access digestible information condensing complex financial data into a few concise words.

- Advanced stock screener: Identify top-performing stocks based on your criteria, considering numerous financial metrics.

- Historical financial data for thousands of stocks: Empower fundamental analysis professionals to delve into comprehensive details.

- Plus, stay tuned for additional services we have in the pipeline!

Walt Disney (NYSE:DIS) is poised to report modest year-over-year (YOY) gains in both revenue and net income as it unveils its first-quarter fiscal 2024 earnings results after today's market close.

This highly anticipated report follows the stock's recent surge to an 8-month high of $97.93, with a gain of over 7% since the beginning of the year.

Notably, Walt Disney shares, which have lagged behind the S&P 500 for the past three years, have now more than doubled the index's gains in January alone. Against this backdrop, today's report will be pivotal in determining whether this outperformance will continue or if a correction is imminent.

In this article, we'll delve into the consensus forecasts for today's results, highlighting key details to watch for.

Additionally, we'll analyze the stock's profile using ProTips, and conclude by examining the projected targets for the stock based on insights from analysts and InvestingPro models.

What are the consensus forecasts for Disney's results?

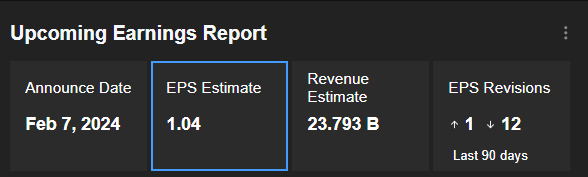

Analysts are expecting EPS of $1.04, almost 27% higher than in the previous quarter, but up by only 5% year-on-year.

Source: InvestingPro

Sales are forecast at $23.79 billion, up 12% on the previous quarter, but up a very modest 1.2% on the same quarter last year.

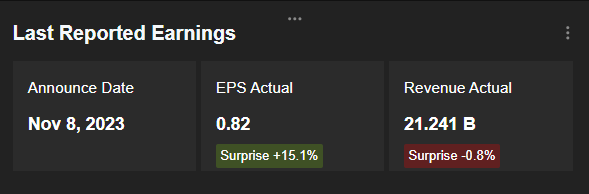

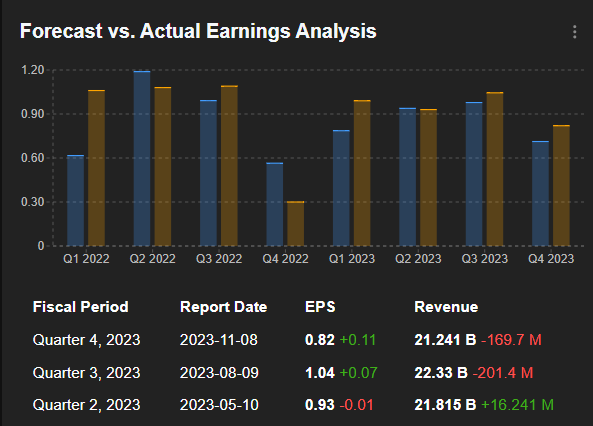

However, it is also important to point out that Walt Disney has exceeded earnings expectations for the last two consecutive quarters, notably beating forecasts by more than 15% in the previous quarter.

Source: InvestingPro

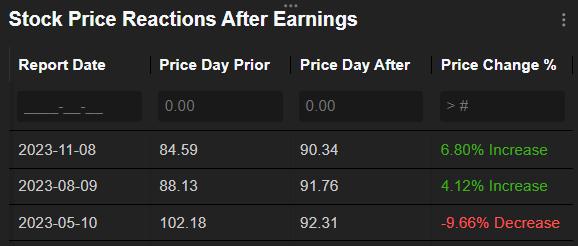

Interestingly, sales have disappointed over the last two quarters, but this has not prevented the stock from reacting positively, as InvestingPro data shows.

Source: InvestingPro

Source: InvestingPro

Conversely, in the quarter preceding these 2 quarters of EPS overshooting, Disney had very slightly missed EPS expectations, while exceeding earnings forecasts, which nonetheless sent the share plunging.

This suggests that the stock is far more sensitive to EPS data than to earnings data, and we'll need to keep this in mind if we're to react well to today's release.

To be watched closely

Beyond these main figures, investors interested in Walt Disney shares will have several details to keep a close eye on.

While the company is moving away from traditional cable services, which has weighed on some of Disney's historical segments, the company has made big strides in streaming, with Disney+, ESPN+, and Hulu.

Thus, subscriber growth for these services is a key metric for judging the company's prospects. Revenues in this segment are expected to reach $5.45 billion, a new record, and up 13% year-on-year.

On another note, we'll also be keeping an eye on any potential updates regarding the battle between the company and activist investor Nelson Peltz, CEO and founder of Trian Partners.

Peltz has proposed new candidates for Disney's board of directors and has continued to push for changes within the company as a major shareholder.

Walt Disney profile update with InvestingPro ProTips

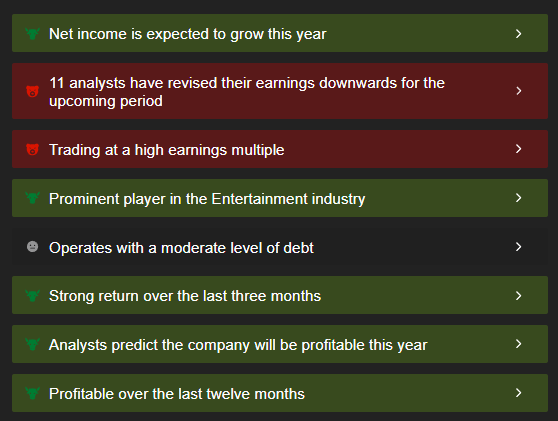

When it comes to Walt Disney's profile, the ProTips reveal more strengths than weaknesses.

Source: InvestingPro

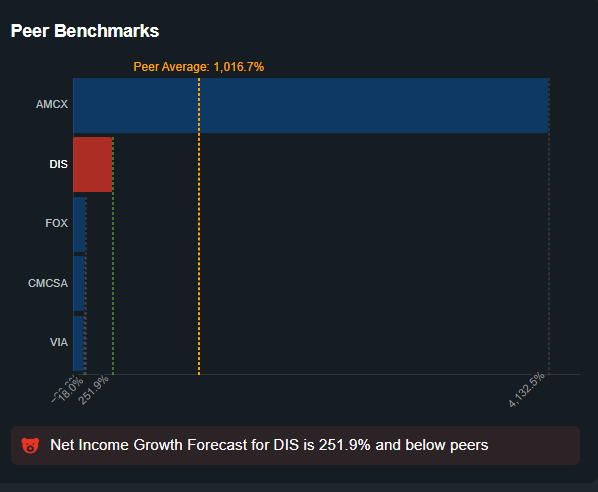

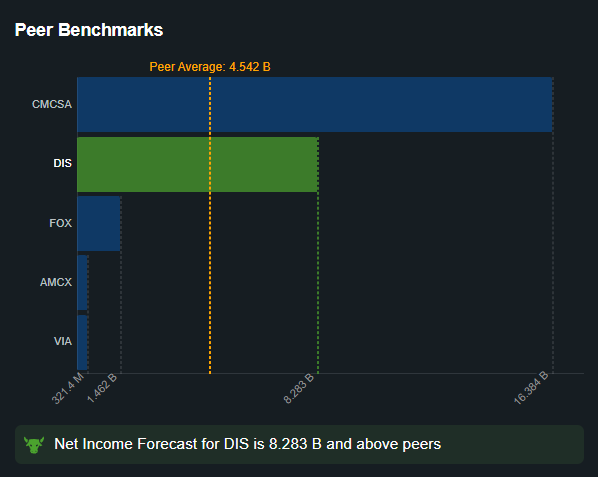

Notably, net income is expected to rise this year, although anticipated growth is below the peer average.

Source: InvestingPro

Moreover, the company has been profitable over the past 12 months, and analysts expect this to remain the case this year.

Source: InvestingPro

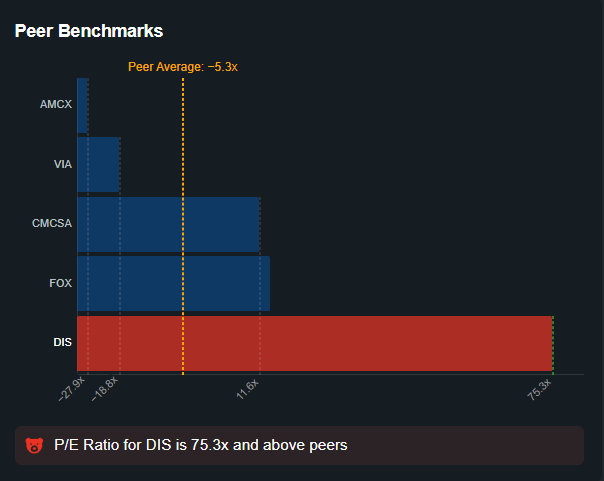

On the negative side, InvestingPro ProTips note that the stock is trading on high earnings multiples.

Source: InvestingPro

What do analysts and models predict for Walt Disney shares?

Finally, it's also worth taking stock of what analysts are forecasting for the stock, and what valuation models can tell us.

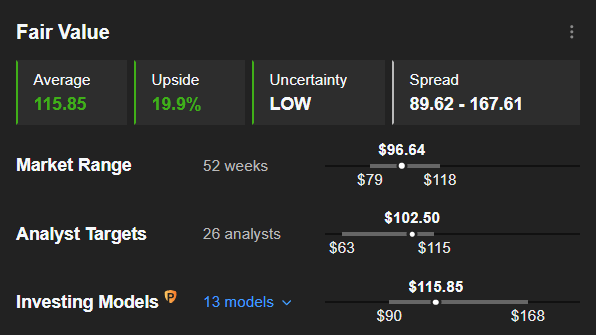

As far as models are concerned, the InvestingPro Fair Value for Walt Disney shares, which synthesizes 13 recognized financial models, stands at $115.85, i.e. almost 20% above Monday's closing price.

Source: InvestingPro

Analysts, on the other hand, are slightly less optimistic, anticipating a rise in the share price to $102.50 within 12 months, or just over 6% above the current price.

Conclusion

While the Walt Disney share has outperformed the S&P 500 since the start of the year, today evening's results will be a key test of the share's short-term direction.

The company's recent trend of surpassing EPS expectations doesn't eliminate the possibility of positive news that could significantly boost the stock, especially considering the historical data available on InvestingPro.

***

As a reader of our articles, you can take advantage of our InvestingPro stock market strategy and fundamental analysis platform at a reduced rate, with a 10% discount, thanks to the promo code "ACTUPRO", valid for 1 and 2-year Pro+ and Pro subscriptions!

Click here to subscribe, and don't forget the promo code "ACTUPRO", valid for 1 and 2-year Pro and Pro+ subscriptions!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.