With the proposed sale of Acal BFi, DiscoverIE (LON:DSCV) is taking the final step to exit the Custom Supply business. Gross proceeds of £50m will be used to reduce debt, providing further headroom for Design & Manufacturing (D&M) acquisitions. We estimate that moving away from this lower-margin business will boost group underlying operating margins from 8.2% to 10.2% in FY22 and from 8.6% to 10.6% in FY23. The disposal leaves management fully focused on the growth of the D&M business and increases exposure to structural growth markets.

Selling Acal BFi for £50m

discoverIE announced that it has agreed to sell Acal BFi, its electronics distribution business, to private equity buyers for £50m (£45m cash upfront and £5m deferred). The deal is subject to various consultation requirements and regulatory approvals and should complete by the end of FY22. Following the recent sale of the smaller Vertec SA business, this will complete the exit from the Custom Supply business. In FY21, Custom Supply generated 35% of group revenue and 13% of underlying operating profit contribution.

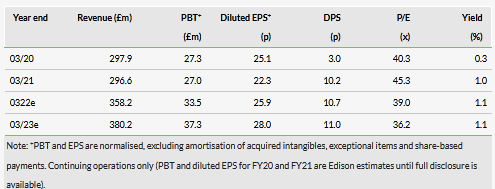

Estimates reflect D&M continuing operations

We have revised our estimates to treat Custom Supply as a discontinued business (both historicals and forecasts). Removing the lower-margin Custom Supply business (underlying operating margin 3.6% in FY21 and FY22e) results in the group underlying operating margin increasing from 8.2% to 10.2% in FY22 and from 8.6% to 10.6% in FY23. The company estimates that post disposal, pro forma gearing would reduce from 1.4x to 1.0x. By the end of FY22, we estimate that this will have reduced further to 0.8x, leaving ample headroom for further acquisitions based on management’s target gearing range of 1.5–2.0x.

Valuation: Reflects D&M growth potential

The stock trades towards the upper end of its peer group on a P/E basis, in our view reflecting the group’s potential to drive earnings growth through accretive acquisitions. The disposal of the Custom Supply business provides the company with resources to fund further acquisitions and frees up management to fully focus on the growth of the D&M business.

Share price performance

Business description

discoverIE is a leading international designer and manufacturer of customised electronics to industry, supplying customer-specific electronic products and solutions to original equipment manufacturers.

Click on the PDF below to read the full report: