Key Points:

- Price action stalls at 1.28 handle.

- RSI Oscillator strongly overbought.

- 1.2754 support zone will need to hold if pair has chance of resuming rally.

The cable had a tumultuous week last week as the U.K. Prime Minister, Theresa May, shocked the market with a snap election to strengthen her mandate for a Brexit. This caught the market off-guard and saw the pair rally nearly 200 pips. However, it remains to be seen if it can continue its upward trajectory in the week ahead. Subsequently, we take a look at what occurred and what potentially looms on the horizon for the venerable Cable.

Last week provided some surprises for the market as an announcement from U.K. Prime Minister, Theresa May, called for a snap election to decide the Brexit issue once and for all. The canny May is seeking to bolster her mandate to take the island nation through a hard Brexit. Subsequently, the cable rallied like there was no tomorrow to test the 1.29 handle.

However, a range of disappointing data stalled the move, with the U.K. Retail Sales falling to 1.7% y/y (3.4% expected), and the pair subsequently moderated and closed the week out around the 1.2803 mark. The latter part of the week also brought some news from the U.S. that the Trump administration is considering tax cuts which also added to the moderating forces.

Looking ahead, there are some key events looming for the pair with the U.K. Advance GDP and U.S. Unemployment Claims data due out. In particular, the Advance GDP figures are going to be a key focus early in the week with the metric forecast to come in at 0.4% q/q. However, anything is possible given last week’s relatively weak retail sales data which emanated from the United Kingdom. In addition, the U.S. Initial Jobless Claims are also due out and most economists have that figure coming in at 242k. Subsequently, there are quite a few data points that could provide plenty of volatility for the cable in the week ahead.

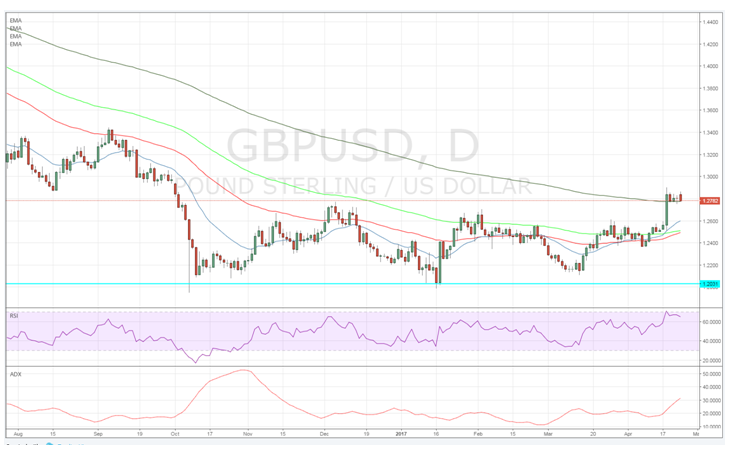

From a technical perspective, the cable’s recent surge has seen it break sharply above the 100MA which suggests that the long term move from 1.2108 has yet to complete. However, the RSI Oscillator is strongly overbought, and the failure to breach 1.29 is likely to suggest a period of moderation. Subsequently, our initial bias for the week ahead is neutral given some of the mounting risks. Support is currently in place for the pair at 1.2754, 1.2625, and 1.2545. Resistance exists on the upside at 1.2844, 1.2904, and 1.3121

Ultimately, the coming week is likely to prove relatively critical for the pair given its current valuation just below the 1.2900 handle. However, if the pair can hold above the 1.2754 zone of support it might allow it to build up some steam for another crack at the April high.

In the case of a breach of this level, all bets are off, and you could see the air rapidly deflate from the balloon that is the cable. Subsequently, there is plenty of risk floating around in the coming days and we will have to wait and see which way it goes.