Recession concerns suggest falling demand for oil. When the economy shrinks, business expansion comes to a standstill, consumers reduce demand, which means less energy is needed to produce goods, and less energy is used to deliver those goods.

On the other hand, a tight supply props up the oil price. Sanctions on Russia, turmoil in Libya, and frequent COVID lockdowns in China make a case for higher oil prices.

Yesterday, oil plunged a whopping 10% on mounting recession worries, as Treasury yields inverted.

When investors increase demand for short-term bonds at the expense of long-term bonds, it creates a market anomaly.

In normal conditions, investors should be compensated more for committing to a longer-term loan to the US government.

Why are they willing to be paid less, even amid a longer commitment?

Because they are scared and are cutting their losses. They consider the lower yields safer than the alternative.

So that explains yesterday. But was it a one-off, or will prices continue lower?

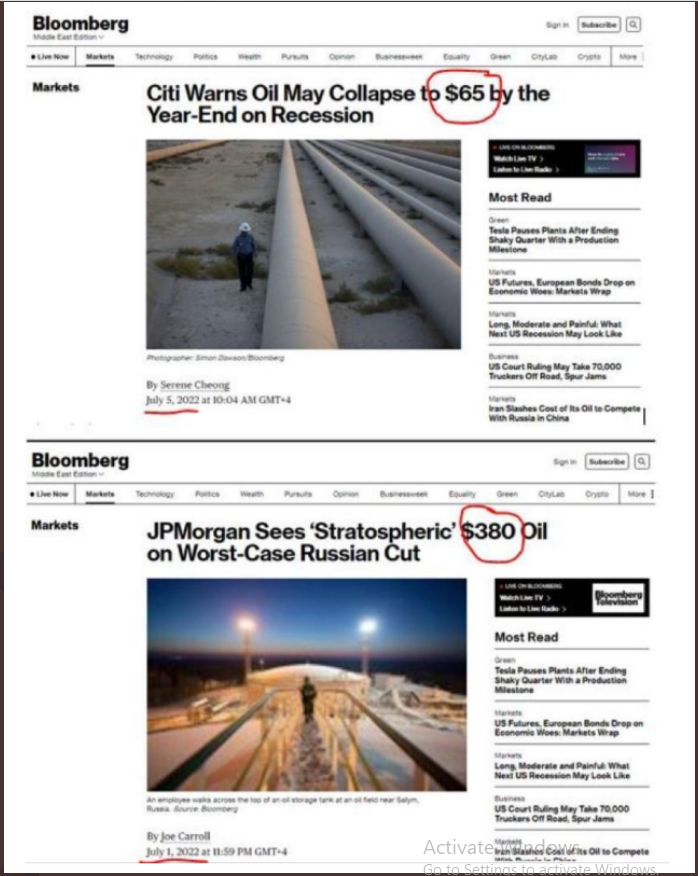

@MacroAlf on Twitter sarcastically characterized the conflicting narrative in the form of deviating investment bank predictions

I am inclined to agree with Citi's forecast. Here's why.

WTI completed a bearish flag, an apparent equilibrium following a $22 plunge within just seven sessions.

Yesterday's decisive downside breakout demonstrates that despite rising, the range did not reach price equilibrium but rather a 'breather' amid the downward spiral. That's because it means that the range rose on short covers as opposed to bullishness. Once the temporary spike in supply ran out, sellers were willing to lower their offers to find new willing buyers. This sets a chain reaction, sending prices spiraling lower.

The initial drop before the flag is expected to repeat after the flag. Therefore, my initial forecast is $86.

But if that scenario plays out, oil will have completed a descending peak and trough downtrend, whose main force is downward.

Finally, suppose the price falls to the level of the April trough, bounces, and falls lower. In that case, it will have completed an additional, much larger pattern than the Rising Flag, a Symmetrical Triangle.

The structure visually displays how buyers and sellers were willing to increase their positions. However, a downside breakout would demonstrate that bears knocked out the bulls and are in charge.

Note how yesterday the price dipped below the triangle bottom, but closed precisely on top of it, respecting its support. That happened again today.

Coincidence? If it breaks, I see the price falling to not just Citi's $65 but to $60.

Trading Strategies

Conservative traders should wait for the triangle to complete and continue falling below $96.80 and a return move that will demonstrate pattern integrity. They will wait for a minimum of two days to ensure the price doesn't climb back above the pattern bottom to avoid a bear trap.

Moderate traders could sell upon a return move to the flag and its proven resistance. Alternatively, they would be short if the price fell below yesterday's $97.43 low and remained below the triangle for at least two days. Then, they would wait for a corrective rally, too short at a higher price, if not for added confirmation.

Aggressive traders will enter a long contrarian position counting on the support of the triangle bottom, which will help a return move—short covers, compounding bulls' longs—to the flag. This trade is relevant only if you know what you're doing. Money management is paramount. Here is a generic trade example:

Trade Sample - Aggressive Long Position:

- Entry: $99

- Stop-Loss: $97

- Risk: $2

- Target: $105

- Reward:$6

- Risk-Reward Ratio: 1:3

Note: This is a generic sample. You could tweak it according to your timing, budget, and temperament. For example, you can buy it now, in case it doesn't dip to $99, but that would increase your exposure and reduce your potential upside until the resistance. Happy trading!

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.