Oil and precious metals continue their comeback in Asia as the market breathes a collective sigh of relief with Macron’s victory.

OIL

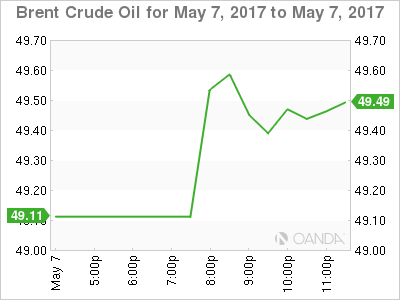

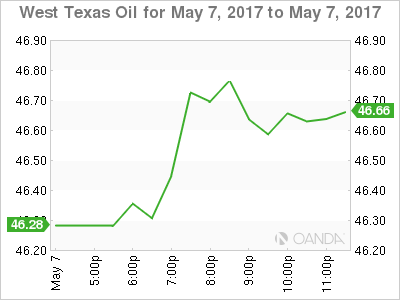

Crude has opened on a positive note in early Asian trading, following on from the bounce from Friday’s lows in Asia. Friday’s collapse looks more stop-loss driven in hindsight rather than structural, given how quickly those losses were recouped. As such, oil may have seen the worst of the selloff for now, as the market turns its attention to the OPEC meeting at the end of the month.

Given the levels that Brent and WTI are trading at now, it is almost impossible to see the production cut deal not being extended in some shape or form. However, this is only likely to maintain the status quo, given the supply dynamics. Unless of course the cuts are increased, a situation we view as extremely unlikely.

To the here and now, Brent spot trades at 49.50 this morning with resistance at 51.00 the 200-day moving average. Support is far distant down at 46.50 highlighting just how volatile black gold has been over the last week.

WTI spot trades at 46.75 with resistance nearby at 47.00 and then 49.00, a double top and the 200-day moving average. Support is found in the distance at 45.00 and 43.50.

PRECIOUS METALS

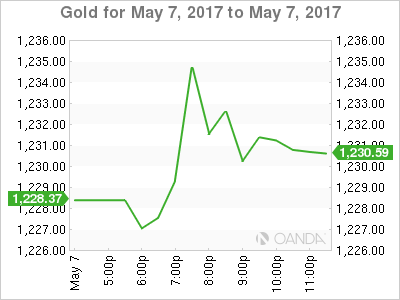

Gold has opened constructively this morning, trading higher to 1231 from a 1227 close New York close. The yellow metal appears to be the beneficiary of “risk-on” sentiment across the Asian markets following Macron’s victory in the French presidential elections. Commodities, in general, have started trading in Asia on a very positive note as geopolitical uncertainty recedes in Europe.

Gold has key support at 1222, its 100-day moving average, with a break signalling a move to the 1200 region. Above, resistance lies at the 1240 area, a daily close above signalling a move back in a 1240/1260 trading range.

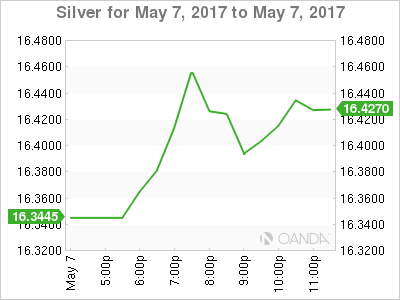

Silver has also started the day positively, up 0.5 percent from its New York close, trading around 16.4300 this morning. The picture, however, does not look so rosy when one zooms out to look at the year-to-date charts. Silver remains mired at the bottom of its longer-term range after its spectacular crash from 18.6550 in mid-April. Two positive days does not a trend change make. From a technical perspective, silver will need to close above 16.8170 to give bulls renewed hope of brighter times ahead.

Silver has initial resistance at 16.5700, last Thursday’s high. This is followed by 16.8170 with a daily close implying a possible move back above 17.0000.

Support is clearly denoted at 16.2100 followed by Decembers low at 15.6350.