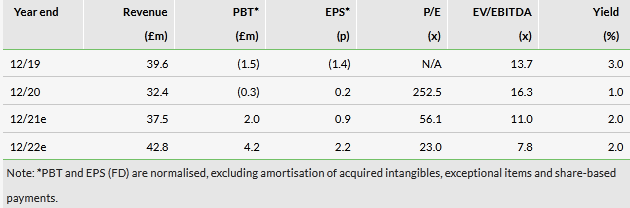

Centaur Media's (LON:CAU) trading update, issued alongside its capital markets day, indicates good progress in H221 to date, building on the post-pandemic recovery in revenues and margin reported for H1. We have edged up our expectations, particularly on the pace of improvement in EBITDA margin towards the FY23 management target of 23%. The share price has held the gain made after the interim results and is now up 68% year-to-date, yet the rating remains at a discount to peers.

Share price performance

Progress at XEIM and The Lawyer

The statement indicates that XEIM is likely to achieve (underlying) revenue growth for FY21 of around 16%, with The Lawyer expected to report a 7% increase. We have therefore edged our full year revenue figures ahead by £0.3m for FY21 and FY22. The uplift in FY21 adjusted EBITDA margin guidance to c 15% compares with our earlier expectation of 13.7%, indicating a more profitable mix of business coupled with good control of the cost base. Within the ‘Flagship 4’ brands, Econsultancy is achieving stronger subscription growth (both new business and blended learning propositions), while the Marketing Week Mini MBA is delivering ‘high double-digit growth’. The recovery post the COVID-19 lockdowns in Influencer Intelligence is taking hold as the customer base re-establishes. The Lawyer is benefiting from good corporate renewals and more subscription sales, indicating a higher quality of earnings. We have lifted our expectation for the EBITDA margin in FY22e from 18.0% to 18.5%.

Strong balance sheet supports growth

The statement indicates end September net cash of £12.4m, from £11.9m at the half-year (which excluded lease liabilities of £2.4m). This implies that payment terms have stayed strong through the pandemic and the recovery to date. With the interim dividend payment of 0.5p per share yet to go out, our model indicates a year-end figure of £11.7m (was £11.0m previously). With a long-term £10m revolving credit facility also in place, Centaur has plenty of financing flexibility.

Valuation

The share price is up 68% year to date as confidence builds that management will deliver against its MAP23 objectives. While improved profit expectations among some quoted B2B media peers have reduced comparative EV/EBITDA multiples, Centaur’s valuation remains at a discount on this metric (averaged over FY20–22 to smooth out the pandemic impact). If this discount were to close, the shares would be priced at 56p (July: 58p), still over 10% above the current level.

Click on the PDF below to read the full report: