In a post-close trading update, Datatec’s (JO:DTCJ) management has released FY22 revenue figures. Group revenue is expected to have risen c 13% y-o-y to US$4.65bn (FY21: US$4.11bn), implying H222 revenues of US$2.39bn with 11% growth y-o-y, continuing the impressive growth seen in H122 (15% growth y-o-y). In particular, the group’s performance reflects robust demand for networking, security and cloud infrastructure.

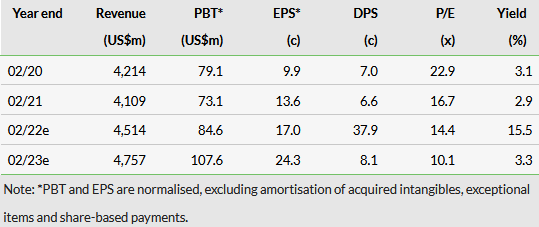

These results are c 3% ahead of our FY22 revenue estimates (FY22e: US$4.51bn), which we increased following the interim results. Given the continuing global strength of demand for technology solutions, underpinned by a steady unwinding of the record backlog seen in FY22 from H223, it is hard not to be optimistic about the group’s prospects for FY23/24, despite continuing economic and geopolitical uncertainties. With all three divisions contributing strongly, Datatec currently trades on 3.8x Edison’s FY22 EV/EBITDA, which we feel does not recognise the group’s trajectory. We also expect a conclusion to Datatec’s strategic review in FY23. We propose to review our estimates with the full results expected on or around 24 May.

FED HAWKISH, BUT CEASE-FIRE TRADES ARE THE RAGE. Logicalis revenues grew 14% y-o-y to US$1.7bn (FY21: US$1.5bn), with Westcon’s revenues rising 12% to US$2.9bn (FY21: US$2.6bn) and revenues at Analysys Mason increasing by 23% to US$90m (FY21: US$73m). For H222, Westcon maintained y-o-y growth at 12% (H122: 12%), with Logicalis growth slowing to 11% (H122: 19%) and growth at Analysys Mason slowing to 9% after a blinding first half of the year (H122: 37%).

As set out in our recent note, Westcon is key to unlocking upside potential, the group’s performance was held back by global semiconductor shortages and ongoing supply chain constraints, leading to inventory build-up and significant backlog growth at both Logicalis and Westcon. These constraints are expected to persist for the foreseeable future (well into FY23 at the very least).

We therefore envisage that ongoing demand for software and services in networking, security and cloud infrastructure will be held back, at least initially, by supply chain constraints limiting the group’s capacity to fulfil demand. This industry-wide demand/supply imbalance should support Datatec in the medium term, with the backlog reducing steadily (and converting into sales) potentially from H223, if not in FY24.

Share price performance

Business description

Datatec is a South Africa-listed multinational ICT business, serving clients globally, predominantly in the networking and telecoms sectors. The group operates through three main divisions: Westcon International (distribution); Logicalis (IT services); and Analysys Mason (consulting).

Click on the PDF below to read the full report: