- Cheniere Energy has outperformed the broader market

- LNG is up 38.1% year-to-date amid the ongoing energy sector rally

- Cheniere remains one of the best stocks to own

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

- *Year-To-Date Performance: +41.3%

- *Market Cap: $36.3 Billion

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

Energy stocks have been some of the market’s best performers in 2022, as investors pile into the sector amid the ongoing rally in crude oil and natural gas prices resulting from geopolitical tensions between Russia and Ukraine.

Not surprisingly, one of the energy sector’s leading ETFs—the SPDR® S&P Oil & Gas Exploration & Production ETF (NYSE:XOP)—has rallied 66.5% year-to-date to reach its highest level since October 2018. The S&P 500, for its part, is down roughly 12% over the same timeframe.

Despite recent gains, we believe that Cheniere Energy (NYSE:LNG) is well-positioned to extend its march higher in the weeks ahead as the current operating environment has created a perfect backdrop for the LNG exporter to thrive.

Cheniere Energy

Cheniere Energy is the largest liquefied natural gas (LNG) producer in the U.S. and the second biggest globally. It made history in February 2016, when it became the first U.S. energy firm to export LNG to international markets.

LNG stock has easily outperformed the broader market so far in 2022, gaining 41.3% year-to-date as it benefits from improving global energy demand and higher natural gas prices.

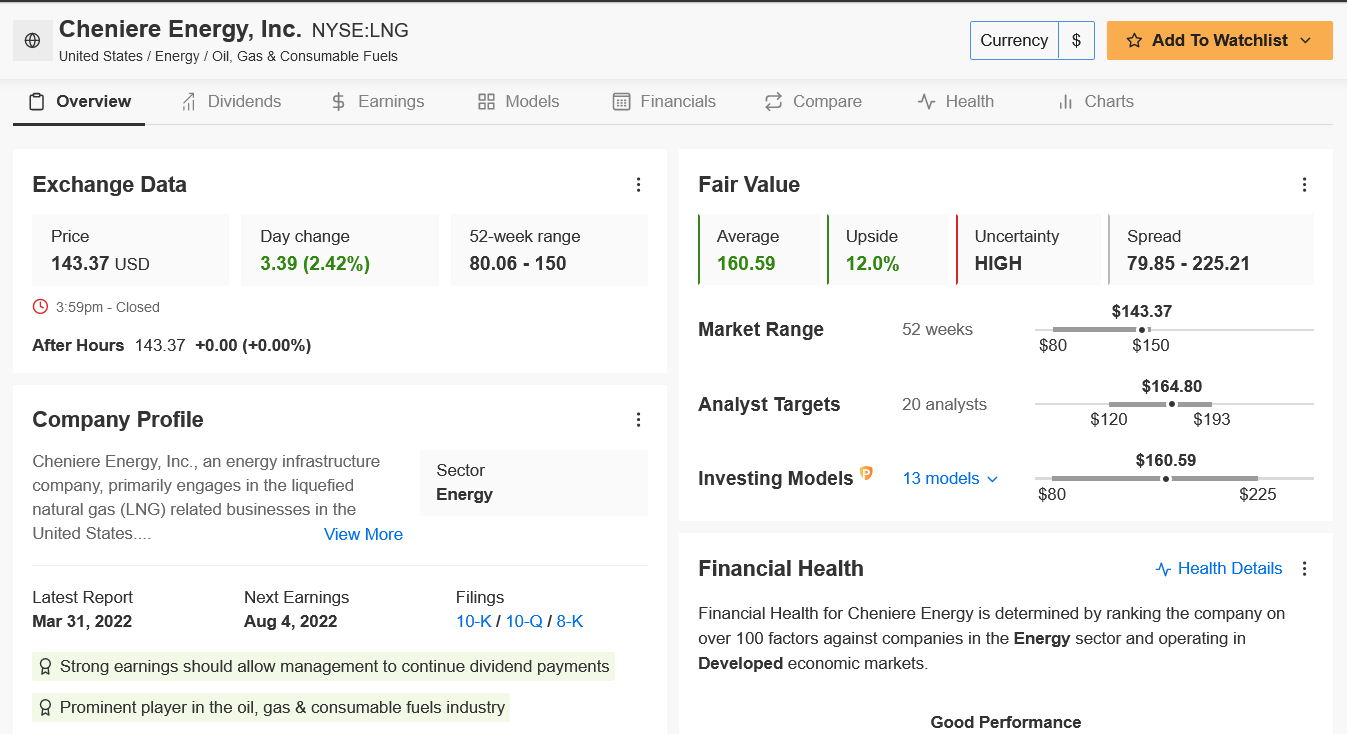

Shares ended Thursday’s session at $143.37, within sight of their recent all-time high of $150.00 touched on May 4. The U.S. LNG giant has a market cap of $36.3 billion at current levels.

Q1 2022 Earnings Release

Cheniere delivered mixed results for profit and revenue when it released its first-quarter earnings report on May 4.

The Houston-based company posted a surprise loss of $3.41 per share for the three months ending March 31, confounding expectations for earnings per share of $3.49. It took a $3.5 billion charge on LNG price-related derivative losses.

Sales for the quarter surged 142% from a year earlier to $7.48 billion, blowing past consensus estimates for revenue of $5.48 billion amid mounting global demand for shipments of the super-chilled fuel.

Cheniere said it exported a record 160 cargo during the first quarter, with about 75% going to Europe. Chief executive Jack Fusco said in the earnings statement:

“Cheniere’s continued focus on execution, seamless operations, and maintenance optimization has enabled record LNG production to help balance the global energy market.”

The U.S. LNG industry has enjoyed a lift in demand as Europe seeks to diversify its energy supplies away from Russia.

Forward Guidance

Looking ahead, Cheniere raised its full-year profit and sales guidance due to the sustained strength in the global LNG market and an increase in expected LNG production.

The LNG exporter now sees 2022 earnings ranging from $8.2 billion to $8.7 billion, up sharply from a prior forecast of $7.0 billion to $7.5 billion.

Additionally, the company is preparing to approve 10 million tonnes per year of new capacity in Texas this summer. Fusco added that:

“The current volatility in the global energy markets signals the need for additional investment in new LNG capacity, underscoring the power of the Cheniere platform.”

Bottom Line

Despite robust year-to-date gains, Cheniere remains one of the best names to own for investors who want to take advantage of the emergence of the U.S. as a major global LNG exporter.

The company is poised to continue to benefit from accelerating demand for liquefied natural gas amid the current environment while taking advantage of high prices, which will help fuel future profit and sales growth.

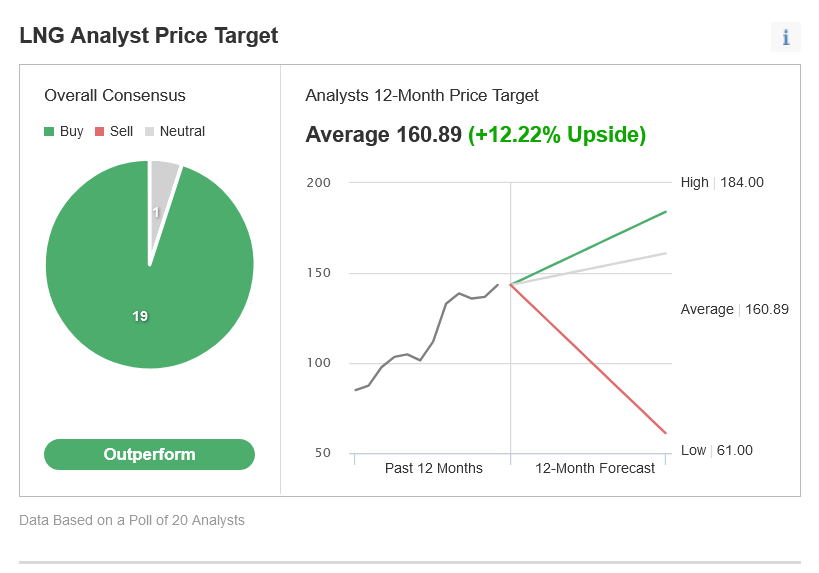

Not surprisingly, 19 out of 20 analysts surveyed by Investing.com rate LNG stock as “outperform”, implying a roughly 12% upside from current levels to $160.89/share.

Source: Investing.com

Similarly, according to several valuation models, including P/E or P/S multiples or terminal values, the average fair value for LNG stock on InvestingPro stands at $160.59, a potential 12% upside from the current market value.

Source: InvestingPro

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »