Ahead of CentralNic's (LON:CNIC) seasonally strongest quarter, it has reported trading for the first nine months of FY21 (9M21) ahead of market expectations. Noting the acceleration of organic growth to 29% for 9M21, driven by the group’s investment programme, management expects to trade comfortably at or above the upper end of market expectations for the year for both revenue and adjusted EBITDA (expectations disclosed as US$355.3m and US$42.0m respectively). Accordingly, we have raised our FY21 revenue estimate by 10% to US$384m, with adjusted EBITDA rising to US$43m, an 11.2% margin, with these changes flowing through to our estimates for FY22/23. Adjusted operating cash conversion was in excess of 100%, meaning that net debt fell to US$79m as at 30 September 2021.

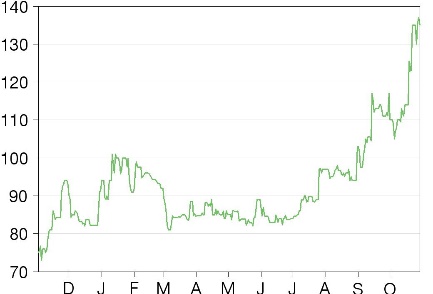

Share price performance

Business description

CentralNic Group is a leading global domain name services provider, operating through two divisions: Online Presence (Reseller, Corporate, and SME); and Online Marketing. Services include domain name reselling, hosting, website building, security certification and website monetisation.

9M21: 29% organic growth, up from 20% for H121

In its Q321 trading statement, CentralNic reported a further acceleration of organic growth to 29% for 9M21 (H121: 20% y-o-y organic growth), driven by its investment programme. As a result, the company expects to report 9M21 revenue of at least US$280m (66% y-o-y growth) and adjusted EBITDA of at least US$32m (45% y-o-y growth) versus 9M20 figures of US$168.5m and US$22.1m, respectively. This indicates an adjusted EBITDA margin of 11.4%, slightly below the 11.7% for H121, likely due to growth continuing to be led by the lower-margin Online Marketing over Online Presence. With adjusted operating cash conversion in excess of 100%, cash at period end rose to US$54m (H121: US$39.5m), with net debt falling to US$79m (H121: US$83.8m).

Upward revision to revenues and adjusted EBITDA

Assuming Q421 will be at least in line with Q321, we have raised our FY21 revenue estimate by c 10% to US$384m, with adjusted EBITDA rising 5% to US$43m, an adjusted EBITDA margin of 11.2%. These changes affect our estimates for FY22 (US$420m, US$48m) and FY23 (US$454m, US$52m) with an 11.4% adjusted EBITDA margin for both, but all other assumptions remain unchanged.

Valuation: Discount despite market-leading growth

Following our upgrade, we estimate that CentralNic will deliver 59% sales growth in FY21. It demonstrates some of the strongest growth in its peer group and yet trades on P/E multiples of 16.0x in FY21e and 15.1x in FY22e. Whether we compare it to web services or (European or US) online marketing, CentralNic continues to trade at a material discount to its peers. The web services peer group trades at average P/Es of 25x for FY21 and 19x for FY22. CentralNic’s discount to its online marketing peers (FY21: 33x, FY22: 25x) is more marked.

Click on the PDF below to read the full report: