The British pound sterling is showing signs of recovery, bouncing back from a five-month low, with GBP/USD stabilising around the 1.2470 mark on Thursday. This rebound is attributed to the release of UK inflation data, suggesting a possible monetary policy easing by the Bank of England (BoE).

The UK's consumer price index (CPI) slowed to 3.2% year-on-year in March, down from 3.4% in February, marking the lowest inflation rate in two and a half years. This slowdown has raised investor optimism regarding potential policy easing by the BoE, particularly since core inflation has also dropped to its lowest since mid-2021. However, persistent inflation in the services sector may lead to cautious deliberation among certain members of the monetary committee.

Meanwhile, representatives from the US Federal Reserve have reiterated that US interest rates are likely to remain high for an extended period. In contrast, the BoE is perceived as relatively stable, potentially initiating monetary policy easing by summer.

The first quarter saw significant pressures from the tight employment market and shocks from rising energy prices, which initially suggested that the BoE might follow the European Central Bank (ECB) and the Fed in lowering interest rates. However, market conditions have shifted considerably. Exchange analysts now anticipate that the ECB might cut interest rates by June, the BoE by September, and the Fed only in Q4.

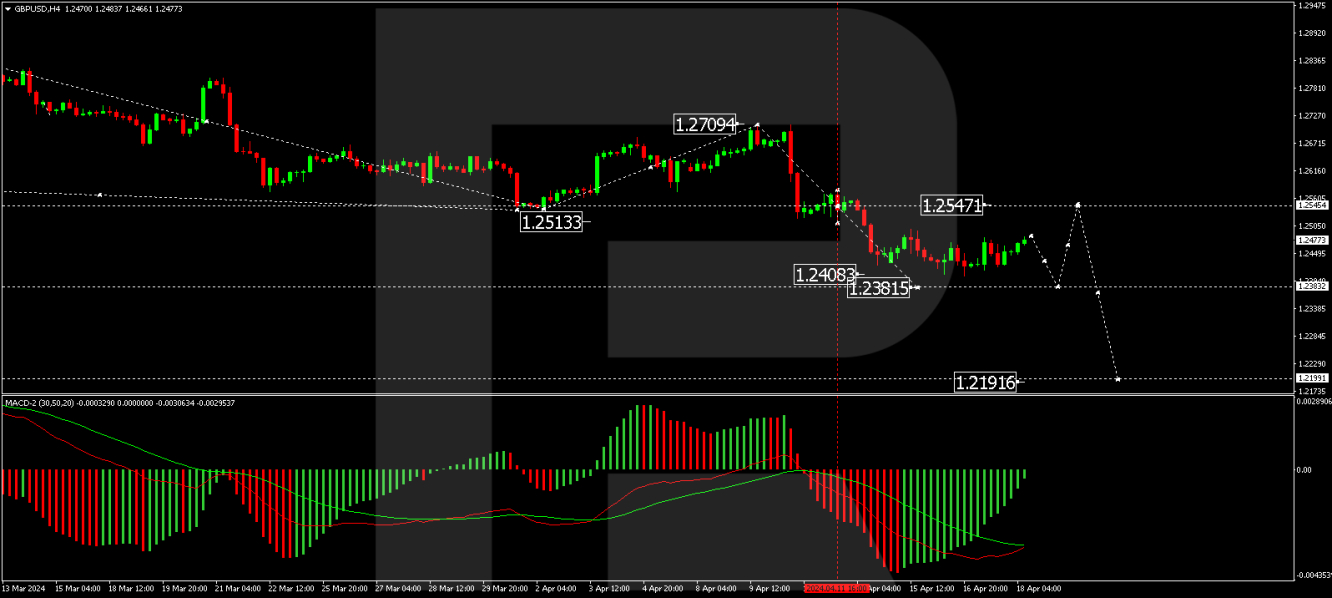

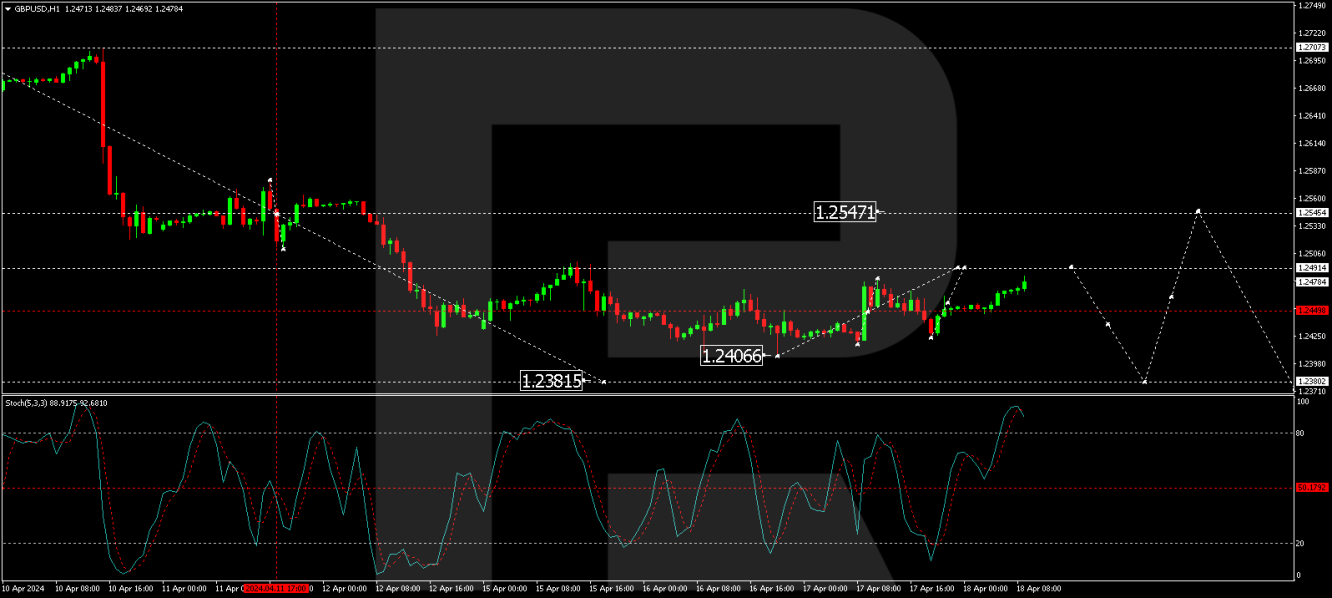

Technical analysis of GBP/USD

The H4 chart for GBP/USD indicates that after forming a consolidation range of around 1.2547, the pair has reached the target of 1.2450 with a downward exit. A new consolidation range is currently forming above this level. A break below this range may drive prices lower to 1.2380, with a subsequent correction to retest 1.2547 (testing from below) before a possible continuation to 1.2200. This bearish scenario is supported by the MACD oscillator, whose signal line is below zero and is trending downwards.

On the H1 chart, the GBP/USD has completed a decline to 1.2406 and is currently undergoing a correction to 1.2491. Following this correction, a new decline to 1.2381 is anticipated. The Stochastic oscillator, currently above 80, is poised for a sharp decline to the 20 mark, reinforcing the likelihood of further downward movement in the short term.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

British Pound shows signs of recovery amid favourable inflation data

Published 18/04/2024, 09:54

British Pound shows signs of recovery amid favourable inflation data

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.