Strong production and oil prices led to Deutsche Rohstoff's (DE:DR0G) (DRAG’s) solid results in H121 with EBITDA up 150% to c €40m (c €16m in H120) and net cash flow generation of c €17m. Management, which is typically conservative, has increased earnings guidance for 2021 and 2022. An extensive $60m drilling programme, comprising 12 wells at Cub Creek’s Knight pad and one well at Bright Rock’s new acreage in Wyoming, is due for completion by end-Q3 with production commencing in Q4.

Strong cash flow generation in H1

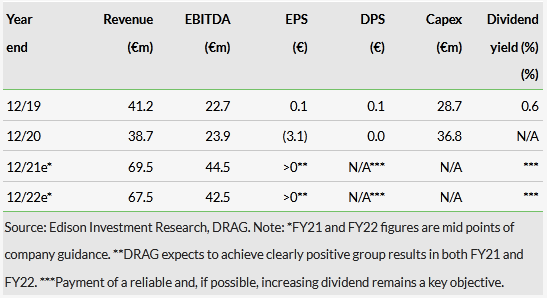

Production has been running at full capacity since early January, with oil production at c 3,700bopd and oil and gas production at 7,801boepd (higher-than-expected due to increased gas at the Olander pad). Combined with strong oil prices, this led to a solid performance in H121. EBITDA increased by c 150% to c €40m in H121 versus €15.8m in H120. Strong net cash flow generation of c €17m compares to a c negative €47m in H120, assisted by sales of shares in oil and gas and mining companies of c €12m. Due to the strong results, management has upgraded revenue and EBITDA guidance for 2021 and 2022. The mid-point of EBITDA guidance was increased by 34% for 2021 and 16% for 2022.

Investment in drilling to provide upside by end-2021

An extensive $60m investment programme in 12 wells at Cub Creek’s Knight pad and one well at Bright Rock’s new acreage (acquired in June 2020) in Wyoming is due for completion by the end of Q3 with production commencing in Q4. This would provide further upside to management’s oil and gas production guidance of 5,700–6,300boepd, which has been surpassed already in H1.

Valuation: Below audited reserve values

DRAG’s 8 March 2021 independent 1P and 2P valuation of its oil and gas assets was $211.6m (€176.3m), including Elster Oil & Gas, Cub Creek Energy, Salt Creek Oil & Gas and Bright Rock Energy. It assumes a long-term oil price of c $55/bbl. We assume DRAG’s mining assets are valued at book value and adjusted for end-H121 net debt. This amounts to a sum-of-the-parts (SOTP) valuation for 1P reserves of c €114m or €22.3/share (39% above the current share price), rising to €26.2/share including 2P reserves.

Consensus estimates

Share price graph

Bull

- High operational leverage provides benefit in a strong oil price environment.

- Cheaply acquired undeveloped acreage offering potential for up to 100 new wells.

- Stable liquid position.

Bear

- A permanently low oil price (WTI

- May be unable to raise sufficiently low-cost debt.

- Faster than expected declines in existing wells, or more than expected uneconomic wells in yet-to-be-developed acreage.

Strong increase in production

Higher than expected oil and gas production in H121, combined with increased oil prices, has delivered a strong set of half year results for DRAG. Net average oil and gas production for H121 was 7,801boepd across all four of the company’s subsidiaries: Cub Creek Energy and Elster Oil & Gas in Colorado, Bright Rock Energy in Wyoming and Utah and Salt Creek Oil & Gas in North Dakota. This is ahead of full year guidance of 5,700–6,300boepd. The production was skewed towards Q2 at 9,155boepd, with Q1 at 6,432boepd and resulted from higher-than-expected gas content from Cub Creek’s Olander pad (c 80% of production comes from Cub Creek). Overall, oil production remained more or less flat in Q2 (3,641bopd) versus Q1 (3,659bopd), which, again, is above full year guidance (2,300–2,600bopd).

Click on the PDF below to read the full report: