By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Tuesday’s sharp slide in Treasury yields drove the U.S. dollar lower against the Japanese yen. No major U.S. economic reports were released and we did not hear from any Federal Reserve officials, leaving the decline in stocks and commodities as the primary driver of USD/JPY weakness. However U.S. equities ended the day off their lows limiting the losses in USD/JPY. We continue to look for dollar strength after the March FOMC meeting. The rebound in commodity prices, recovery in U.S. stocks and improvement in U.S. data gives the Fed plenty of reasons to maintain a hawkish monetary policy bias. While no one is talking about the possibility of hawkish guidance, that should change next week when FOMC comes into focus.

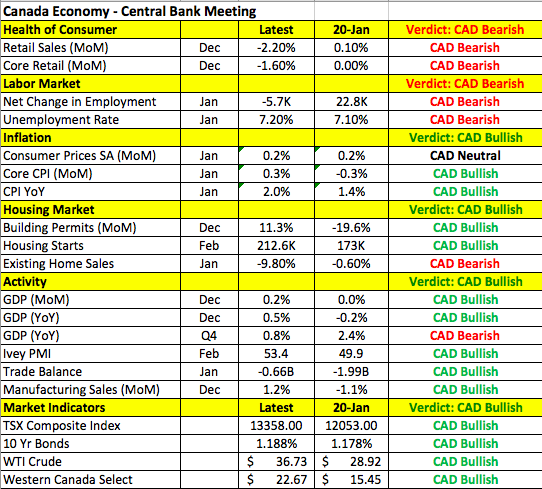

In the meantime, we have two monetary policy announcements in the next 24 hours. The first will be from the Bank of Canada. Based on the table below, there’s been widespread improvement in the Canadian economy since the last monetary policy meeting. Inflation is on the rise, building permits and housing starts are up sharply, the economy expanded according to GDP, manufacturing activity increased and the trade deficit narrowed. Most importantly, oil prices are 27% higher, providing the BoC with hope that commodity prices have bottomed. Not all news was good news however as retail sales and labor-market activity weakened but policymakers have been positive throughout the decline in crude and we believe the recent recovery will only strengthen their optimism. The last time the BoC met, Governor Poloz expressed little concern about a global recession and while they won’t be happy with the CAD's rise, they were encouraged by the economy’s resilience and flexibility. As such, we believe the tone of Wednesday’s monetary policy statement will be positive for the Canadian dollar.

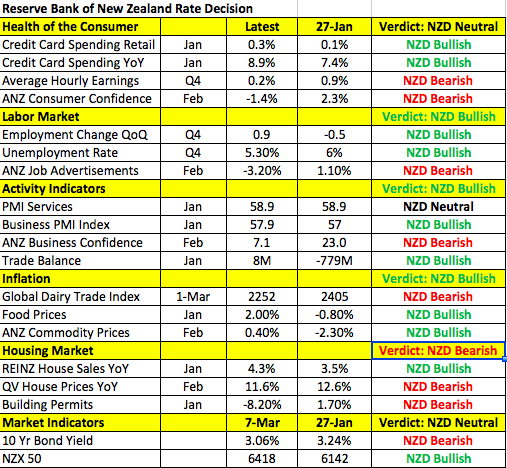

The Reserve Bank of New Zealand also has less to worry about in March compared to January. The following table shows improvement in consumer spending, labor-market activity, business activity and inflation. While average hourly earnings are lower, house prices fell, consumer and business confidence declined, there’s enough improvement for the Reserve Bank to keep interest rates unchanged. The RBNZ may leave the door open to additional easing but the recent rise in AUD/NZD reduces the pressure to ease. So RBNZ poses no major threat to the New Zealand dollar.

Nonetheless, all three commodity currencies including the Australian dollar traded lower Tuesday on the back of weaker Chinese trade data. As reported by our colleague Boris Schlossberg, China’s trade numbers

came in significantly worse than forecast at 35.59B versus 51B eyed as exports dropped a whopping -25% while imports declined by 13.8%. Markets shrugged off the data because the numbers were skewed by the Chinese New Year, but the complacency of traders may turn to concern if next month’s data does not improve. This is the second consecutive month of double-digit declines in both exports and imports and it shows that Chinese growth is clearly slowing. The pressure to devalue the yuan will increase markedly if the Trade numbers don’t improve in March and that could cause further turbulence in the financial markets. The recent run up in risk and the rally in commodities have been largely based on the assumption that the Chinese economy has stabilized itself, but there is nothing in today’s Trade data numbers to draw such a sanguine conclusion.

In response not only did commodity currencies move lower but commodity prices retreated as well.

The euro continued to hold onto its gains ahead of the European Central Bank meeting. At this stage, further euro weakness hinges on the outcome of the monetary policy decision. While investors may have discounted a 10bp deposit rate cut, there are other actions the ECB could take that would weaken the euro. They include increasing the amount of assets purchased per month, extending the end date of bond buying and introducing new TLTROs. Since analysts are predicting an increase to the QE program of anywhere from zero to 20 billion euros, the wide range provides plenty of room for surprise. In addition, Mario Draghi could talk about doing more in the coming year that could also affect how the euro trades.

After six straight days of gains, sterling finally experienced a down day. There were no U.K. economic reports released, but after saying that the next move in rates should be higher, Bank of England monetary policy committee member Weale also noted that they could cut rates and restart Quantitative Easing if needed. The GBP/USD rally may have finally run its course ahead of the 50-day SMA. U.K. industrial production numbers are scheduled for release on Wednesday and the decline in the PMI manufacturing index points to a softer release.