It’s the worst performing commodity of the year despite being the chief ingredient in some of the most beloved confections.

Cocoa, the raw material for chocolates, baked goods and ice cream, is down more than 8% in price since the start of 2021, totally missing the inflation boat that has buoyed countless commodities from soybeans to copper and lumber.

Overproduction is the culprit, say those in the know.

As veteran analyst Jack Scoville of Chicago’s Price Futures Group puts it, cocoa’s problem began, like everything else, with the COVID-19 pandemic that reduced the global demand for chocolates and related treats.

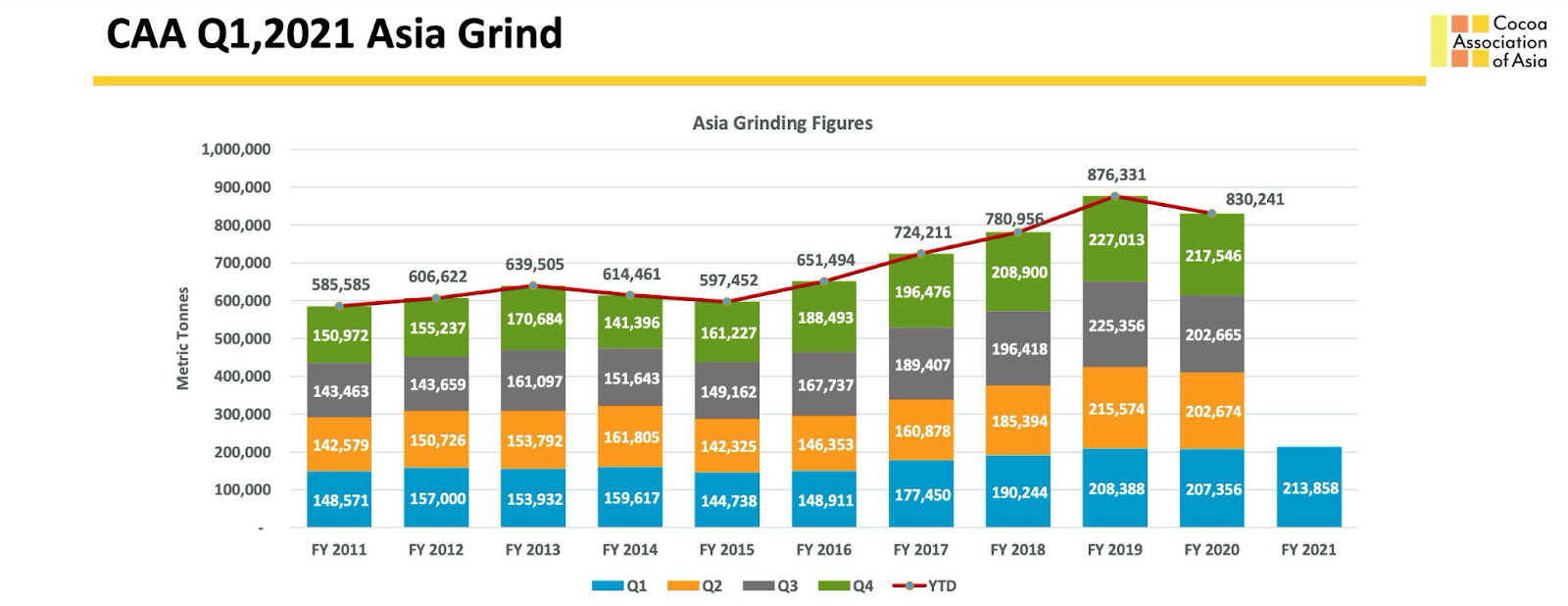

Scoville says grinding of cocoa beans to produce the butter and powder required for confections has shown encouraging improvement in Asia and North America—even Europe, despite the bloc’s multiple problems with the pandemic—in the year leading to the first quarter.

Nevertheless, “supplies are there for any increased demand,” he says, referring to the glut in beans versus grinds.

Some researchers say the situation will get better for cocoa with the full imminent reopening of New York City that is expected to be followed by other major destinations and capitals of the world that readmit tourism and leisure—the two catalysts for the consumption of luxury items such as chocolates.

What no one is sure of though is how long it would be before those things make a meaningful difference to cocoa demand, and how high bean prices could go at that point.

Rabobank, one of the world’s most authoritative “agricultural banks,” posited in its cocoa outlook for the second quarter:

“In our opinion, risks are skewed to the upside, with global demand likely to continue to recover and even increase while production for 2021/22 remains unclear, with potential for lower output than initially expected.”

“Speculators also have the capacity to build a sizable long position in the coming months, which could catch out short sellers and industry participants with limited forward cover.”

But a study of cocoa futures on the New York Mercantile Exchange makes for a less assuring read.

Source: S.K. Dixit Charting

While the front-month contract has rebounded since the start of the quarter, gaining 1.5% in April and 0.3% for May, it has lost $214, or 8.2% since the start of the year. It has also fallen in six of the past 10 trading sessions.

Investing.com has a “Strong Sell” recommendation for the front-month July cocoa futures contract on its Daily Technical Outlook. At Monday's settlement of $2,385.50 a tonne, the contract could reach a near-term low of $2,379.16, according to Investing.com projections.

Some, like Trading Economics, have it lower, projecting $2,354.32 a tonne by the end of the second quarter.

“Looking forward, we estimate it to trade at $2,073.85 in 12 months time," Trading Economics said.

Sunil Kumar Dixit of S.K. Dixit Charting in Kolkata, India, says July cocoa could even plunge to $1,700 before rebounding.

“Prices are trapped in a tight range on weekly charts between a cluster of resistance, namely the middle Bollinger Band at $2,489, the 100-week Simple Moving Average of $2,492 and the 50-week Exponential Moving Average of $2495 on the upper flanks.”

“The 200-week SMA of $2,372 has, meanwhile, been an active support.”

He said weekly charts showed a bearish engulfing pattern indicating an extended fall to $2,372 for a retest of $1,700.

“The upside looks limited, with $2,550 and $2,700 as potential upper range. The weekly Stochastic RSI reading of 38/36 also leaves enough room for a continuation of the bearish streak.”

Rabobank says the shift in the shape of the cocoa futures curve might not last as it could return to an inversion by the time the September contract becomes the front-month and weather conditions for the crop worsens.

“Those in possession of (bean) stocks in Europe may stand to benefit, as the lower availability of stocks compared to the US presents a greater risk of volatility and price spikes in the region,” Rabobank said in its quarterly outlook.

