Wall Street was mostly down on Tuesday

Yesterday has been the first trading day of the week because the market has been closed on Monday for Martin Luther King Day.

The Nasdaq, on Tuesday, was the only index to report a profit, in fact, both Dow Jones and S&P 500 closed in negative.

At the end of the market session, the three big indexes closed as follows:

The S&P 500 closed at -0.20%, the Dow Jones closed at -1.14% and the Nasdaq ended the trading session at +0.14%.

The heavy tech index, Nasdaq, is on a strike of 7 consecutive positive trading days.

The reason behind the decline of the two major indexes is that the big investment banks have reported lower revenue.

US investment banks

Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) are two of the biggest US banks and both reported fewer earnings yesterday.

Wall Street investors have rewarded Morgan Stanley for the implementation of a clear strategy and its shares have rose 5.9%.

Goldman Sachs's shares, instead, have dropped 6.4% as investors are still not sure about their plan of action.

It is worth mentioning that all the banks in the US are expecting a possible recession and for this reason are setting aside more money than usual.

"Goldman executives said the bank increased rainy-day funds partly in response to existing credit-card balances. Executives also said they had slowed credit-card originations and tightened underwriting" according to Wall Street Journal.

Bank of Japan

The Bank of Japan has decided to maintain an ultra-loose monetary policy despite the market pressure.

By doing so, Japanese stocks rallied and the Yen dropped 2%.

EU Central Bank

The European Central Bank officials are starting to take into consideration the possibility to reduce the pace of interest-rate hikes.

There are signals that in March the rate hike will be 0,25% however for the month of February the interest rate increase remains at 50 basis points.

US Central Bank

The Federal Reserve has implemented a very tight monetary policy to reduce inflation.

The latest CPI has shown inflation of 6.5% and the target is to arrive at 2%.

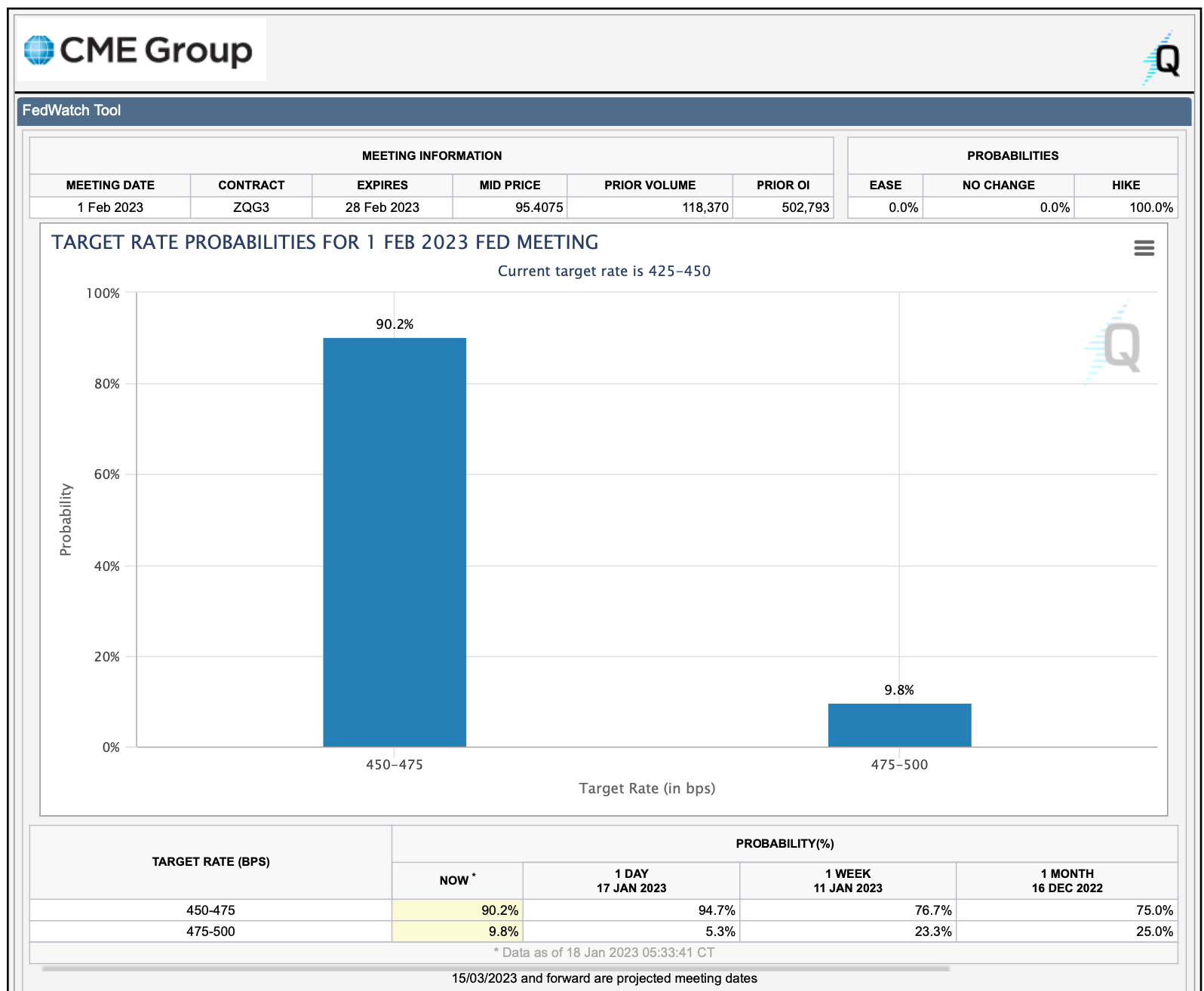

The next Fed meeting is in 14 days and in the following chart, there are available data about the probability of how much will be the next interest rate hike.

FedWatch Tool - FED rates probabilities

90.2% of investors are expecting the FED to increase the interest rates by 0.25% at the next meeting.

The remaining 9.8% are expecting a 0.50% rate increase.

The number of investors expecting a rate increase of 0.25% has slowed down by 1% compared to yesterday.

No other options are considered at this time.

The next FED meeting is on 1 February 2023.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Banks on Different Paths: US Tightens, BOJ Loosens, ECB Considers Easing

Published 18/01/2023, 12:25

Central Banks on Different Paths: US Tightens, BOJ Loosens, ECB Considers Easing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.