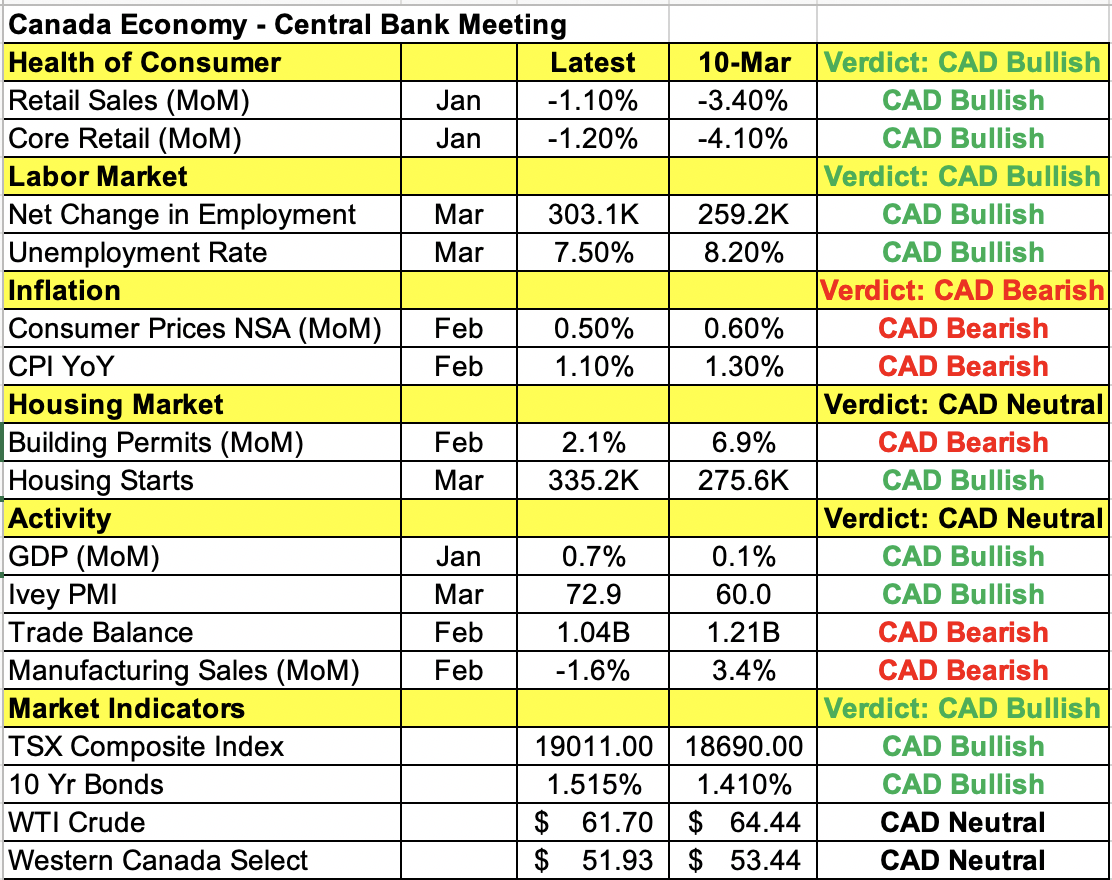

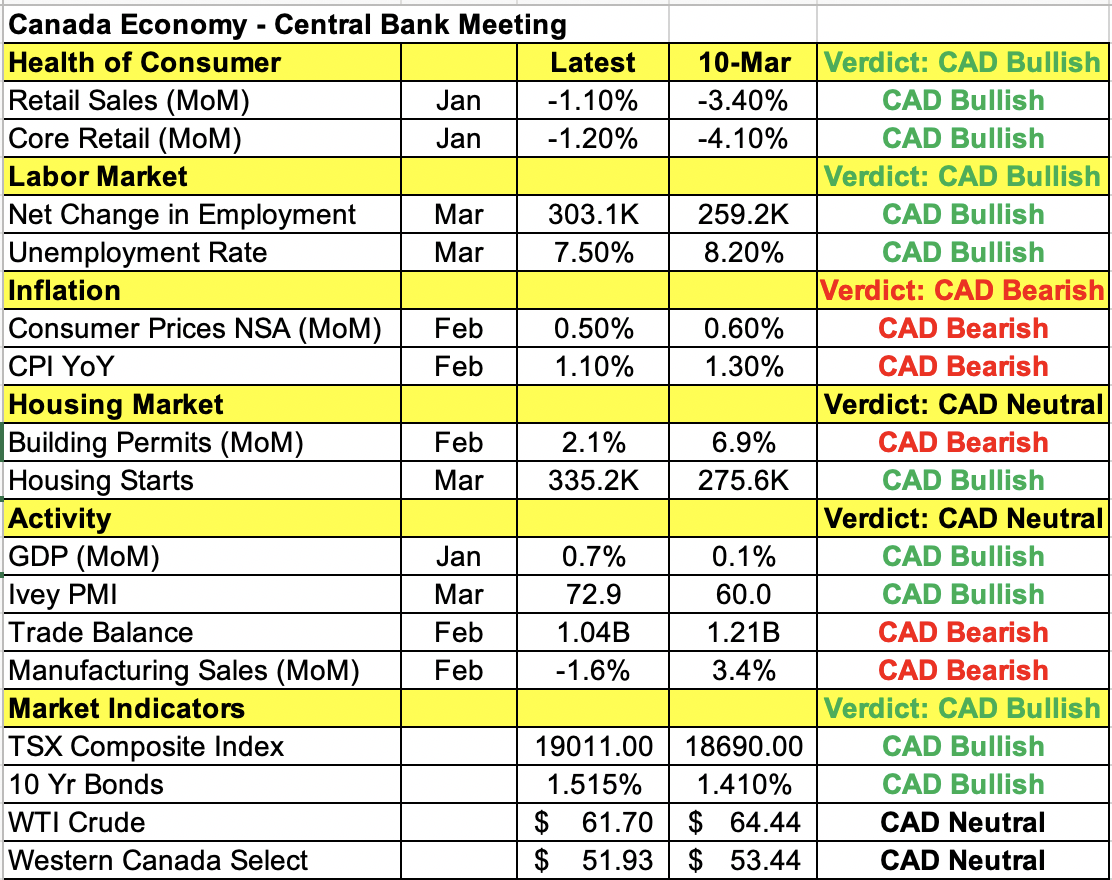

Tomorrow’s Bank of Canada monetary policy announcement is a tricky one. On one hand, economic data has been very good. Job growth is strong, consumer spending is improving, the housing market is on fire with homes selling far above their ask prices and manufacturing activity expanding at its fastest pace in 10 years. Inflationary pressures weakened in February, but the March numbers that will be released right before the 10 a.m. ET rate decision should show stronger price pressures. Canada’s southern neighbor is also recovering at a rapid pace, which should boost Canada’s growth anywhere from 0.5% to 1.5%. Based on these economic reports, the Bank of Canada should be more confident and ready to taper bond purchases. But this month’s rate decision is not that easy.

COVID-19 cases are spiking in Canada, with the country surpassing the U.S. in new coronavirus cases per capita last week. The most populous regions in Canada are under lockdown with new restrictions imposed as recently as this morning. British Columbia prohibited its residents from booking accommodations outside of their local health authority. There will also be random health checks to ensure that no one is travelling outside of their local areas without a legitimate reason. These measures along with current bans on indoor dining and fitness activities will be extended through the end of May. In Ontario, which includes Toronto, a stay-at-home order will last until at least May 20. Residents are required to remain at home at all times except for essential purposes. In Montreal, non-essential businesses are reopen, but there’s a curfew between 8 p.m. and 5 a.m. The third wave has taken a turn for the worse and with slow vaccine rollout, hospitals are getting slammed. These widespread restrictions will slow the recovery and should prevent the Bank of Canada from reducing stimulus prematurely. There’s no doubt that more people will be vaccinated every day and with time, the recovery will gain momentum, but how long before that happens remains an open question.

This tug of war between good data and widespread restrictions is one of the main reasons why this month’s rate decision will be tricky for the BoC. The Canadian dollar rose to a one-month high on Monday on the prospect of central bank optimism but today, the Canadian dollar sold off as investors see the risk of cautiousness. USD/CAD has been trading in a tight 1.2470 to 1.2647 range for the past month. If the BoC maintains a positive outlook and emphasizes the prospect of recovery, USD/CAD could slip back to 1.25. If the central bank focuses on the risks and the tone of its statement is predominately cautious, USD/CAD could squeeze well above 1.27 as traders/investors cover their shorts.