Occupier strength and asset management

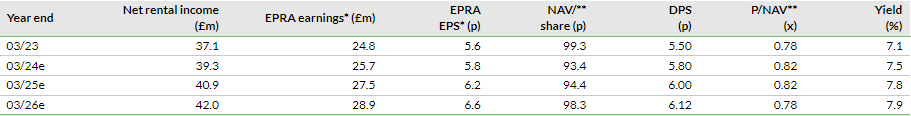

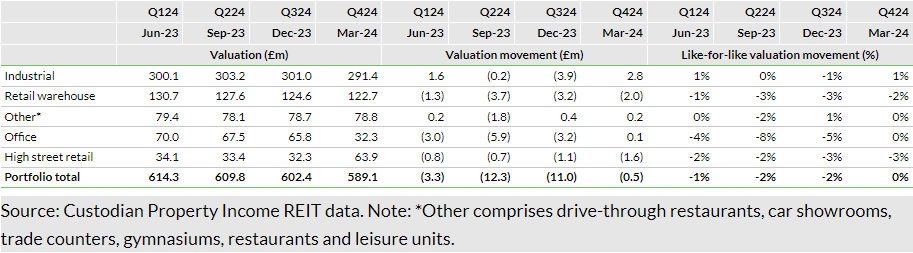

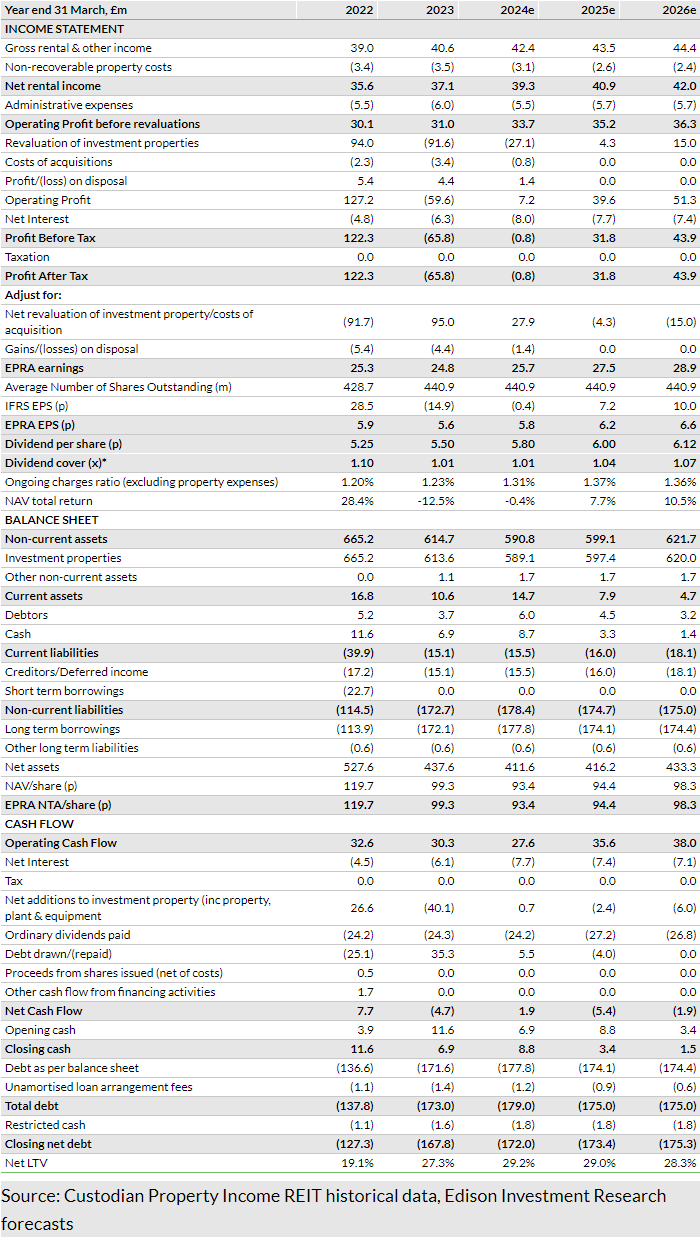

Through Q424, leasing remained strong and portfolio rents continued to increase. In FY24, rent roll increased by 5.6% on a like-for-like basis and estimated rental value (ERV) by 3.6%. Reversionary upside remains strong, occupier demand is robust and borrowing costs are mostly (78%) fixed. Selective property disposals are accretive to earnings and NAV, with proceeds supporting further debt reduction. Property valuations were modestly (4%) lower for the year but stabilised in Q4, as did unaudited NAV per share (results will be published in June). FY24 EPRA EPS of 5.8p is in line with FY24 total dividends. We have increased our FY25e EPRA EPS by c 3%, fully covering the targeted DPS, and expect further growth in FY26.

Diversified and differentiated

CREI targets attractive and stable dividend returns from an actively managed, diversified portfolio of UK commercial real estate, differentiated by a focus on properties with smaller individual values (lot sizes), typically less than £10m at the point of investment. These provide a yield premium over larger assets, partly the result of a broader range of potential occupiers and less competition from larger institutional investors. Diversification mitigates income risk but also provides the flexibility to rebalance the portfolio and optimise expected returns as market conditions evolve. An active, above-average exposure to industrial and retail warehouse assets (c 70% by value), combined with conservative balance sheet management, has benefited the company in recent years. While it acknowledges the potential for sector consolidation to generate economies of scale and further enhance diversification, and is disappointed that the recommended merger with API proved unsuccessful, CREI sees strong income growth potential from the existing portfolio, with reversionary rent potential of c £6m, or 15% of current rents.

Valuation: Growing DPS and attractive yield

The FY25 DPS target represents an attractive yield of 7.8%, with the potential for capital growth, while the discount to FY24 NAV is 18%.

Organic income growth without M&A

CREI continues to demonstrate its capacity for organic growth in income and dividends, despite its unsuccessful attempt to merge with abrdn Property Income Trust (API). The transaction was approved by the boards of both companies, recognising the complementary nature of the portfolios and diversified income-led strategies, the potential for cost efficiencies and the benefits of increased scale, not least increased share trading liquidity. The transaction was approved by CREI shareholders but, although a majority of the votes cast by API shareholders at the general meeting were in favour, the critical 75% threshold was not met.

Organically, CREI is benefiting from a robust occupational market across most of its portfolio, but particularly in the industrial and logistics sectors where it is strongly weighted. Market rent levels are increasing across most of the portfolio and this is being reflected in CREI’s income through a strong leasing performance, with considerable further income potential built into the portfolio. The end-FY24 portfolio ERV of £49.4m is £6.3m or 15% above current passing contracted rent of £43.1m. Recent disposals, with a strong focus on vacant properties, are accretive to earnings, with the impact on rental income more than offset by lower property operating costs and interest savings. At a strong average premium to book value, the sales enhance NAV.

During Q4 and year to date, CREI has sold five assets for an aggregate consideration of £29.5m, on average 21% ahead of book value. The proceeds have been used to reduce variable rate borrowing and we estimate a blended gross yield on the disposals of less than 4%, well below the c 7% marginal cost of debt.

CREI also continues to invest in selected portfolio assets, improving their quality (including environmental credentials), attractiveness to occupiers and rent potential, with the latter contributing to growth in capital values. We estimate that capex was c £16m in FY24, with the company targeting a yield on costs of at least 7%.

CREI has long sought to appeal to a broad base of institutional and private shareholders by providing a diversified and differentiated portfolio, with a strong income focus and low-risk balance sheet. This strategy is especially suited to investors that are unable or disinclined to choose between the broad range of single-sector, in many cases higher-risk, funds. Corporate activity over the past 12 months has markedly reduced the number of similarly diversified REITs that are available to investors, with many companies determining that being consolidated or selling their portfolio best solves the issue of trading at an embedded deep discount to NAV. Several recent transactions have been driven by acquirers seeking to expand their presence in the industrial and logistics sectors, where structural demand factors and limited supply continue to drive above-average rental growth and capital value performance, areas in which CREI’s portfolio is well represented.

While property sector discounts to NAV have persisted for some time, these have historically proven to be cyclical. UK commercial property valuations have fallen significantly from their peak in late 2022 and there is a widespread expectation that interest rates will soon begin to moderate. This may well create a turning point in capital values and meanwhile investors benefit from high dividend yields.

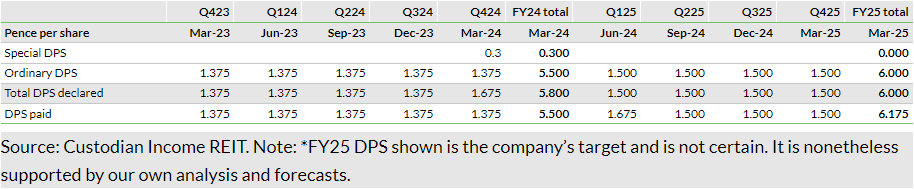

Increasing fully covered dividend distributions

The 1.375p quarterly dividend per share declared for Q424 was in line with CREI’s target of at least 5.5p for the year and more than covered by EPRA earnings. To reflect a continuing strong leasing performance, earnings-accretive disposals and the company’s confidence in the outlook, a special dividend of 0.3p takes the total distribution for the year to 5.8p, in line with unaudited EPRA EPS. Both the Q424 DPS and the special dividend will be paid on 31 May 2024.

The new FY25 DPS target of 6.0p represents a 9% uplift on the FY24 target of 5.5p and is again expected by the company to be fully covered.

Further details on financial performance

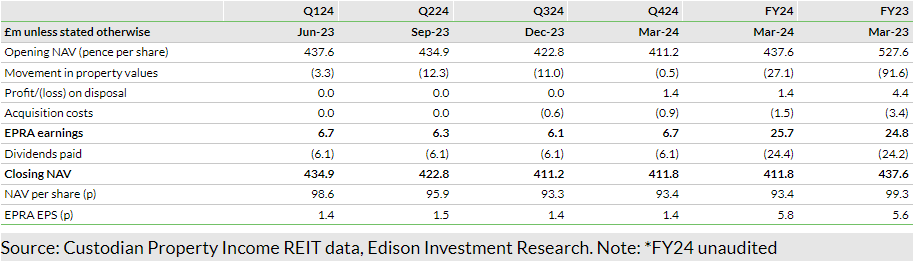

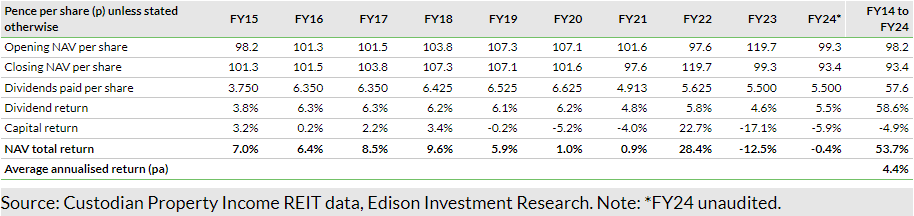

Exhibit 3 shows a reconciliation of the unaudited quarterly movements in NAV through FY24. NAV per share was unchanged in Q424 after payment of the Q324 dividend but was 5.9% lower over the year. Dividends paid of £24.4m (5.5p per share) were more than covered by EPRA earnings of approximately £25.8m1 and the decline in NAV resulted from the c £27.1m property valuation loss.

The FY24 dividends have been declared but other FY24 financial data are unaudited and quarterly aggregates are subject to rounding differences.

The FY24 dividend return on NAV was 5.5% (given the discount to NAV at which the shares trade, the dividend yield is higher). This was substantially offset by the capital loss and NAV total return was negative 0.4%, a substantial improvement on FY23. With property valuations stabilising in Q424, the NAV total return was a positive 1.6%.

