COMMODITIES: It’s the worst asset class (DJP) this year, like last. China’s GDP slowdown has been a key factor, alongside the strong dollar and global manufacturing recession. Near term hopes are pinned on a bigger China policy stimulus from next week’s ‘two sessions’ event. Longer term from the rise of India as the next big long-term demand driver. But the world’s fifth economy is still too small, with its $4 trillion GDP sandwiched between Japan and UK. Even as it drives specific commodities from sugar, to cotton, and wheat. It is under a quarter China’s $18 trillion GDP, that accounts for half of all demand for iron ore to copper, aluminum, and soybeans.

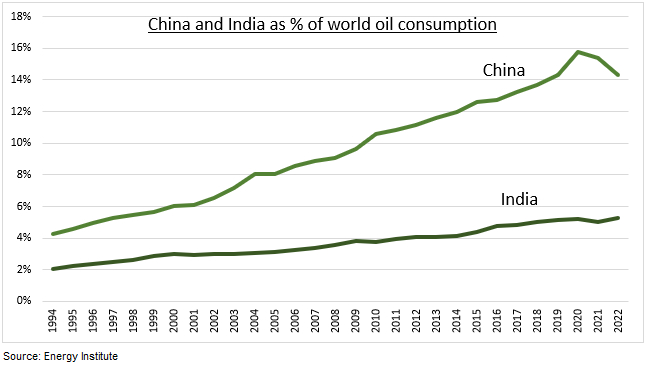

INDIA: The world’ 1.4bn most populous economy’s GDP growth has outpaced China since the pandemic. With its strong demographics, low urbanization, and policy refocus on infrastructure investment and manufacturing – which represents only 13% of the economy vs 28% in China. It has become the world’s second largest oil importer (see chart), accounting for near 5% of global production, and is dependent for 85% of its needs. Its long been one of the biggest gold buyers and is a top producer of sugar, cotton, rice, and wheat. Its export restrictions have driven global supply volatility. Commodity sector stocks make up a big 20% of the local stock market (INDA).

CHINA: The authorities have been reining in the super-sized property-sector and GDP growth is structurally slowing. The decades of 10%+ GDP growth are long gone. As it rebalances towards the consumer, to be less-carbon intensive, and as demographic headwinds build. Yet it still accounts for c.30% of global GDP growth, the most of any economy, and dominates commodity demand. Its GDP per capita of $13,000 dwarfs India’s $3,000. Whilst its commodity-heavy 40% investment/GDP level remains both higher and more state-led than India’s 30%. Yet its commodity sectors under-represented in the local market (MCHI), at under a 7% weighting.