Is the tech sector cyclical or secular? We believe it is both. While technology adoption is clearly a secular trend (a fundamental change in a business model), there are many cyclical trends that impact valuations in the tech sector which vary significantly from company to company. Two major contributors are earnings and interest rates.

1. Earnings

Earnings cyclicality is a function of business model and business maturity level. Companies that provide hardware, such as semiconductors face significant cyclicality in earnings as inventory management exacerbates weak demand.

Conversely, software offers solid subscriptions which provide steady earnings. However, depending on business maturity levels, there may be slower growth levels or elongated sales cycles. Similarly, themes and ideas which are in the early adoption stage, such as cloud infrastructure, are less dependent on the economy so their earnings are less cyclical when compared to mature business models such as CRM, e-commerce, and gaming.

2. Interest rates

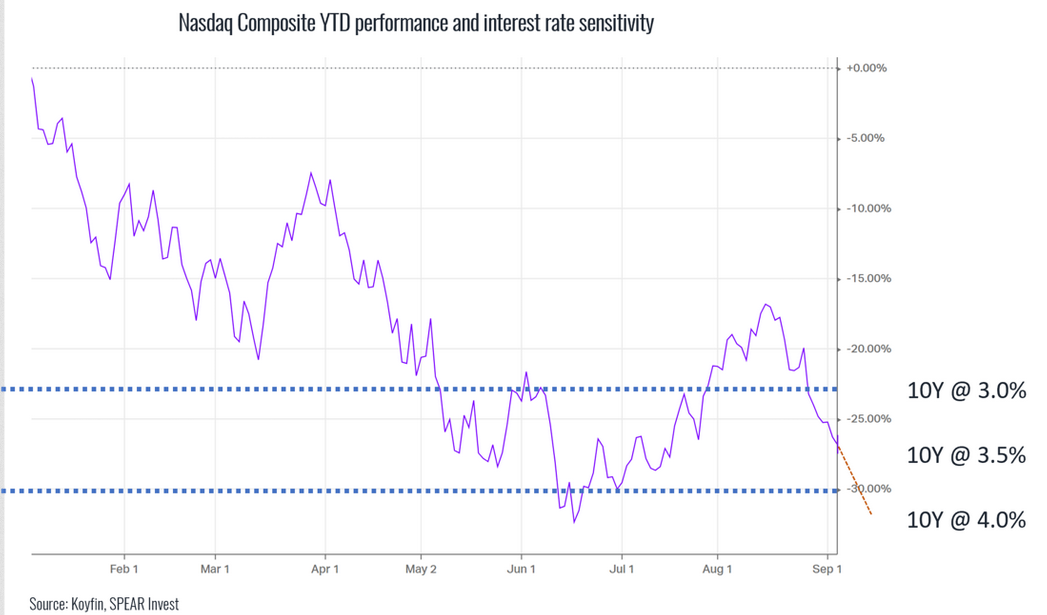

The risk-free rate is a key valuation metric for all stocks, so the U.S. Federal Reserve's stance on interest rate has driven a lot of volatility in the market, particularly in technology stocks as their valuation is dependent on future profit forecasts.

We estimate that a 1% move in interest rates results in ~15-20% downside in the sector. However, it is important to note that with the 10-year yield between 3% and 3.5%, the current Fed stance on interest rates has largely been priced into stock valuations so tech stocks have been forming valuation floors. We believe that any downside from here will be largely driven by earnings.

Therefore, it is unsurprising that there seem to be more earnings downside surprises in the cyclical area of industrial tech, such as semiconductors, and strong earnings in the more secular areas, such as cloud infrastructure.

Cyclical semiconductor stocks

NVIDIA (NASDAQ:NVDA) and Marvell (NASDAQ:MRVL) both noted supply chain challenges and earnings downside was exacerbated by inventory.

NVIDIA provided weak Q3 guidance with revenues expected to be down 17% year-on-year (yoy) and 12% quarter-on-quarter (qoq). This was 15% below consensus and was driven mainly by the gaming segment. Enterprise spending remained strong, but investors are now worried that this will be the next area of disappointment.

Secular cloud infrastructure

Snowflake (NYSE:SNOW) reported very strong results, including 83% revenue growth. It guided to 67-68% revenue growth in fiscal 2023.

Customers that were underspending in the prior quarter are now outpacing expectations, demonstrating how non-discretionary enterprise spending is. EMEA was strong despite the fact that Europe is in a recession, highlighting the secular component of Snowflake's business.

For more research and primers, visit our website.