Reflecting CREI’s income-focused strategy and the broad, market-wide weakness of property values in the past two years, dividends paid have accounted for all of CREI’s aggregate accounting returns since listing.

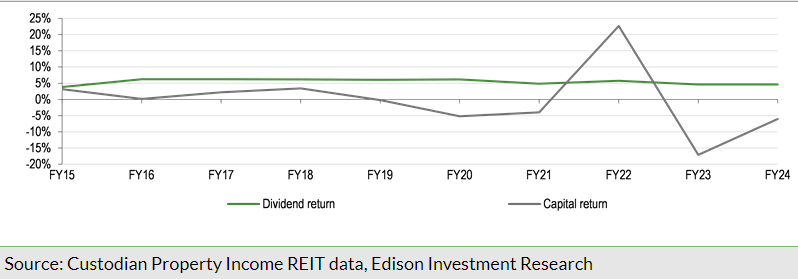

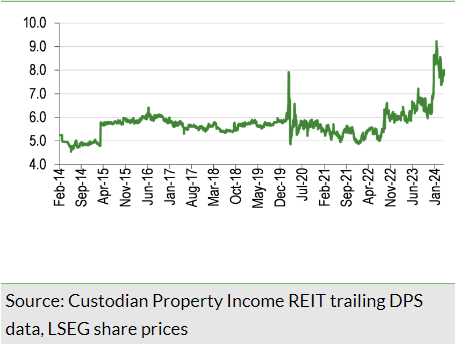

The relative stability of income returns versus more volatile and uncertain capital returns can be seen clearly in the chart below. Across the broad UK commercial property market, income returns have historically accounted for c 70% of property returns through the cycle.

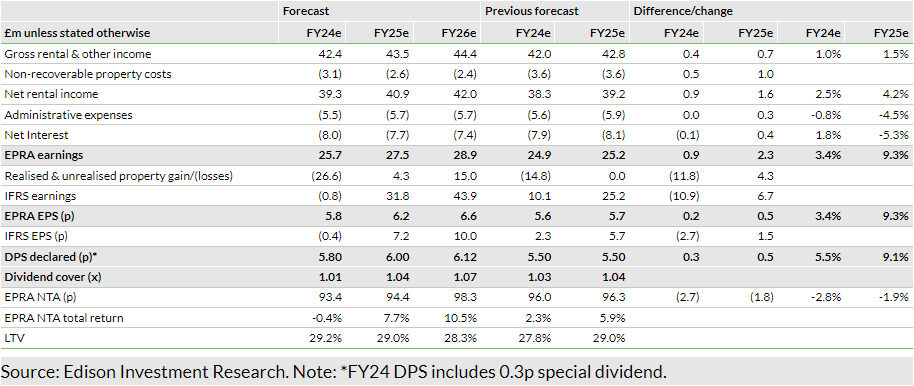

Earnings forecasts

FY24 EPRA EPS of 5.8p was c 3% above our previous forecast. We have increased our FY25 EPRA EPS c 9% to 6.2p, fully covering the company’s FY25 DPS target of 6.0p. We forecast further progress in both earnings and DPS in FY26, at a more modest pace.

Compared with our previous FY24 forecast, net rental income appears to be stronger, with leasing progress benefiting gross rents and disposals reducing property costs. We expect similar drivers in FY25 along with well-controlled expenses and interest savings as disposal proceeds reduce average borrowings and floating rate debt costs moderate.

Our previous forecast had assumed flat property valuations through H224 and a higher NAV than reported. Looking forward, we have assumed some modest valuation upside, driven by leasing progress and a broadly unchanged net initial yield.

