The commodity market started the week with growth. A Brent barrel is growing to 95.05 USD. Even the USD growing once again does not prevent the oil prices from further growing.

The fundamental horizon of the oil sector remain saturated. The first event is an OPEC+ meeting planned for today. The main issue for discussion is the quotas for October. Most probably, production will remain as previously, for various reasons. OPEC+ could revise the quotas if the nuclear agreement between the US and Iran could be restored. However, there is no news about it, which means there is no reason for increasing supply.

Previously, G7 members agreed on the limit of purchase prices for Russian oil. The limits might be imposed in December already. In the market, they say that without participation of strategic buyers of Russian oil (namely, India and China) the decision will remain purely declarative.

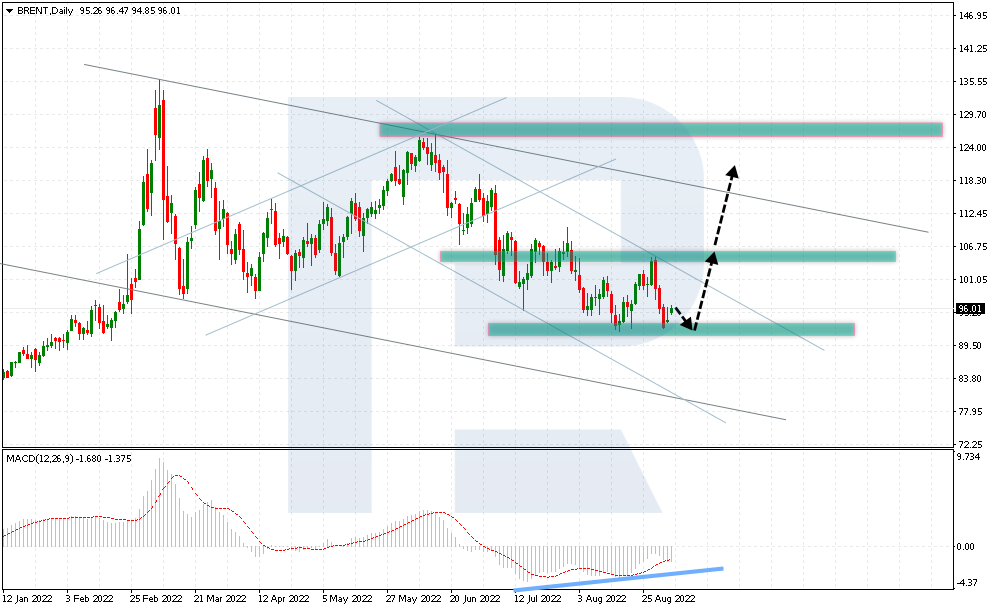

On D1, Brent keeps pushing off the support level of 92.00. On the MACD, a bullish divergence might form, which can become a strong signal supporting an uptrend. However, the level of 89.00 might be tested before the growth starts. For buyers, it is important to secure above 106.00. If this happens, a Double Bottom reversal pattern will be complete, again pushing oil to the potential goal of 119.00.

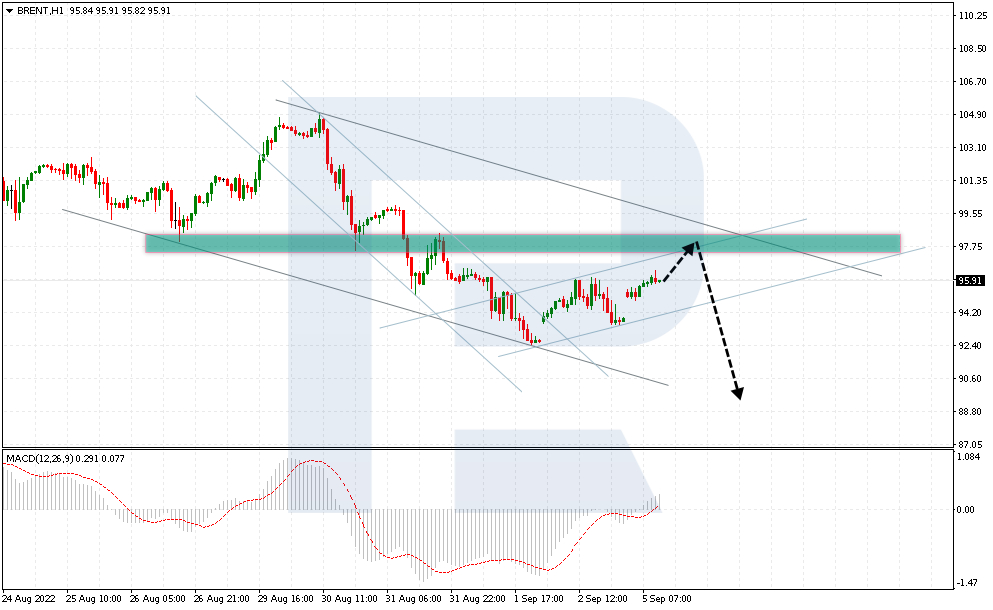

On H1, Brent is correcting inside a descending channel. A bearish 5-0 pattern may still form, which will mean price growth to 98.00. After a breakaway off the upper border of the descending channel, a decline to 89.00 might start, going by the pattern. The decline will be over with a breakaway of the upper border of the descending channel and securing above 99.50. In this case, a bullish trend might recover.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil is Waiting for OPEC+ Decisions

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.