Despite the COVID-19 challenge, 2021 was a good year for CVC CVC Credit Partners European Opportunities Ltd (LON:CCPG) (CCPEOL). NAV total return was 12.2%, outperforming the high-yield debt indices. While the manager remained positive throughout 2021, the portfolio closed the year more defensively – the credit opportunities basket was 49% of gross assets versus 67% in February and 55% in July. Management is nevertheless encouraged by the supportive economic outlook, the floating rate nature of leveraged loans and active corporate loan debt markets. CCPEOL’s dividend yields are 4.7% and 5.1% on its sterling and euro shares, respectively.

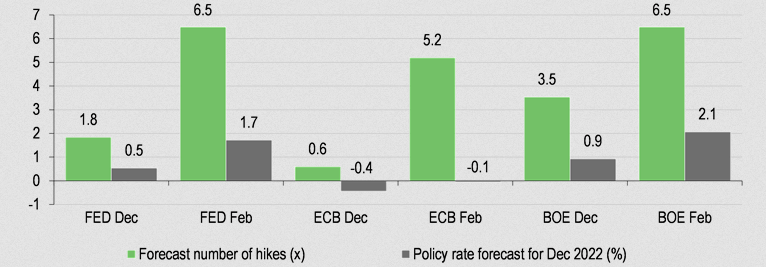

Policy rate expectations have risen sharply in the last few months

Source: Refinitiv. Note: Based on overnight index swaps, 24 February 2022. US Federal Reserve and Bank of England hikes are assumed at 25bp each, European Central Bank at 10bp.

Fund objective

CVC Credit Partners European Opportunities (CCPEOL) is a closed-end investment company, domiciled in Jersey and listed in London. It invests through a Luxembourg vehicle, CVC European Credit Opportunities (CEC), aiming to provide investors with regular income and capital appreciation from a diversified portfolio of predominantly Western European sub-investment grade debt instruments. The portfolio is split into two pools: performing credit and credit opportunities. CCPEOL has two classes of share: sterling shares (CCPG) and euro shares (CCPE) traded on LSE.

Why invest in high-yield debt now?

Most leveraged loans are floating – their coupon rates go up with policy rate increases. This is an advantage with rising inflation expectations. Leveraged loans carry a premium yield despite rising loan prices – CCPEOL had a yield to maturity (YTM_ of 8.3% and a cash yield of 7.9% at the end of the year. Investment opportunities are expected to remain strong: corporate debt issuance was very active in 2021 and is expected to increase further in 2022 driven by M&A activity and private equity deals.

The analyst’s view

The base case outlook is positive, with economic recovery expected to continue and COVID-19 risks receding. Governments have cut back most support but likely to turn their attention to the vulnerable sectors of the economy. Default levels were low in 2021 and should remain so in 2022. Inflation is both an opportunity and a risk. It is an opportunity because rising inflation should lead to interest rate hikes and hence increase the yield on the portfolio. In contrast, it will put pressure on profit margins and cash flows, which could increase default risk.

Valuation: Dividend yield 4.7%/5.1%

Both CCPEOL’s share classes have traded close to NAV (apart from during exceptional market turbulence) since the fund launched in 2013 due to share conversion facilities, active trading in treasury shares and the quarterly tender facility (subject to a specified limit). The recent dividend increases due to resilient portfolio performance result in yields of 4.7% (CCPG) and 5.1% (CCPE).

Click on the PDF below to read the full report: