DiscoverIE's (LON:DSCV) trading update confirmed that performance in H122 was ahead of board expectations, with organic revenue growth of 15% y-o-y and 8% versus the pre-COVID H120. Despite supply chain challenges, the company maintained gross margins. Q222 order intake continued in the same strong vein as H221 and Q122, resulting in a record order book entering H222 and driving a small upgrade to our FY22 and FY23 forecasts.

H122 trading ahead of expectations

discoverIE noted that the strong order intake experienced in H221 and Q122 continued through Q222. H122 revenue was 23% higher y-o-y at constant exchange rates (CER), 15% higher y-o-y organically and 8% higher organically compared to H120 (pre-COVID). Orders grew 64% y-o-y on an organic basis and 34% compared to H120, with similar growth in both divisions. The order book at the end of H122 was 71% higher organically y-o-y and 53% higher than at the end of H120. Gross margins were maintained during H122 and the five acquisitions made over the last year are making excellent progress. Pro forma gearing (net debt/ adjusted EBITDA) at the end of H122 reduced to 1.4x from 1.6x at the end of FY21, below the company’s target range of 1.5–2.0x providing headroom for further acquisitions.

Small upgrade to estimates

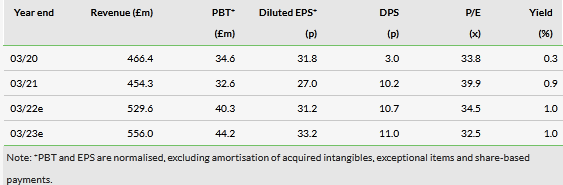

Management noted that performance in H122 was ahead of board expectations, despite currency headwinds and supply chain challenges. While the company reported that supply chain issues limited revenue growth slightly in H122, we estimate that growth was ahead of our forecast. We have revised up our FY22 and FY23 revenue estimates by 1.1% and underlying EPS by 1.3% in both years. The strong order book at the end of H122 provides good visibility for H222, with the ability to ship product the limiting factor for growth, rather than any lack of customer demand.

Valuation: Reflects growth potential

On our revised forecasts, the stock trades towards the upper end of its peer group on a P/E basis, in our view reflecting the group’s potential to drive earnings growth through accretive acquisitions. Aside from the ongoing recovery in customer demand, we view the key trigger for earnings and share price upside to be progress in increasing the weighting of the business towards the higher-growth, higher-margin D&M business (organically and via acquisition), which in turn should move the company closer to its 12.5% medium-term operating margin target.

Share price performance

Click on the PDF below to read the full report: