Brent price continues to rise steadily with the Brent quotes trading at about 86.00 USD per barrel on Monday.

The oil prices are supported by the production cut policy followed by the OPEC+ countries. A meeting of the Joint Ministerial Monitoring Committee of the cartel (JMMC) took place via videoconference on 4 August, at which the ministers of the member countries reaffirmed their commitment to the agreement on output cuts which was extended to the end of 2024 at the OPEC+ meeting on 4 June.

Saudi Arabia confirmed that it would extend a voluntary output cut of 1 million barrels per day into September. Russia announced its plans to extend the oil export cut of 300 thousand barrels per day in September.

Due to the measures taken by OPEC+, oil “feels” quite confident now, and the quotes might continue to rise following a small correction.

Тechnical analysis of Brent

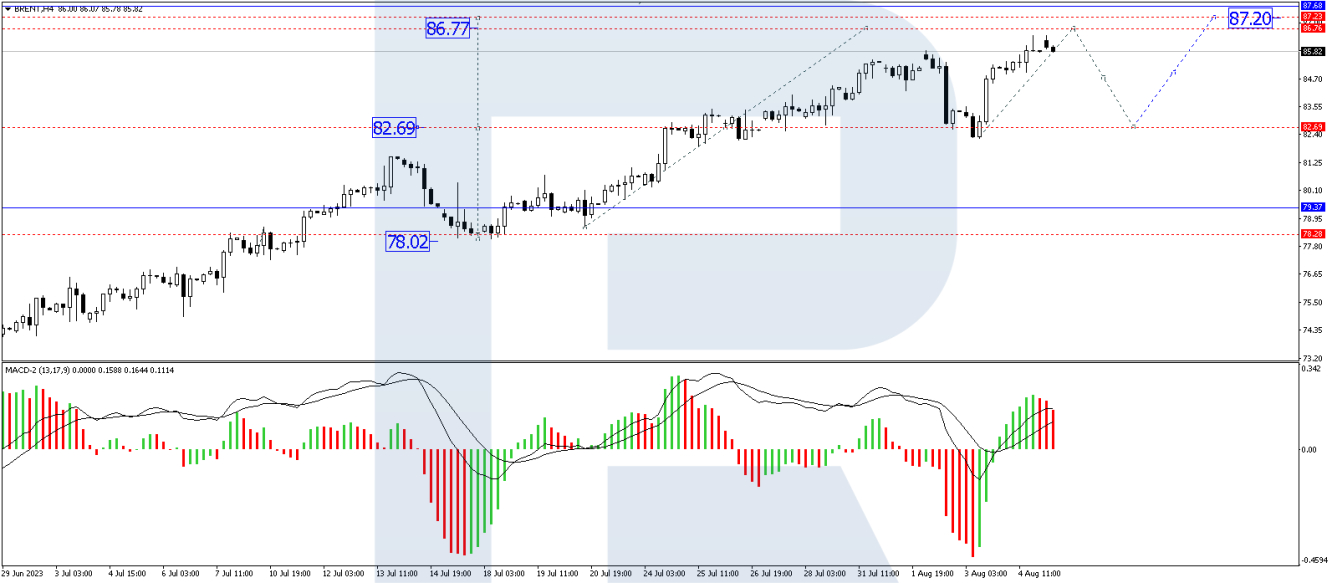

On the H4 chart, Brent has completed a structure of growth to 85.85 and corrected to 82.25. Today the market has broken the 85.85 level upwards and is considering the continuation of growth to 87.37 with the prospect of developing the trend to 87.67. This is a local target. Once the price achieves this target, a link of correction to 82.70 (a test from above) could form, followed by growth to 94.00. Technically, the MACD indicator confirms this scenario; with its signal line above the zero mark, it is showing a clear upward direction, indicating potential new highs.

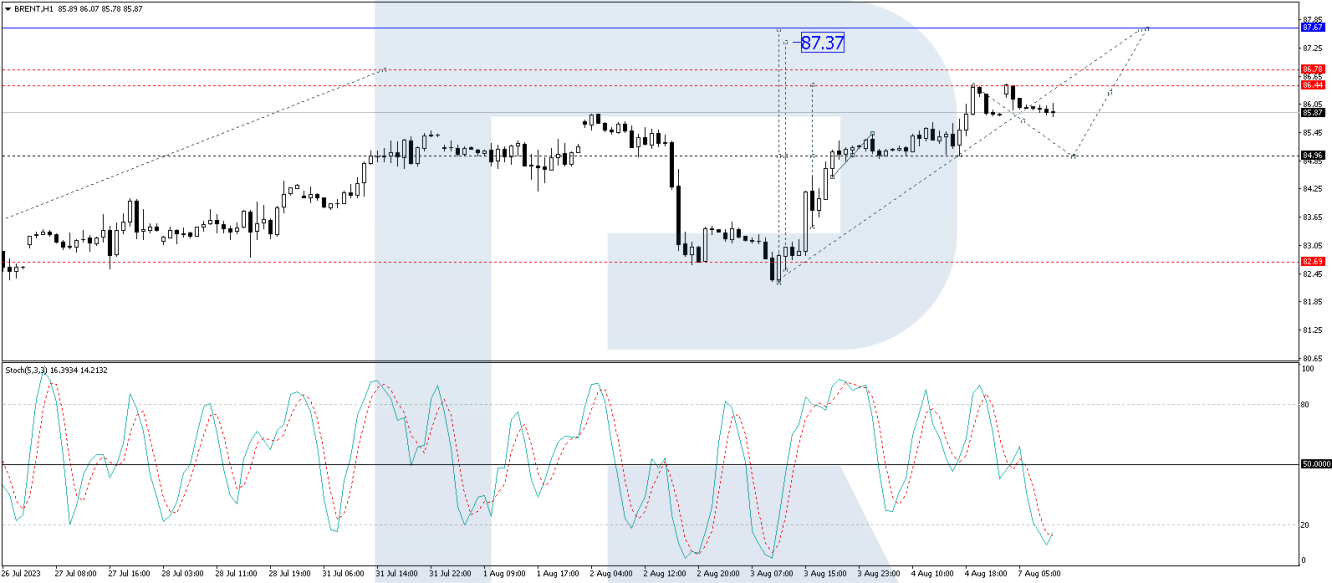

On the H1 chart, Brent has completed a wave of growth to 84.96. A consolidation range has formed around this level, and breaking it upwards, the price reached the target at 86.44. Today a link of decline to 84.96 (a test from above) is expected, followed by a wave of growth to 87.67. Technically, the Stochastic oscillator also supports this outlook, with its signal line below the 20 mark, indicating a readiness to continue rising towards the 50 mark. An upward breakout of this mark will open the potential for further growth to the 80 mark.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.