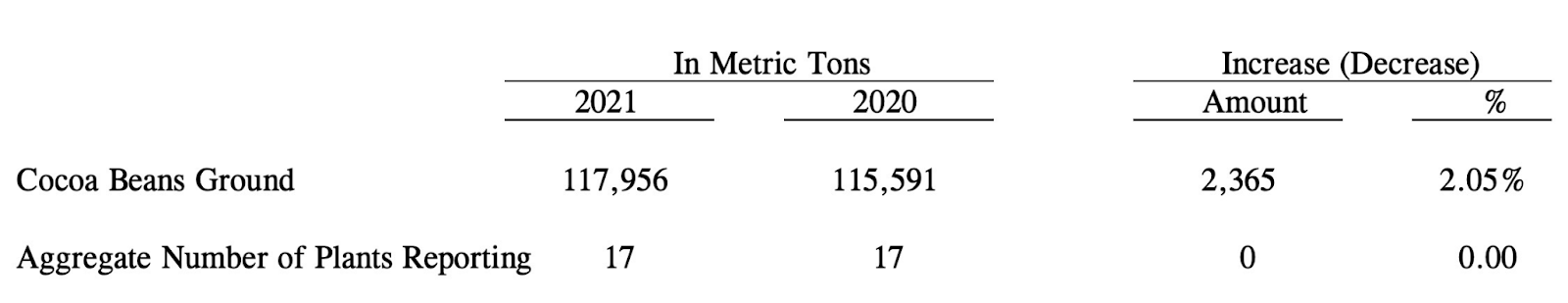

Source: candyusa.com

Source: European Cocoa Association

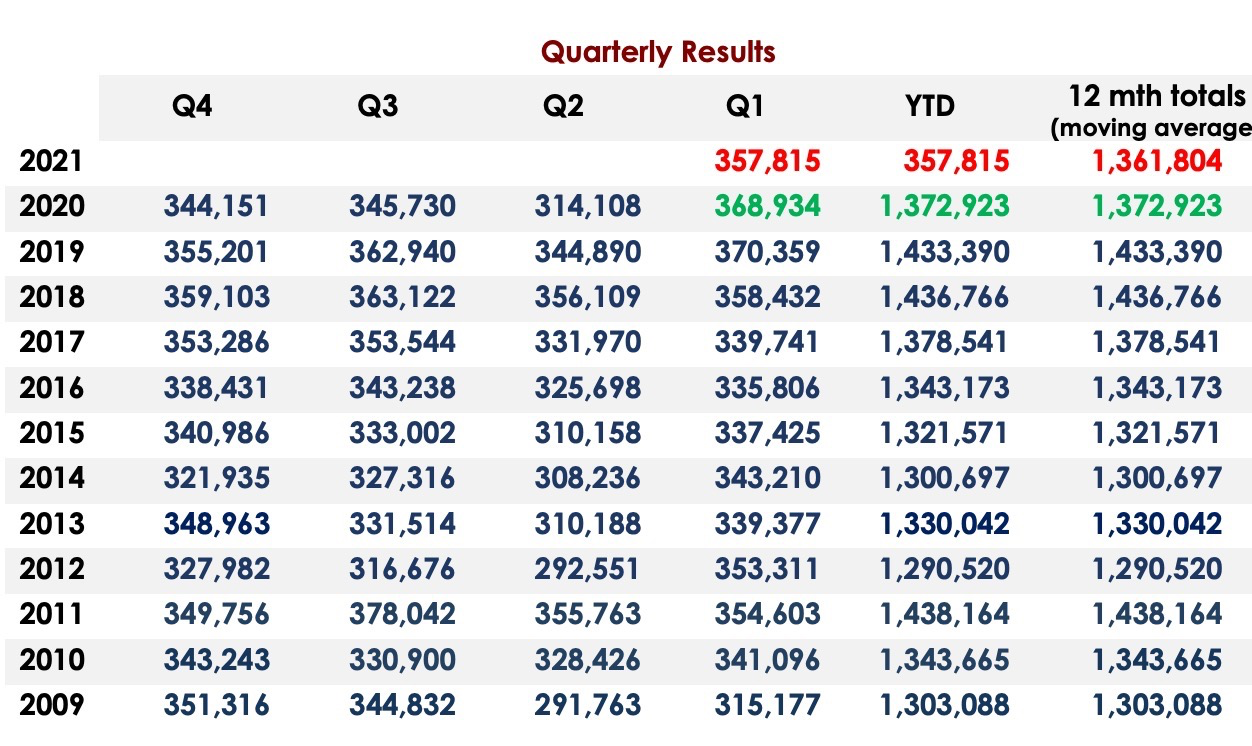

Source: Cocoa Association of Asia

Source: Cocoa Association of Asia

RaboBank acknowledges that the current supply and demand balance suggests a large surplus in the market.

“This is backed up by increasing US merchant stocks, which are the highest since 2018, and declining differentials at origin, suggesting very good availability,” it said.

Since December, reports suggest European differentials have declined as much as 60% for Nigeria and Cameroon and around 50% in the Ivory Coast and 30% in Ghana, Rabobank said.

In addition to the decline in differentials, futures prices also fell around 7.5% for the period.

The farmgate price in the Ivory Coast has also declined by 25% for the mid-crop, it said.

“The decline suggests a greater flexibility on price than previously expected. The current supply situation is bearish and, coupled with uncertainties stemming from COVID-19 and the living income differential, has resulted in reduced futures market participation from both speculators and commercials and reduced forward cover.”

It said cocoa powder prices have remained robust over the last year, compared to beans and butter, and will likely persist on continued post-pandemic demand growth.

Cocoa powder is used to produce baked goods such as cakes and biscuits and for making beverages like hot chocolate. The butter goes into making chocolates and ice cream, giving them their smooth, creamy taste.

“Butter prices continue to lag as out-of-home consumption and sales of beauty products in the US and Europe make a slow recovery,” RaboBank said.

Looking ahead, strong consumption growth and less-than-ideal weather in West Africa in the lead up to the 2021/22 main crop could cause the 2021/22 balance to turn negative, it said.

It says it has changed its outlook for 2021/22 from a surplus of around 60,000 tonnes toa deficit of 8,000, a much tighter market than previously thought, on potentially higher-than-expected demand and lower production.

The unseasonably good weather in West Africa that boosted 2020/21 production may also not continue ahead of the 2021/22 season, Rabobank said.

“The potential for this appears underpriced in our opinion, with demand likely continuing to steadily rise over the next 6 months and possibly over the next 12 months. Much of the increase in retail demand seen over the pandemic will likely be sticky, despite the easing of lockdowns and increasing out-of-home consumption.”

“The net effect from this and better consumer sentiment will likely be an overall demand boost that could be present in the market for some time. The greatest risks for price increases appear in Europe, where stocks have not increased in the same way they have in the US due to the present futures arbitrage.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.