BT Group PLC (LON:BT), a leading name in the telecommunications industry, has had a year full of changes and strategic moves in 2024. This company, which provides broadband, mobile, and TV services across the UK and beyond, has navigated a challenging yet promising landscape. Here’s a look at how BT Group has performed over the past year and what investors might expect in the future.

Overview of 2024

This year, BT Group has focused on expanding its fibre broadband network and boosting its 5G infrastructure. These efforts are part of a larger strategy to meet the growing consumer demand for faster and more reliable internet services. By investing in digital infrastructure, BT aims to strengthen its market position and drive long-term growth.

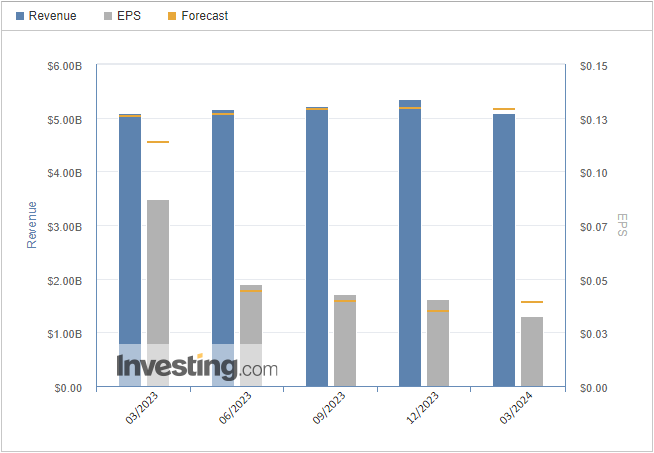

BT's revenue has been supported by its wide range of services. The consumer division has seen steady growth due to the increased demand for high-speed internet and digital entertainment. Meanwhile, the enterprise segment has benefited from businesses needing strong communication solutions as they adapt to hybrid work models.

Stock Performance

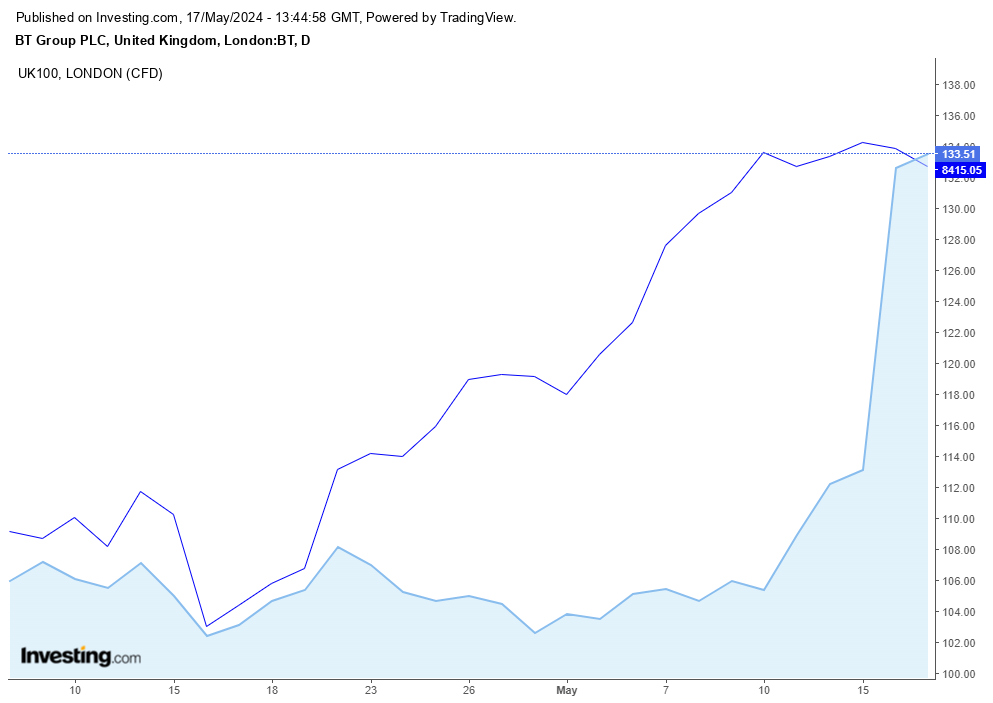

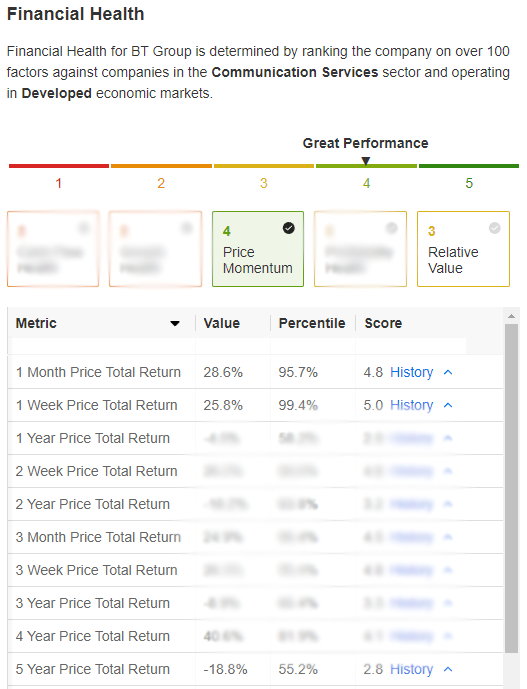

BT Group's stock (BT) has experienced ups and downs throughout 2024, influenced by market conditions and company-specific developments. Despite these fluctuations, the stock has shown resilience, with a gradual upward trend thanks to positive earnings reports and strategic initiatives.

Sarah Johnson, a financial analyst at Reuters, noted, "BT's stock has shown stability in a volatile market, supported by the company’s ongoing investments in crucial infrastructure and its ability to adapt to changing consumer demands."

The company’s commitment to shareholder value is also evident in its consistent dividend policy, providing investors with a steady income stream.

Recent Developments

One of the most significant developments for BT Group in 2024 has been the rollout of its full-fibre broadband network. The company aims to reach 25 million premises by the end of the decade, making substantial progress this year. This ambitious project is expected to enhance customer experience and drive future revenue growth.

Additionally, BT has been exploring partnerships to improve its service offerings. A notable partnership with Google (NASDAQ:GOOGL) Cloud aims to leverage AI and machine learning to improve customer service and operational efficiency. This collaboration is expected to bring significant benefits in the coming years.

Looking Ahead

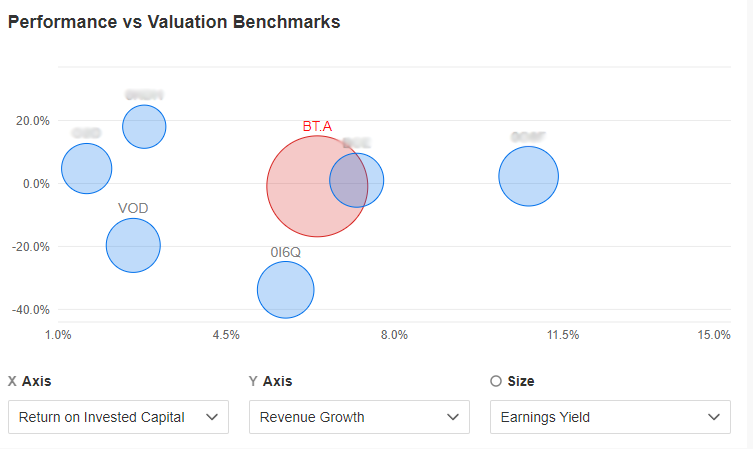

Looking forward, BT Group is well-positioned to capitalise on the growing demand for high-speed internet and advanced digital services. The expansion of the fibre broadband network and the enhancement of 5G capabilities are key growth drivers. However, the company will need to navigate regulatory challenges and competitive pressures to maintain its market position.

David Miller, a telecommunications expert at CNBC, commented, "BT's focus on digital infrastructure and strategic partnerships puts it in a strong position for future growth, but the company must continue to innovate and adapt to stay ahead in a competitive market."

According to our AI supported InvestingPro Protips, BT Group had been profittable over the last 12 months.

In conclusion, BT Group PLC has shown resilience and strategic foresight in 2024. While challenges remain, the company’s investments in digital infrastructure and innovative partnerships provide a solid foundation for future growth. Investors should keep an eye on BT's ongoing projects and market developments, as these will be crucial in determining the company’s path forward in the years to come.

Feel ready to dive into details and start finding interesting stocks to invest? Try our AI supported solution InvestingPro today!

Get an extra 10% discount by applying the code UK10 on our 1&2 year plans. Don't wait any longer!

Created with the help of AI.