CentralNic (LON:CNIC) provides domain name services and online marketing, focused on consolidating a highly fragmented global market. It offers a broad range of internet services, including reseller services, to corporates and SMEs (Online Presence), as well as monetisation services (Online Marketing) to domain investors. The group strategy is to benefit from structural market growth, building its two segments and diversifying the group’s revenues through cross-selling and upselling services. CentralNic has achieved a five-year revenue CAGR to FY20 of 78%. The company is valued on an FY21 EV/EBITDA multiple of 12.6x and a P/E of 17.4x, a material discount to its peer group, with our DCF underlining the discount to fair value. We would expect future M&A to bring CentralNic’s multiples down further.

Recurring revenues with attractive cash dynamics

CentralNic’s Online Presence division operates in a growing, subscription-based, technology-enabled global market (management estimates a US$30bn addressable market, 6% growth). Online Marketing operates in a US$400bn market, with 20%+ growth. Both divisions offer attractive cash dynamics, with operating cash conversion of c 100%. Customers tend to be sticky, becoming stickier the longer they remain (FY20: 99% recurring revenues). CentralNic operates a leveraged ‘buy and build’ model, with M&A adding to organic growth.

Resilient, M&A-driven business model

CentralNic completed one major acquisition in FY20, Codewise (Online Marketing), which follows four acquisitions in FY19: TPP Wholesale, Hexonet and Ideegeo (Online Presence) and Team Internet (Online Marketing). In FY21, CentralNic has completed the US$3.7m (plus a US$0.7m earn-out) acquisition of SafeBrands (Online Presence), a brand protection software provider, Wando Internet Solutions (Online Marketing), for US$13.0m in cash (including a US$6.5m earn-out) and a publishing network of revenue generating websites from White & Case (Online Marketing) for US$6.5m in cash. With 9M21 net debt of US$79m, leverage of 15% and net debt/EBITDA of 2.6x, CentralNic retains capacity for further M&A.

Valuation: Growth story, but discount remains

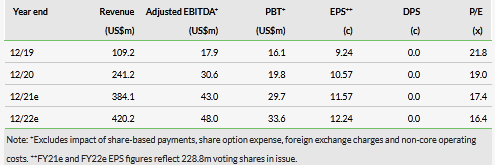

Based on Edison’s estimated 59% sales growth in FY21 (estimates raised with the Q321 trading update), CentralNic offers some of the strongest growth among its peers, yet trades on an FY21 P/E multiple of 17.4x and 16.5x for FY22e. Whether we compare CentralNic to web services or online marketing, the shares continue to trade at a material discount to its global peers, with our NPV analysis underlining the significant discount to theoretical fair value.

Share price performance

Business description

CentralNic Group provides the essential tools for businesses to go online, operating through two divisions: Online Presence (Reseller, Corporate, and SME); and Online Marketing. Services include domain name reselling, hosting, website building, security certification and website monetisation.

Click on the PDF below to read the full report: