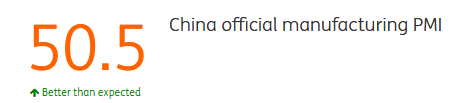

China's official manufacturing PMI beat consensus in March. We believe this was mostly the result of fiscal stimulus on new infrastructure production, not a recovery from external demand. Since activity growth was pushed by fiscal stimulus, we expect this kind of growth will continue to support the economy during 2019.

Surprisingly good manufacturing PMI

China's official manufacturing PMI rose to 50.0 in March from 49.2 in February. Among all sub-indices, production, new orders, prices, and purchasing activities all showed gains (i.e. above 50). But new export orders and orders placed by customers stayed in contraction territory (i.e. below 50), though by less than the previous month.

|

|

Fiscal stimulus working

For the manufacturing PMI sub-indices as a whole, we believe the improvement was the result of the fiscal stimulus' infrastructure projects. These projects are mainly new metro lines and toll roads. And this matches with the sub-index on construction business activities at 61.7 in the non-manufacturing index, which rose to 54.8 from 54.3.

These activities have pushed up some commodity prices, for example, iron and copper. Thus, upstream manufacturers that are in the mining industry should be among the first producers to enjoy the positive outcome of the fiscal stimulus.

In the latter part of 2019, when the production process goes from upstream suppliers to downstream products for metro lines and toll roads, eg, equipment, more manufacturers will enjoy positive growth.

But this is not led by external demand

We have to admit that this PMI report is mainly driven by China's own fiscal stimulus. Though new export orders' reading improved, it was still only at 47.1 in March (from 45.2 in February), indicating that export orders were still shrinking, albeit at a slower pace. This implies that external demand has not improved. Moreover, trade negotiations are still ongoing. Even if there is a trade deal, we believe that the monitoring system will create continuous uncertainties on China-US bilateral trade.

More improvement in manufacturing PMI in the coming months

We expect fiscal stimulus in China will continue. Therefore, domestic demand will continue to lead to an increase in new orders and production in the manufacturing PMI. If the external environment does not deteriorate further, we believe that the fiscal stimulus and monetary easing on private firms should be large enough to keep economic growth above 6.0%, which is in line with our forecast of 6.3% growth in 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.