After a series of smaller acquisitions in CY24, discoverIE (LON:DSCV) has acquired Burster Group, a German-based sensor business, for cash of €30.6m/£25.9m. Generating operating margins above the group target of 15%, Burster will join the Sensing cluster within Sensing & Connectivity. discoverIE estimates the deal will be earnings accretive for FY26; we upgrade our FY26 underlying diluted EPS by 1.3%.

Pro forma gearing of 1.6x at the end of FY25 sits at the lower end of the 1.5–2.0x target range, leaving further headroom for future deals.

Bolstering Sensing cluster with German acquisition

discoverIE has acquired Burster Group, a German-based designer and manufacturer of specialist sensors for markets closely aligned with discoverIE’s target markets. Founded in 1961, Burster sells into c 60 countries, with c 40% of revenue from outside of Germany. Burster generated revenue of €18m/£15m in CY24, with an underlying operating margin above discoverIE’s 15% medium-term target. The company is paying €30.6m/£25.9m in initial cash on a debt-free, cash-free basis with a €12.4m/£10.5m earn-out dependent on financial performance in CY25. Burster will join the Sensing cluster, within the Sensing & Connectivity division, and its existing ongoing management and brand will be retained.

EPS accretive in FY26

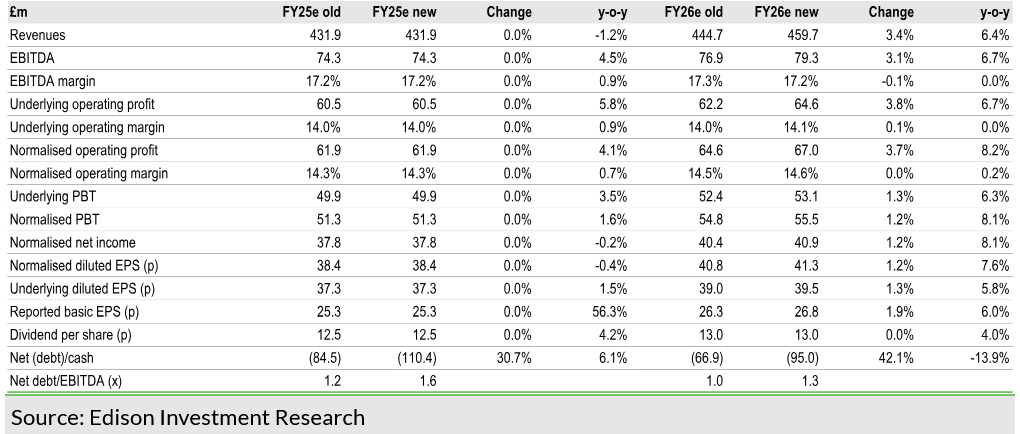

We have revised up our FY26 revenue, operating profit and underlying diluted EPS forecasts by 3.4%, 3.8% and 1.3% respectively. We forecast a small 0.1pp increase in the FY26 underlying operating margin to 14.1%. The company estimates that pro forma gearing at the end of FY25 will increase from 1.25x to 1.6x and we forecast an increase in end-FY26 gearing from 1.0x to 1.3x. Based on our conservative EBIT forecast, discoverIE is paying a forward EBIT multiple of 10.8x (9.2x EBITDA), in line with recent larger deals.

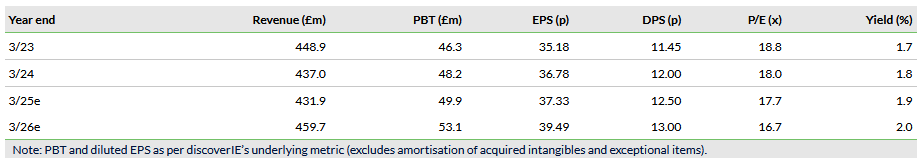

Valuation: Discount has widened

After a bounce post interims, the stock has declined over the last month and now trades at an 18% discount to its broader UK industrial technology peer group on FY25 P/E and at a larger discount to peers with a similar decentralised operating model (such as Halma (LON:HLMA) and Spirax (LON:SPX)). Considering that the earnings outlook has been maintained and the company continues to make excellent progress towards its margin targets, we believe this discount is overdone. With an active M&A pipeline and post this deal, c £45m of debt headroom, we expect further acquisitions to boost growth and earnings.

Changes to forecasts

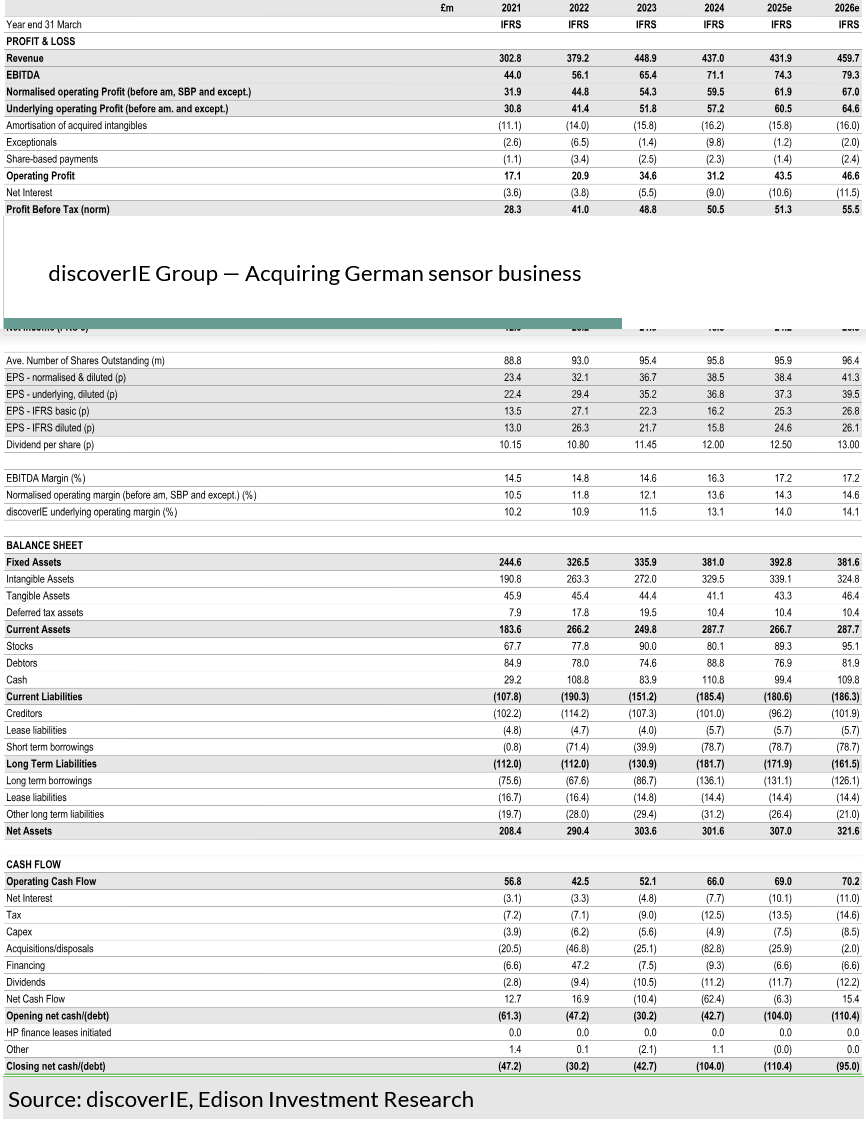

Exhibit 1: Changes to forecasts

Exhibit 2: Financial Summary