DiscoverIE Group PLC (LON:DSCV) reported strong organic growth in H122, up 8% compared to pre-COVID H120, and the underlying operating margin increased 0.8pp y-o-y to 10.3%. With the disposal of the distribution business agreed, the group is now solely focused on its design and manufacturing business and has revised key strategic targets to reflect this. Through its focus on structural growth markets, internationalisation and further higher-margin acquisitions, discoverIE expects to continue to grow the business and expand operating profitability to 13.5% by FY25.

Strong H122 performance

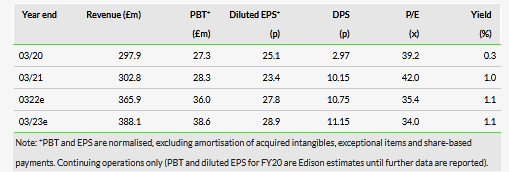

discoverIE reported strong organic growth in H122, with revenue up 15% on a constant currency organic basis versus COVID-hit H121 and up 8% compared to the pre-COVID period of H120. The Design & Manufacturing (D&M) business achieved an underlying operating margin of 13.7% (H121: 12.2%) which, after central costs, resulted in a group underlying operating margin of 10.3%, up from 9.5% in H121. Orders increased on an organic basis by 64% y-o-y and by 34% versus H120. Net debt at the end of H122 was £75.6m; after adjusting for the imminent Custom Supply disposal, pro forma gearing was 0.9x at the end of H122. To reflect the strong performance in H122, we have raised our normalised EPS forecasts by 7.1% for FY22 and 3.4% for FY23.

Revising targets to reflect D&M focus

As previously announced, discoverIE has agreed to sell its lower-margin Custom Supply (CS) business, with the deal expected to complete by the end of FY22. discoverIE has updated its key strategic indicators to reflect the new group structure, lifting targets for operating margins and international sales. The higher proportion of D&M business focused on structural growth markets compared to CS supports the aim to grow revenue ahead of GDP and, with c £70m debt headroom, we expect higher-margin acquisitions to further bolster growth and profitability.

Valuation: Reflects D&M growth potential

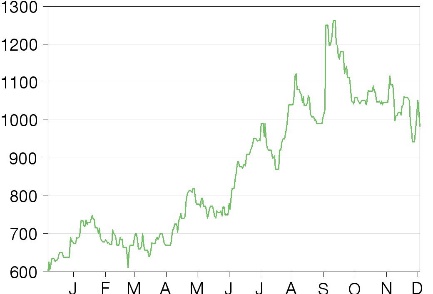

The stock trades towards the upper end of its peer group on a P/E basis, in our view reflecting the group’s potential to drive earnings growth through accretive acquisitions. The disposal of the CS business provides the company with resources to fund further acquisitions and frees up management to fully focus on the growth of the D&M business.

Share price performance

Business description

discoverIE is a leading international designer and manufacturer of customised electronics to industry, supplying customer-specific electronic products and solutions to original equipment manufacturers.

Click on the PDF below to read the full report: