After a year of underperformance, a better-than-expected earnings report on Wednesday suggests that the Burbank, California-based Walt Disney (NYSE:DIS) may be getting some of its magic back.

The entertainment giant reported that its quarterly profit rose to $1.06 a share, well ahead of the $0.57 average of analysts' estimates. Sales in the period ended Jan. 1 increased to $21.8 billion, also topping expectations. The stock jumped 3.4% on the news, closing Thursday at $152.16.

Disney's shares lost 14.4% during the past year, as growth in its fastest-expanding business segment, Disney+, slowed. The downtrend steepened in November after the company announced subscriber numbers that fell short of Wall Street projections.

However, that was not the case this time. The company's flagship Disney+ unit added 11.8 million new streaming subscribers, reaching 129.8 million at the end of the holiday quarter. According to FactSet, analysts' consensus was for fewer than seven million additional subscribers.

Moreover, subscription numbers displayed strong growth from the 118.1 million subscribers recorded in the prior quarter.

Another encouraging sign came from the company's parks division, which posted $2.45 billion in operating income, compared with a loss from a year earlier. Revenue from the resorts unit also doubled from lows during the pandemic, showing strong consumer demand.

These figures indicate that the worst pandemic-related damage to Disney's massive entertainment empire may be over.

New Content

In an earnings call reported by the Wall Street Journal, Chief Executive Bob Chapek told investors that the recent turnaround in subscription growth results from Disney's focus on creating new content for its most popular franchises, including Star Wars and Marvel.

Chapek also highlighted the decision to bundle Disney+ subscriptions with its Hulu and ESPN+ services, displaying a more general interest in TV series and live sports.

Furthermore, he added that the company is still on track to reach 230 million to 260 million Disney+ subscribers by the end of fiscal 2024.

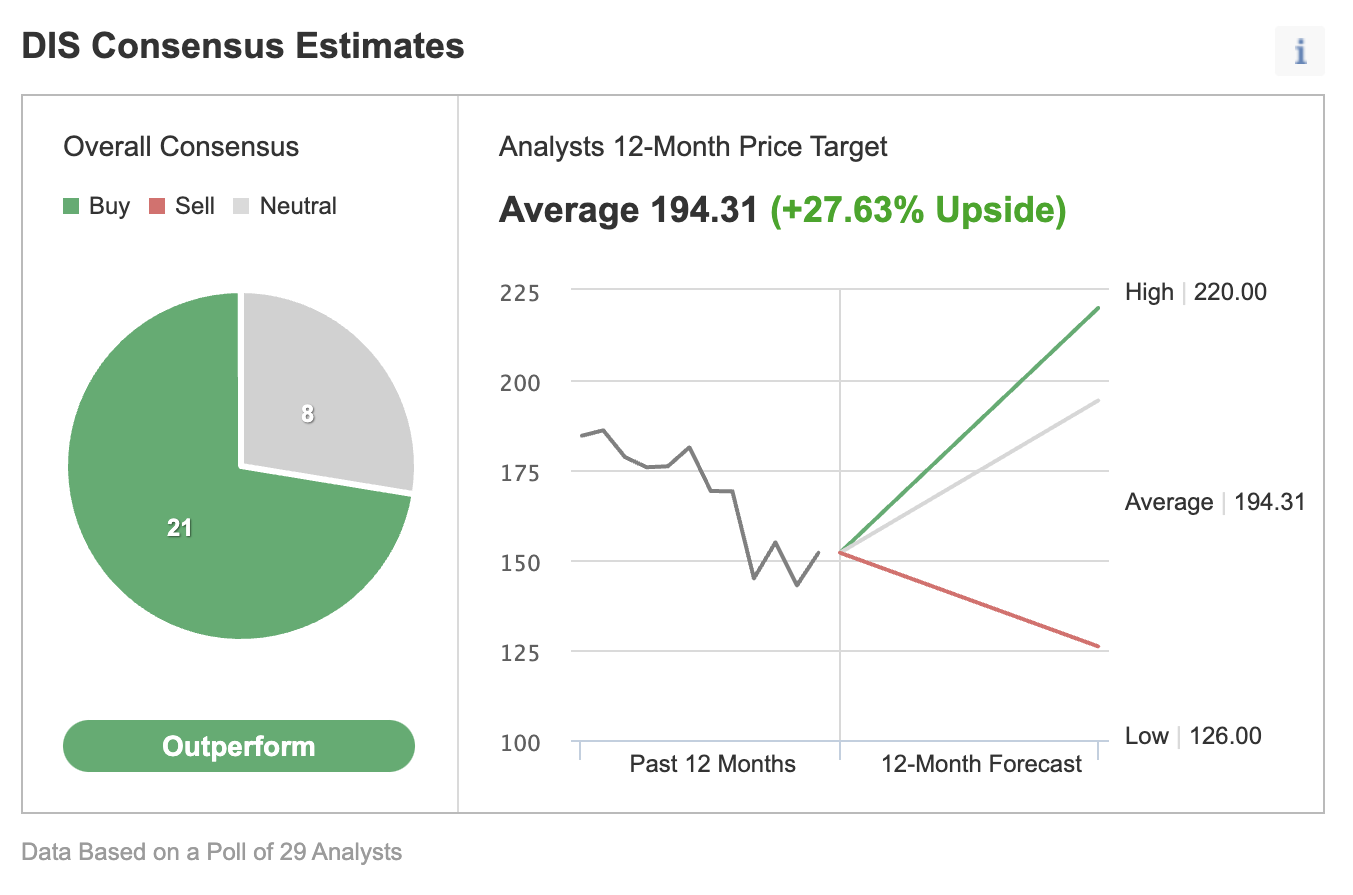

Disney's earnings beat proved the resilience of the company's diversified entertainment model and encouraged many Wall Street analysts to issue positive statements. Analysts' consensus estimate in an Investing.com poll of 29 forecasters implies a 27.6% upside potential for the stock.

Source: Investing.com

JPMorgan, which has an overweight rating and $200 price target on the stock, said in a note:

"Even more notable were strong Parks results, which we had expected to be solid after Comcast/Universal results in January, but they were even better on very high margins due to improving yields from dynamic pricing on admissions, as well as significantly higher per caps, and the popularity of new products ... We maintain that Disney should see Park's margins exceed pre-pandemic levels in F23 as Disney continues to enhance the guest experience with new attractions and improved operations."

Morgan Stanley also highlighted a strong trend in consumer spending, helping the company generate more income. Its note added:

"Disney is achieving this success despite operating below capacity and without the benefit of international tourism, thanks to over 40% growth in spending per capita relative to 2019."

Bottom Line

Disney's latest earnings report shows that the entertainment giant is on track to resume growth in its legacy businesses after the pandemic-driven slump in demand. With that, its flagship streaming service is still in a strong growth mode.

Both developments bode well for its stock.