We are initiating coverage of Creo Medical (LON:CREO), which is developing and commercialising minimally invasive electrosurgical devices. Its CROMA platform delivers a combination of bi-polar radiofrequency (RF) and microwave energy for the purpose of dissection, resection, ablation and haemostasis of diseased tissue. The initial focus will be on gastrointestinal (GI) procedures but will expand into soft tissues (such as the pancreas) and pulmonology. The company has had all six products within the CROMA platform CE marked and four are also cleared for use by the FDA, with the other two expected to be cleared in the coming months.

Share price performance

Allowing for quicker and safer procedures

Creo Medical’s flagship Speedboat product allows for incision, dissection and coagulation to be accomplished with one device, leading to more efficient use of the surgeon’s time as there is less switching of instruments. With bi-polar RF, the current is restricted to a specific area, which should help reduce complications compared to monopolar RF, which drives energy across relatively large areas.

A large addressable market

Creo Medical products are in a large and lucrative market. Conmed estimates the GI endoscopic technologies market is approximately $3.0–3.2bn with the RF energy-based surgical device market at $2.7–2.9bn per year.

Albyn acquisition provides products and a salesforce

In July 2020, Creo Medical announced the acquisition of Albyn Medical, which commercialises products for the urology, gynaecology and GI endoscopy markets. Albyn Medical was purchased for €24.8m plus up to €2.7m in performance-related milestones. While full year revenues have not been disclosed, Albyn Medical was profitable with €1.7m in profit before tax (PBT) for FY19 and contributed £12.8m in sales to Creo in H121. Importantly, with this acquisition, Creo has also acquired Albyn Medical’s 70-person European sales and marketing team.

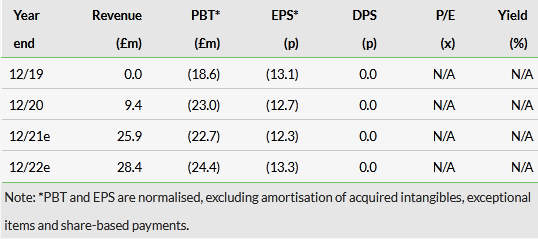

Valuation: £434m or 240p per basic share

We value Creo Medical at £434m or 240p per basic share using a risk-adjusted net present value (NPV) model. The vast majority of the value is attributable to the CROMA platform (especially the GI market) with the remainder divided between the value of Albyn Medical and net cash. Creo Medical had reported that it had £30.6m in cash and £10.7m in debt at the end of H121 and raised £36.3m in gross proceeds in a Q321 placement and open offer.

Click on the PDF below to read the full report: