CI Games (WA:CIG) is a global video games developer and publisher that focuses on premium AA+/AAA multi-platform games, with two main franchises: a first-person shooter, Sniper: Ghost Warrior (SGW); and a soulslike fantasy action role-playing game, Lords of the Fallen (LotF). With SGWC2 launched in H121, no major new games are expected in FY22, before LotF2 and the next iteration of the SGW franchise launch in 2023, as CI Games’ revenue base builds. Following a similar strategy to Remedy Entertainment and Frontier Developments, the company then expects to launch one major title every 12–18 months, incrementally broadening its portfolio. CI Games also owns a third-party publishing arm, United Label, expected to launch two to four smaller titles per year. CI Games’ current valuation takes no account of the potential for success in FY23, which could justify a c 5x increase in the share price. In August, CI Games announced a review of its strategic options, to include identification of a potential strategic investor.

Share Price Performance

Long-term track record, ambitious growth plans

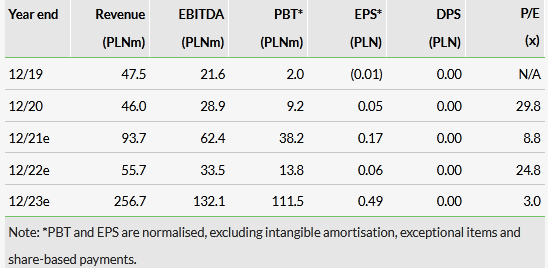

CI Games has a 20-year track record under its founder and CEO, Marek Tymiński, with two established franchises, SGW (12.5m units sold) and LotF (over 3m units sold). To become a major publisher, CI Games intends to build out its existing franchises, launching a major title every 12–18 months from 2024. Based on our assumptions, we estimate year-on-year revenue growth of 104% in FY21, with a revenue CAGR of 77% from FY20–23. We forecast FY21e EBITDA of PLN62.4m (67% margin), rising to PLN132.1m (51% margin) in FY23, a 66% CAGR FY20–23.

Investment case centred around LotF2

With SGWC2, the group’s key FY21 title, already released and performing well, our FY21/22 forecasts are substantially underpinned. No major releases are planned for FY22, leaving the successful launch of LotF2 in FY23 as the major focus for investors. Timely delivery of a high-quality title is critical to the investment case.

Valuation: Material discount to European peers

As a domestically held stock, with a mixed history of execution, CI Games trades on 4.0x FY21e EV/EBITDA and a P/E of 8.9x and 1.9x FY23e EV/EBITDA and an FY23e P/E of 3.1x. This compares to the peer group on an FY23e EV/EBITDA of 13.1x and a P/E of 23.4x. If CI Games can successfully launch the next SGW game and LotF2 in FY23 (selling 1.5m and 2.5m digital units) to establish a broad-based portfolio, then both our DCF analysis and peer multiples indicate that there is the potential for almost 5x upside as a reward for early investors in this growth story.

Investment summary

An emerging, IP-owning European developer and publisher

CI Games is an experienced game developer and publisher, with headquarters in Poland, but serving a global player base from offices in Spain, Romania, the UK and the United States. With a 20-year track record, CI Games has established two franchises, SGW, which has sold over 12.5m units across multiple iterations, and LotF, which has sold in excess of 3m units. These games have established a loyal and committed player-base in the first-person shooter (FPS) and soulslike role-playing game (RPG) segments, which CI Games is seeking to build on with future games. In 2018, CI Games also launched its own indie games publisher, United Label.

Strategy: Building a portfolio of high-quality titles

In August 2021, CI Games announced a review of its strategic options, to include identification of a potential strategic investor, advised by Drake Star Securities.

Over the next five years, CI Games wants to establish itself as one of Europe’s major games developers and publishers, building on its soulslike, RPG and FPS expertise. It is following a path similar to Frontier Developments (AIM: FDEV) and Remedy Entertainment (HEX: REMEDY), building out its existing franchises, but also launching new games (based on owned as well as licensed IP) on a more regular basis. Currently, with two teams, new titles are launched every c 24 months, but from 2023 this should reduce to 18–24 months, with the intention of launching a major title every 12–18 months from 2024 based on a third team working alongside CI Games Warsaw and Hexworks.

CI Games’ latest title, Sniper: Ghost Warrior Contracts 2 (SGWC2), was launched in June 2021 to strong reviews, and has had very promising initial sales, with 560,000 units sold in the two months to 31 August 2021. This successful launch, together with ongoing digital sales and monetisation of the title, largely underpins the group’s results for FY21/22, leaving the successful launch of LotF2 in FY23 as the critical element of the investment case. We also assume that the next iteration of the SGW franchise will launch in FY23, but as the sixth iteration in an established franchise, we perceive the risk for this title to be significantly lower than for LotF2.

Strategy 2.0: Lessons learned from 2017 crunch

Management stripped the business back to its core and rebuilt its strategy following previous development challenges, which came to a head in 2017, with a disappointing reception to the release of SGW3 and the termination of a third-party contract to co-develop LotF2. Management is seeking to de-risk the development process and re-engineer CI Games to produce high-quality titles, to time and to budget.

- Strengthening in-house development – in order to deliver its vision, management put in place an experienced senior development team, with strengthened processes and controls.

- Refreshing the development team – the development team was scaled back to 30 people in 2018. Capacity has been steadily rebuilt, with the team now standing at over 120 developers.

- Partnering Polish with European talent – development capacity remains constrained in Poland, with strong demand raising salaries. As a result, CI Games has partnered its Warsaw-based team with teams across Europe, notably in Spain, Romania and the UK.

- Increased budgets – in order to improve game quality, team sizes and budgets have had to increase, alongside tighter management of the development process.

- External game engine – LotF2 is being developed on the Unreal game engine (and we expect the next instalment of the SGW franchise will be as well), significantly saving development time and allowing the teams to focus on distinctive gameplay.

The success of CI Games’ revised strategy will be judged by user reviews (as an indicator of end-user demand), Metacritic scores (as an indicator of quality) and ultimately in terms of units sold, delivering effective monetisation over the cycle.

Title release schedule: LotF2 remains the lynchpin

With SGWC2 released in H121 (and on PS5 in Q321), we do not expect the next major release (LotF2) until H123, meaning that we expect FY22 to be a ‘lull year’ with a y-o-y fall in revenues. Given an approximate 18- to 24-month development time between iterations of the SGW franchise, we also expect the next instalment in FY23, though likely H223. We assume that CI Games would like to run a third development team in parallel with the existing two teams (although the company has not confirmed this), meaning that we would expect a new IP to be launched in FY24 with major game releases following every 12–18 months thereafter.

To these release assumptions, we add a low level of revenue from United Label (a 78.4% held subsidiary), building over time as more niche titles are released, as well as CI Games’ back catalogue, principally from prior releases from the SGW franchise.

Financials

Ostensibly, with a solid performance from SGWC2 in FY21, investors are being asked to look ahead to FY23 and beyond in order to ascribe anything like full value to CI Games’ shares. Our forecasts are built on the gating assumption that LotF2 and the next iteration of the SGW franchise are both launched in FY23 and achieve moderate to good sales figures, of 2.5m and 1.5m digital units, respectively. Thereafter, we assume games are launched every 12–18 months, offering a broad and increasingly stable future revenue profile.

CI Games delivers strong margins in years with a major new title release (FY21, FY23), but is also profitable in years between releases (FY20, FY22), despite lower revenues. As with other Polish-based publishers, EBITDA margins for the forecast period (c 50–65%) are expected to remain above European peers (c 35–40%) through cost-effective development expertise and good process controls. For FY21, we estimate revenues of PLN93.7m, 104% y-o-y growth over FY20 (PLN46.0m), almost doubling H121 revenues, with EBITDA of PLN62.4m (a 66.5% margin). In FY22, we expect no major new releases and, as such, forecast a 41% fall in revenues to PLN55.7m, with EBITDA of PLN33.5m (a 60.2% margin). In our base case for FY23, we assume digital unit sales of 1.5m for the next iteration of the SGW franchise and 2.5m for LotF2, leading to revenues of PLN256.7m with EBITDA of PLN132.1m (51.5% margin).

Games market: 8% global growth FY21–24

Buoyed by exceptional demand for games during lockdown and boosted by the start of a new console transition, the global games industry showed year-on-year growth of over 20% in FY20 (Newzoo). Market growth is expected to pause in FY21 (1.1% fall year-on-year), before growth resumes in FY22, with 8% annual growth from FY21–24. Driven by global growth as well as increasing demographic penetration, we expect that the games sector will remain high growth for the foreseeable future.

Sensitivities: Execution risk a focus for investors

With FY23 critical to the investment case, investors are being asked to look through FY22 to potential higher levels of profitability in FY23 and beyond. CI Games has learnt from the challenges it faced in 2017 and reconfigured its strategy to deliver consistently higher-quality games. Currently CI Games holds a relatively narrow portfolio of titles, so a key risk is whether management can deliver successive titles of increasingly higher quality, to budget in a timely manner. Recent launches indicate that quality is steadily improving. As a people-based business, CI Games is reliant on the quality of staff that it can attract and retain. Management has chosen to continue with a strategy of distributed development post-pandemic, allowing the business to attract key talent who might otherwise not be prepared to relocate to Warsaw. However, this increases execution risk. CI Games is reliant on a stable tax regime and plans to use Poland’s IP box tax relief to reduce its effective tax rate from 2022. With an increasingly European cost base and revenues principally denominated in US dollars, euros and pounds sterling, CI Games reports its results in Polish zloty, although it seeks to hedge FX risk.

Valuation: Potential for c 5x upside if targets are met

CI Games trades on 4.0x FY21e EV/EBITDA and a P/E of 8.9x, with its key FY21 title already released and performing well. Based on our base case assumptions, CI Games trades on 1.9x FY23e EV/EBITDA, together with a P/E of 3.1x. This compares to the peer group EV/EBITDA of 13.1x and a P/E of 23.4x. With FY21/22 already largely underpinned by the successful launch of SGWC2 in H121, if CI Games can successfully meet our FY23 targets, and build a broad-based and sustainable business thereafter, then both our discounted cash flow (DCF) analysis and peer multiples indicate that there is the potential for 5x upside as a reward for early investors in this growth story. Investors should closely monitor development progress at LotF2.