The cable recovered well last week after some solid falls the week before. The pair climbed steadily throughout the week thanks to strong UK employment data and soft US data. Solid resistance at the 50.0% Fib level and the 1.5240 handle has set the pair up for a tough week ahead.

The cable was a standout performer last week as it retraced more than just a dead cat bounce as short positions were closed and profits taken off the table. The pair climbed steadily off the recent low thanks to a solid improvement in UK employment figures. The unemployment rate fell from 5.4% to 5.3% which was a bit of a surprise to the market.

By contrast, the US unemployment claims missed estimates of 270k to come in at 276k and US core retail sales were a disappointment, rounding out a week of poor US data at 0.2% m/m vs 0.4% exp. Solid resistance has been met and the expected differential in monetary policy will see this pair continue the recent bearish trend. The US looks set to raise interest rates this year whereas the situation is bleaker for the Bank of England.

The week ahead will be data heavy for the cable with UK inflation and retail sales figures due for release. A poor inflation result will see the cable under pressure as it will back up the BoE's dovish assessment of expected interest rate rises. They recently pushed out their estimate of when interest rates will begin to lift, from Q1 2016 to Q2 2017. The market is expecting CPI to remain at -0.1%, with anything lower likely to see the cable fall considerably.

The retail sales figure has the potential to cause a bit of harm to the cable. The market is expecting a sharp fall, from 1.7% to -0.6%, which highlights the headwinds the UK economy is facing at the moment. From the US side, CPI figures are also due. Anything to the upside will see speculation of a rate rise in December step up a notch.

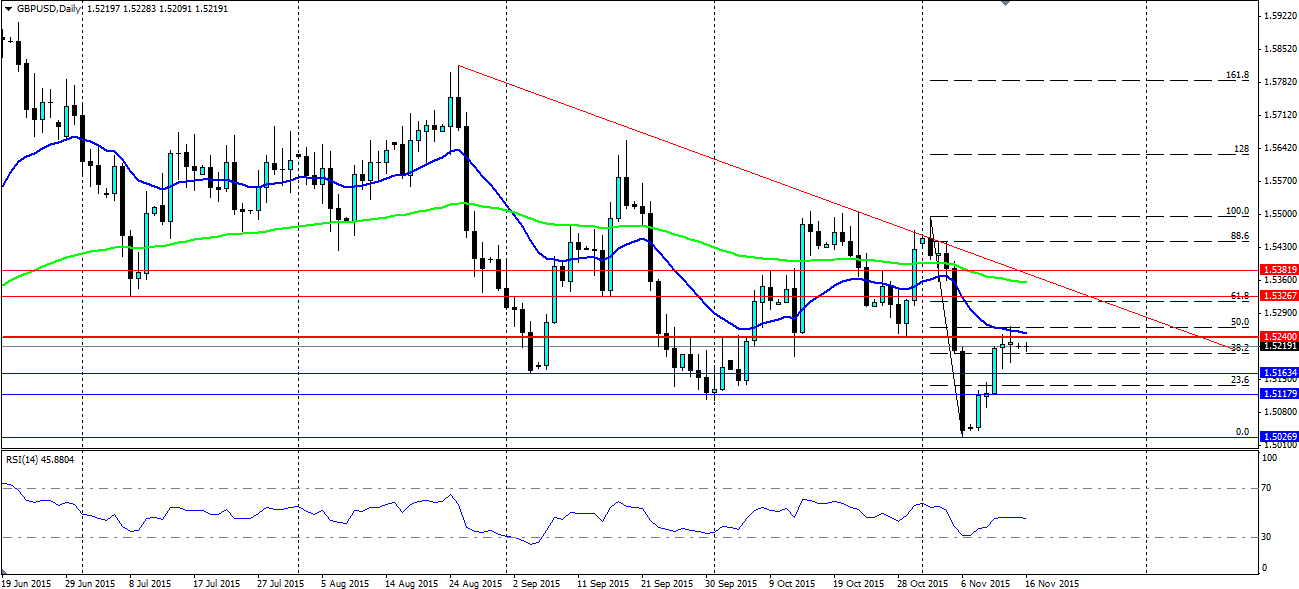

Technical analysis shows the 50% Fibonacci retracement of the previous bearish leg holding firm. This coincides with a very strong level of resistance at the 1.5240 handle, with a minor push above it as stop losses were hunted.

The pair looks to be stalling at this level and a reversal is on the cards. RSI pulled up to neutral and now looks to be reversing back down as the bearish trend continues. Look for support at 1.5163, 1.5117 and 1.5026 while resistance can be found at 1.5240, 1.5326 and 1.5381.