SPENDING: Defence spending is set to structurally rise around the world with the new normal of geopolitical tension and end of the multi-decade peace dividend. The US passed $95 billion of supplemental defence aid for Ukraine, Israel, Taiwan. And the UK committed to take the lead in Europe, by boosting spending to 2.5% of GDP by 2030. Europe spends proportionately less on defence than most but has started a multi-year catch up. Growing spending at three times the rate of the dominant US. This is driving outperformance of its smaller local defence stocks where this extra money goes a disproportionately long way versus lagging US defence giants.

READ ACROSS: More spending does not always equal better defence stock performance. This is one reason the US defence ETF (ITA) has been lagging the S&P 500 in the past year. As 1) it is lumpy, multi-year, and weapons system dependent. 2) Much of the extra outlay can be on non-weapons spending like wages, housing, and pensions. 3) Many contractors are part of bigger defence, space, and aerospace conglomerates. But Europe’s smaller and less diversified defence stocks have been on a tear. Rolls Royce (LON:RR.L) is the top performer in Europe’s Stoxx 600 the past year, with Italy’s Leonardo 3rd (LDO.MI), and German Rheinmetall (RHM.DE) 6th.

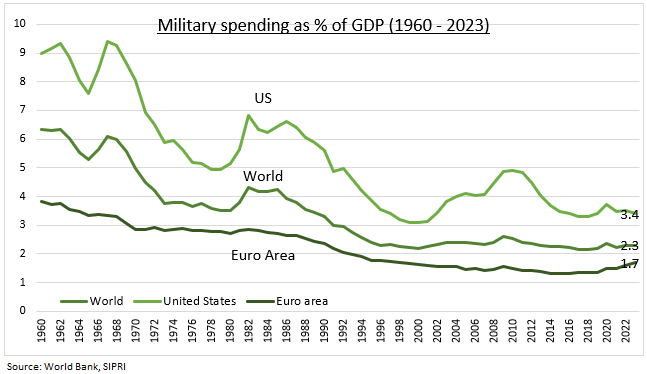

CONTEXT: World defence spending has fallen by a proportional 60% since its cold war highs (see chart) and averaged 2.3% of global GDP, or $2.4 trillion, last year. The US is by far the largest defence spender. With its $900 billion budget representing 37% of global spending and three times larger than no.2 China. These top 2 account for over half of total spending. Russia is the 3rd largest global spender, at around $100 billion. The Arab world leads proportional spending at near 5% of GDP. Europe lags, under the oft-spoken minimum target 2.0% of GDP. But has started to catch up and is growing spending at some of the fastest rates globally.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Defence spending back in the cross-hairs

Published 01/05/2024, 08:07

Updated 09/02/2024, 07:53

Defence spending back in the cross-hairs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.