Key Points:

- Bank of England likely to keep bank rate steady.

- Watch for UK Retail Sales data.

- Cable likely to be volatile during Thursday’s session.

The cable was initially buoyant last week after a surprisingly strong UK Services PMI rose out of contraction to 52.9. The PMI result, along with the weaker USD sentiment, saw the pair rising sharply before it failed around the 1.3444 mark and then reversed. However, there are some relatively key fundamental events looming for the cable and it is therefore salient to take a look at what the pair faced last week as well as what is potentially looming.

The cable started the prior week in a positive manner as the UK Services PMI surprised markets and clawed its way out of contraction to a 52.9 print. This proved bullish for the pair which immediately rose to 1.3444 before it ran out of steam. The strong result actually offset a highly disappointing BRC Retail Sales result of -0.9%. However, the gains were to be short lived as the much watched Manufacturing Production figures fell into the doldrums coming in at a meagre -0.9% m/m which also coincided with some stronger US labour market data. Subsequently, the cable gave up its gains late into the week to finish around 1.3270.

The week ahead is likely to be exceedingly busy for the cable with both a slew of US economic data and the critical UK CPI and interest rate decisions due out. In particular, the UK CPI figures are likely to be closely watched by the market in the lead up to the Bank of England’s decision on the official bank rate. The estimates largely have the central bank keeping rates on hold at 0.25%, however, there is likely to be plenty of jawboning and subsequent volatility following the decision. In addition, the US PPI and Core CPI figures are also likely to play a part in the coming week given the looming FOMC vote.

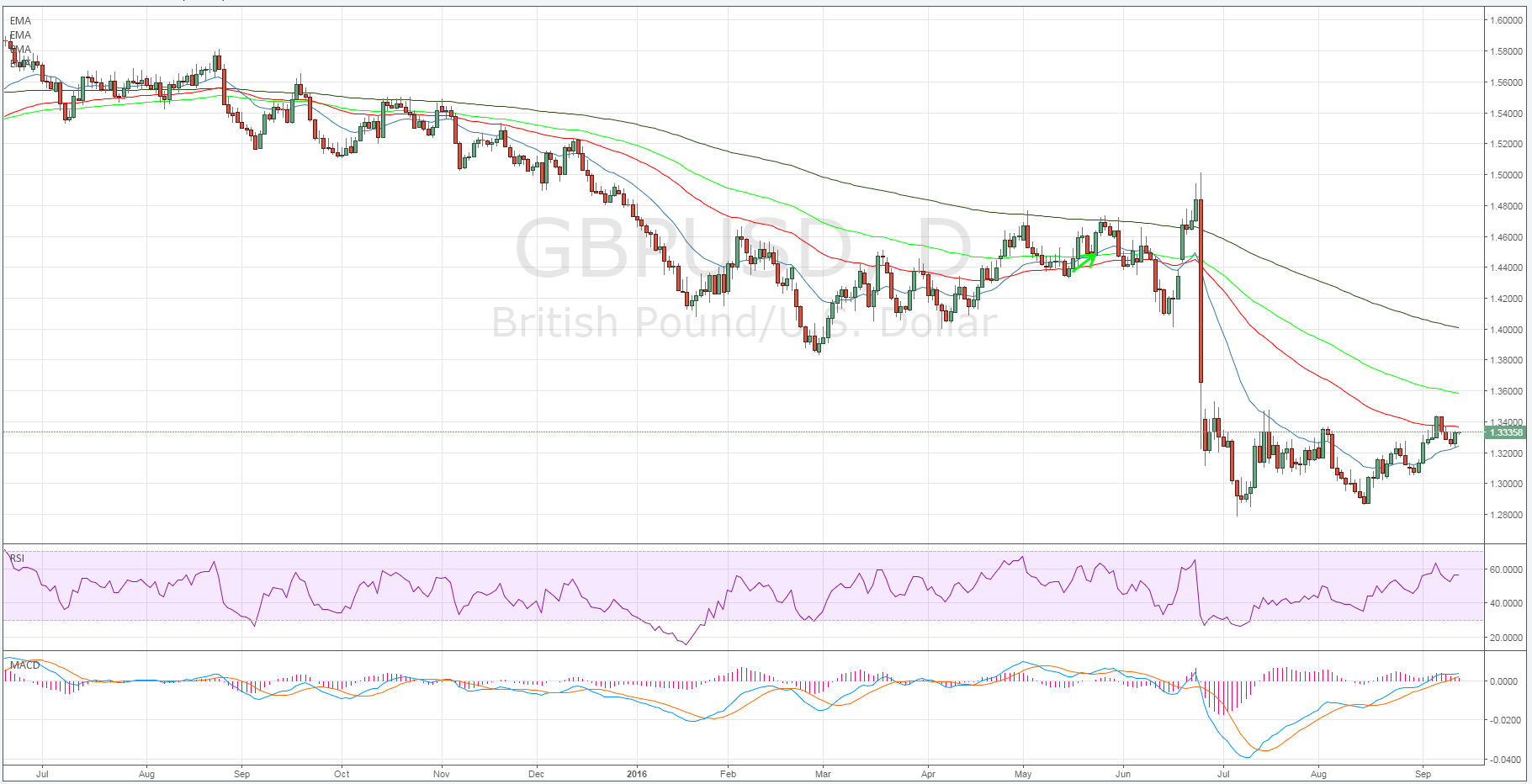

From a technical perspective, our initial bias remains bearish for the week ahead with the RSI Oscillator currently trending lower and price action resting upon the 50EMA. Subsequently, watch for a break of 1.3251 as a decisive break at that point could resume the larger downtrend. Any upside moves are likely to be relatively short lived and capped by resistance at 1.3480. Support is currently in place for the pair at 1.3047, and 1.2794. Resistance exists on the upside at 1.3373, 1.3480, and 1.3534.

Ultimately, the Bank of England is unlikely to take drastic action on their monetary policy in Thursday’s meeting but some volatility from the decision is all but ensured. Given that Thursday includes both the Core Retail Sales figures, and Bank Rate Decision, the cable could potentially swing sharply and the results are likely to determine the near term fundamental trend.