Wall Street finished mixed yesterday

Wednesday has been a negative day for the S&P 500 and the Nasdaq.

Among all three major US indexes, only the Dow Jones has reported a profit.

The S&P 500 finished at -0.38%, the Nasdaq ended the trading session at -1.29% and the Dow Jones closed at +0.27%.

The negative movement has been driven by the fall of tech stocks and the Central Bank of Canada's unexpected decision about interest rates.

In particular, GameStop (NYSE:GME) lost 19%n its share price in extended trading, while its CEO has been replaced.

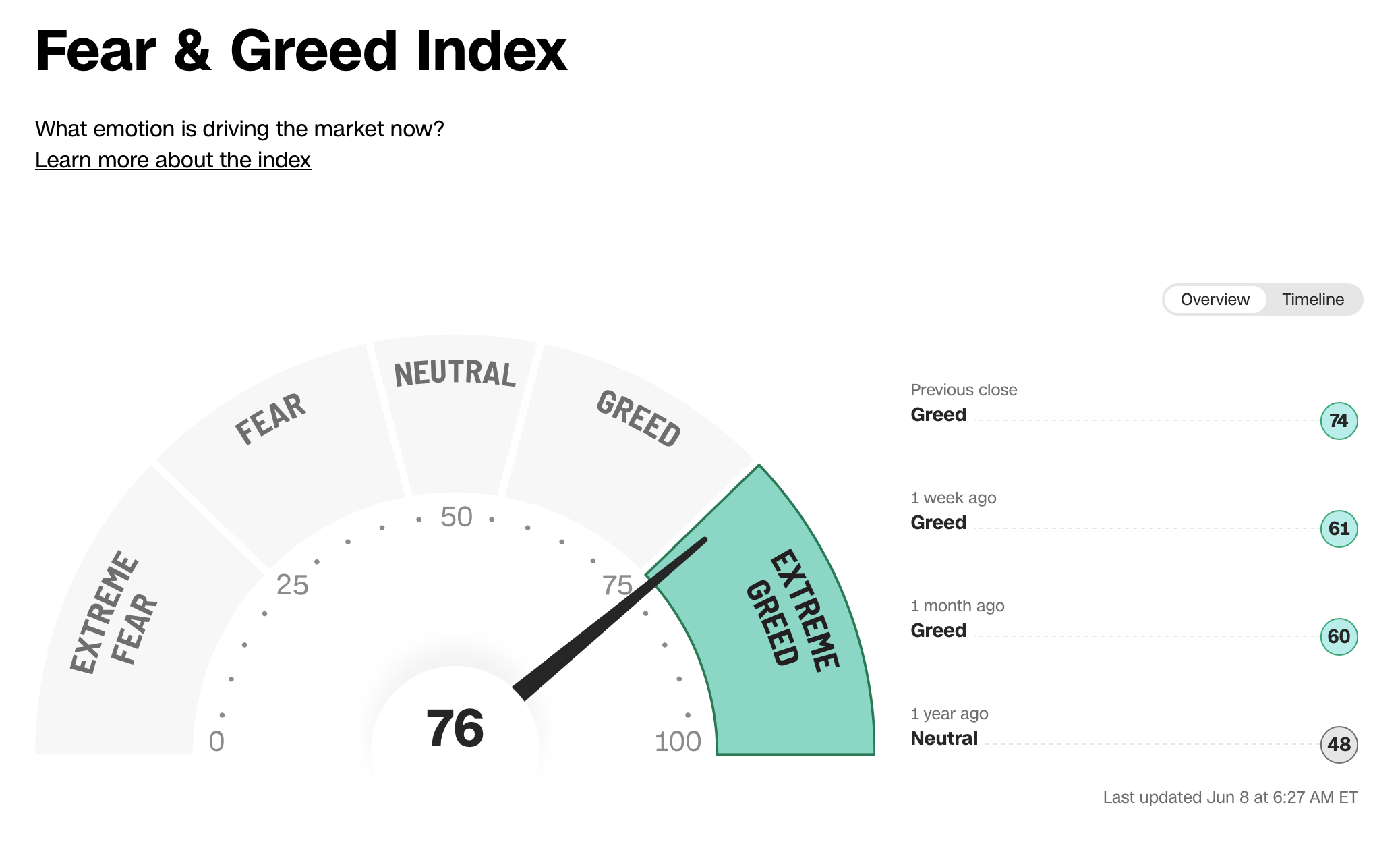

The investors' sentiment is Extreme Greed, as indicated in the graph below:

Sentiment indicator - Fear & Greed Index

The market sentiment is 76, in “Extreme Greed” mode, up from the previous days.

Central Banks are raising rates

This week, the Canadian Central Bank and the Reserve Bank of Australia increased their interest rates surprisingly.

By doing so, the worries about stuck inflation above its target of 2% have risen.

Investors are now more cautious because the Federal Reserve could also keep rising interest rates.

The FED will meet on 14 June to decide the next monetary policy move, and the number of investors expecting another rate hike has increased (32, 2%) compared to the previous days. The majority of the investors (67,8%), however, are betting on a no-rate hike this time, so on a pause.

What to watch today

At 13:30 pm GMT, the weekly US initial jobless claims will be published.

It is expected to be at 235,000 up from the last week's reading of 232,000.

Financial markets could be volatile today.

Follow me

If you find my analysis useful, and you want to receive updates when I publish them in real-time, click on the FOLLOW button on my profile!

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Banks are raising rates while the markets are in Extreme Greed

Published 08/06/2023, 12:43

Central Banks are raising rates while the markets are in Extreme Greed

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.