Predominantly fixed-cost borrowing

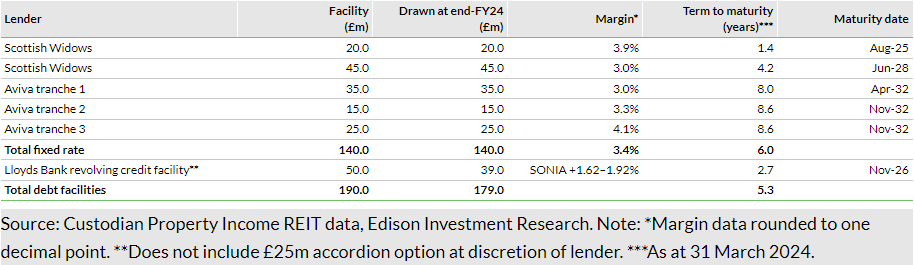

The end-FY24 loan to value ratio was 29.2% but has since been reduced to pro-forma 27.9% by the continuing property disposals.2

- Over the medium term, CREI targets an LTV of c 25%.

End-FY24 borrowings were £179m, from total facilities of £190m, or £215m including an accordion option at the discretion of the lender. Drawn borrowings comprised £140m (78% of the total) of long-term fixed-rate debt, at a blended interest cost of 3.4%, with a six-year average maturity and £39m of floating rate debt. The weighted average cost of aggregate borrowings was 4.1%, slightly down over the quarter (31 December 2023: 4.3%) due to proceeds from the disposal of properties being used to repay the revolving credit facility. The end-H124 net LTV was 29.6% (end-FY23: 27.4%), ahead of the company’s medium-term target of 25%, but with significant headroom against debt covenants and a substantial pool of assets unencumbered by borrowings (£126m at end-H124).

Valuation and performance

CREI’s 6.0p target DPS for FY25 represents a prospective yield of 7.8%. Meanwhile, the shares trade at an 18% discount to the FY24 NAV per share of 93.4p.

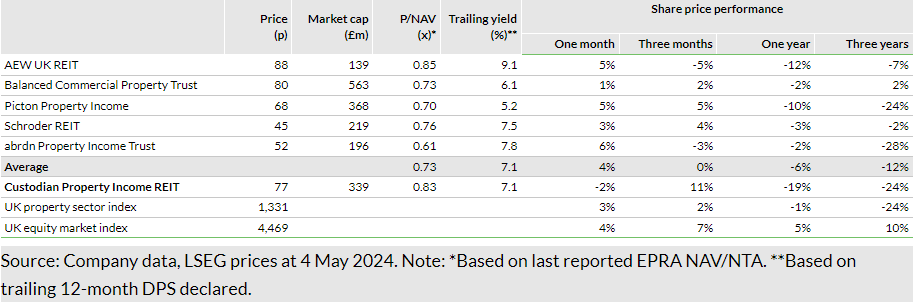

In Exhibit 11, we show a summary performance and valuation comparison of CREI and what we consider to be its closest diversified income-oriented peers. The list of peers has narrowed considerably in the past two years and looks likely to narrow further. abrdn Property Income Trust is now pursuing a strategy of managed wind-down and Balanced Commercial Property Trust is undertaking a strategic review. Companies that have been removed from the peer group in the past two to three years through completed or ongoing M&A activity or by winding down their portfolios include Circle Property, Palace Capital, Ediston Property, CT Property Trust (acquired by LondonMetric (LON:LMPL)) and UK Commercial Property REIT (acquired by Tritax).

CREI trades on a higher P/NAV than the average of the group, as it has done for most of the period since IPO. Its trailing yield is in line with peers, not yet reflecting the targeted dividend growth on a fully covered basis3 and the company’s focus on smaller lot-size properties, with a premium yield, has historically supported risk-adjusted income returns.

- API has reported cover for the three months to 31 March 2024 (Q124) of 75.4% (December 2023: 83.4%), excluding exceptional items associated with corporate activity.

______________________________________________________

General disclaimer and copyright

This report has been commissioned by Custodian Property Income REIT and prepared and issued by Edison, in consideration of a fee payable by Custodian Property Income REIT. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom