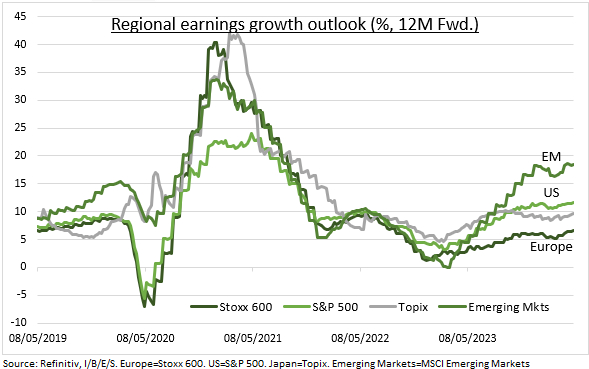

Q1: Improving earnings is the main driver of this nascent bull market. We are optimistic as we enter the final stretch of earnings season. The three US tech sectors have decisively led the 7% S&P 500 earnings growth. It’s been a feast or famine quarter vs healthcare and commodity laggards. Easing inflation has allowed profit margins to recover, compensating for sluggish 3% sales. US GDP ‘exceptionalism’ saw domestic company sales outpace global peers. Management guidance, from Tesla (TSLA (NASDAQ:TSLA)) to Meta (META), been as crucial as the reports. Companies have been the most bullish on conference calls in two years, and analyst forecasts are rising (see chart).

US: S&P 500 earnings growth is running up 7% and well ahead of lowered analyst expectations. With 77% of companies and all sectors ahead of analyst forecasts. Growth has been led by the three ‘tech’ segments. With Communications, Discretionary, and Information Technology sector profits up at least 20%. With Healthcare dragged down by Bristol-Myers (BMY) alongside Energy, led by natgas and refining, and Materials, by chemicals. All are seeing profits fall at least 20%. Misses are treated no worse than usual, down 2.5%, reflecting already lowered expectations. The season will end with a bang as Nvidia (NASDAQ:NVDA) does not report until May 22nd.

EUROPE: Near half the Stoxx 600 has reported so far, and the earnings claw-back has started. Revenues are down -5% and earnings -9%, reflecting the weak economy and lack of tech. But results are beating expectations, and ‘beats’ ahead of average. Utilities and financials have led growth, with real estate and commodities slumping. Spain is leading country results and Germany lagging. Europe’ earnings forecasts have been rising at twice rate of US in past three months. We expect an accelerated recovery from here. Given the low earnings and profit margin base, more cyclical index composition, and the rate cut driven macro-economic recovery catalyst.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bullish messages from Q1 earnings season

Published 07/05/2024, 08:29

Updated 09/02/2024, 07:53

Bullish messages from Q1 earnings season

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.