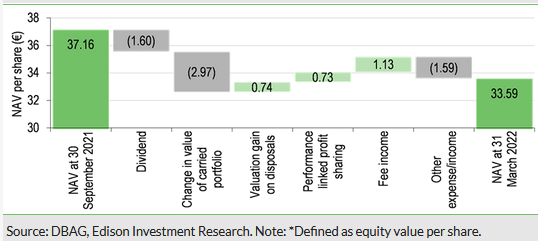

Deutsche Beteiligungs (ETR:DBANn) reported a 5.3% NAV decrease to €631.6m (defined as equity value) in H122 in total return terms. The main driver of the decrease was the revaluation of the held portfolio, which reduced NAV by 8pp, on the back of contracting market valuation multiples (amid the recent public market sell-off) and higher discount rates to reflect the risk of several companies not achieving their respective FY22 budgets. Meanwhile, DBAG continues its capital deployment agenda and invested a significant €92m in H122 versus its €114m annual investment target and has sufficient resources to continue to do so.

DBAG’s NAV* development in H122 ending March 2022

Fund objective

Deutsche Beteiligungs is a Germany-based and listed private equity investment and fund management company. It invests in mid-sized companies in Germany and neighbouring German-speaking countries via MBO transactions and growth capital financings. It focuses on growth-driven profitable businesses valued at €50m–250m. DBAG’s core objective is to sustainably increase net asset value.

Bull points

■ Solid track record, with an average management buyout exit multiple of 2.7x.

■ Growing exposure to broadband, IT, and healthcare.

■ Stable and recurring cash flow from fund services.

Bear points

■ Significant exposure to German industrials may weigh on performance in a prolonged recovery scenario.

■ Ample dry powder in the market translating into high competition for quality assets.

■ High valuations in most resilient sectors.

H121 results: Reflecting the deteriorating environment

DBAG reported a €35.8m net loss in H122 ending March 2022 (H121: €73.1m net profit), due to a downward revision of its portfolio value amid deteriorating macroeconomic conditions and declining public market valuations. Meanwhile, the fund services segment continues to generate stable income, broadly in line with management expectations.

Click on the PDF below to read the full report: