What a long, strange trip it’s been for some analysts since the summer of recession forecasts turned into yesterday’s robust 2.8% rise in third quarter GDP. A key driver of Q3’s advance: higher consumer spending, which accounts for roughly two-thirds of GDP. Personal consumption expenditures increased 3.7% in Q3, a robust pickup from Q2’s 2.8%.

The crowd, recall, was focused on a recession signal triggered by the Sahm Rule in early August. Despite a reportedly flawless record, the case for making a high-confidence recession call based on unemployment data alone – the basis for the Sahm Rule’s analytics – was always flawed. As I explained in early August, relying on one or two data sets to profile the enormous complexity and size of the US economy is tempting fate – needlessly so.

Monitoring a broad set of economic and financial indicators, by contrast, filters out a lot of noise and maximizes signal. There’s always uncertainty, no matter how you slice and dice the data. But the temptation to cherry-pick one or two indicators to inform your economic outlook is the macro equivalent of a rookie mistake.

Have the usual suspects learned their lesson? I’m not holding my breath. One of the incentives to make bold recession calls is that such forecasts draw a crowd. Think of it as free advertising. An analyst issues a stark warning that the end is near and the media rush to interview the sage. Presumably, the news generates new clients. What of the quality of the nowcast/forecast? Well, the analyst quickly moves on to a new forecast. Rinse and repeat.

Fortunately, there’s a better way. Consider, for instance, the combination of nowcasts that have repeatedly been featured on CapitalSpectator.com in the months leading up to yesterday’s Q3 GDP report. These updates, drawn from a variety of sources, have consistently pointed to low recession risk – the Aug. 27 and Aug. 13 revisions, for instance. Last week’s median nowcast (Oct. 23) reaffirmed earlier estimates and reflected a +3.0% outlook for yesterday’s report.

If you think you’ve seen this movie before in previous quarters, you’re right. There was also no shortage of misguided recession warnings going into the Q2 GDP report – warnings that also proved misleading.

Not surprisingly, the recession forecasters haven’t reformed but instead rolled the projected start date for contraction forward. Eventually, they’ll be right, but this is no way to run a railroad.

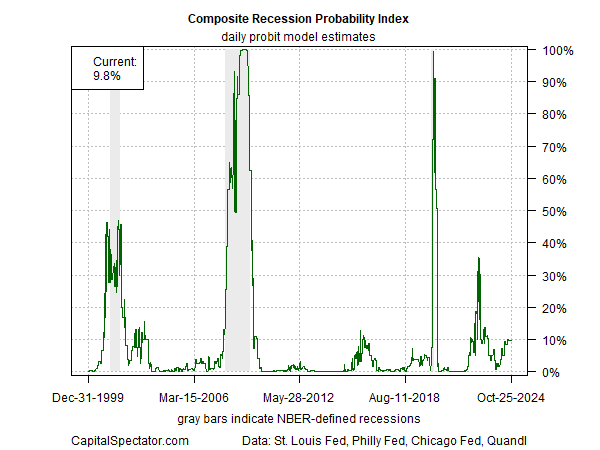

Recession risk remains low, I reported in the Oct. 26 issue of The US Business Cycle Risk Report. The key indicator that informed this view: an estimated 10% probability that an NBER-defined recession has started or is imminent, based on the Composite Recession Probability Index (CRPI), which aggregates a variety of business-cycle data sets.

CRPI, along with several other broad-minded metrics, speak clearly on the upbeat outlook for the near term. But old habits die hard in the art/science of recession analytics that’s designed to maximize attention rather than signal. It’s only a matter of time before the dark warnings resurface and the roller coaster ride restarts. Caveat emptor.