The crude oil market is witnessing a notable surge, with a barrel of Brent escalating to 87.70 USD.

This uptick in commodity prices comes amidst an intensifying conflict between Arabian and Israeli forces. The current armed clashes arise from a longstanding, simmering dispute that periodically intensifies. Should the conflict persist, prices for energy carriers may venture even higher.

In the forthcoming week, the market anticipates new reports from the International Energy Agency (IEA), the Organization of the Petroleum Exporting Countries (OPEC), and the US Department of Energy, which will shed light on the global oil supply and demand dynamics.

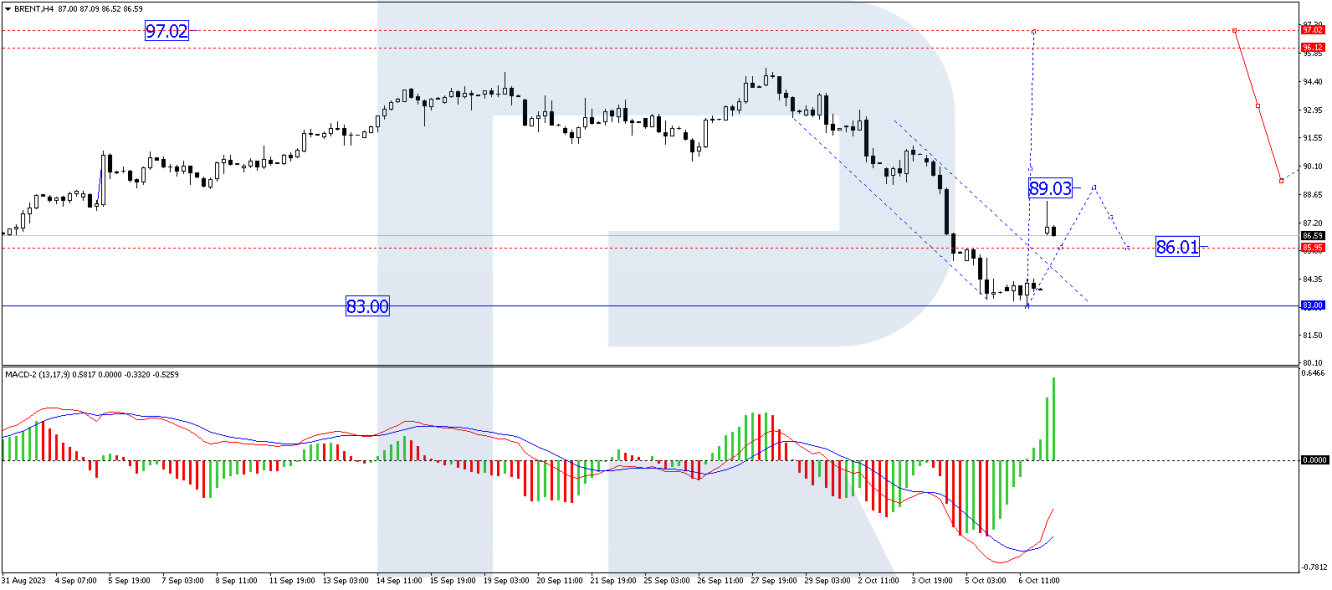

Brent Oil Technical Analysis

On the Brent H4 chart, a corrective movement to 83.00 has been observed. The market is currently forming a growth impulse toward 89.00. Upon reaching this level, a correction down to 86.00 may ensue. Subsequent to that, another wave of growth to 89.00 is anticipated. Should this level be breached upwards, there is the potential for a climb to 94.00, potentially even advancing to 97.00. The Moving Average Convergence Divergence (MACD) provides technical confirmation for this scenario, with its signal line oriented sharply upwards, and expectations that the indicator will explore new highs.

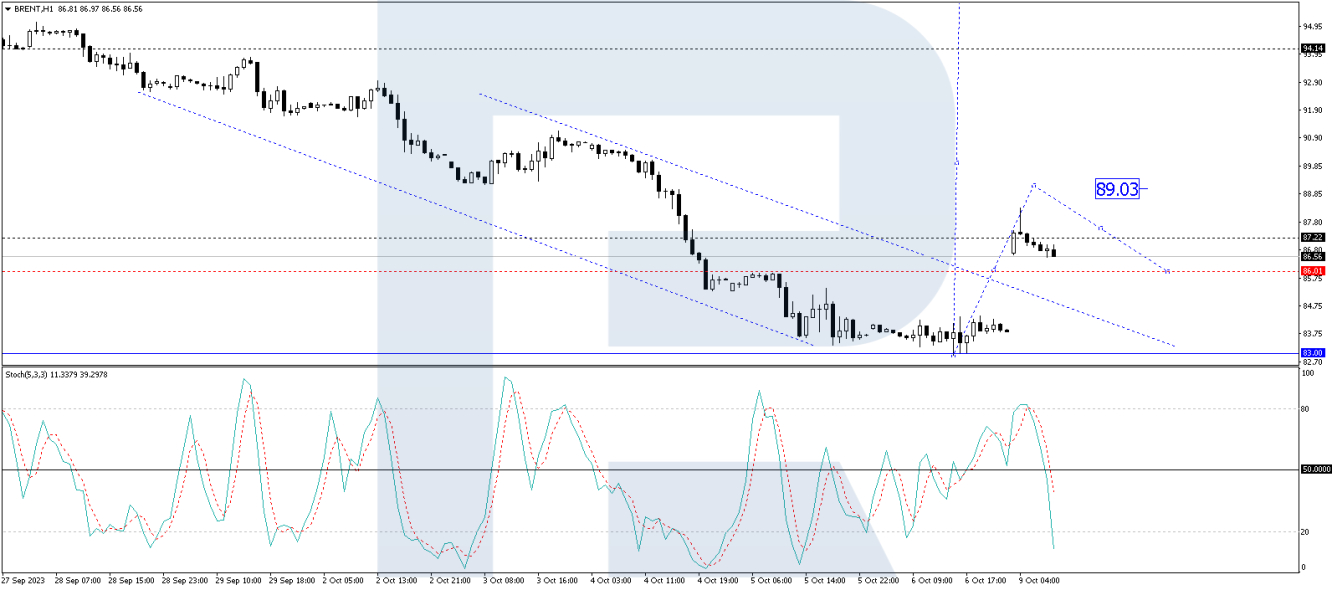

On the Brent H1 chart, a correction to 83.00 has concluded, and today’s market activity has produced a growth impulse to 88.33. A downward motion to 86.00 is anticipated, to be followed by an ascent to 89.00, which is identified as the initial target. The Stochastic oscillator provides technical validation for this scenario, as its signal line is directed sharply downwards toward the 20 mark. Subsequently, it may surge to 50, and should this level also be breached upwards, the potential for an ascent to 80 might be unlocked.

Conclusion

The escalating Arabian-Israeli conflict is casting its shadow over the crude oil market, propelling prices upwards amidst the turmoil. The market will be attentively observing upcoming reports from major energy organizations and aligning strategies with unfolding geopolitical and economic events. Technical indicators suggest possible further upticks in price, but as always, traders must navigate with caution amidst such volatility and uncertainty.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil Ascends Amidst Escalating Middle Eastern Conflict

Published 09/10/2023, 11:59

Crude Oil Ascends Amidst Escalating Middle Eastern Conflict

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.