Borussia Dortmund (DE:BVB) has an established track record as one of the most successful football clubs in Europe. This enables it to exploit structural tailwinds, increasing global and multi-media coverage, to drive long-term revenue growth. FY21 was a challenging year financially due to the negative effects of COVID-19 related restrictions, but the team was relatively successful including winning major silverware and guaranteed participation in the financially lucrative Champions League in FY22. The phased return of fans to the stadium through FY22 should lead to better financial results. The share price weakness has led to it trading at recent low multiples and well below our sum-of-the-parts valuation of €11.56/share.

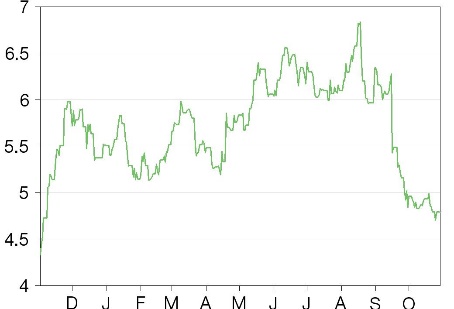

Share price performance

Business description

The group operates Borussia Dortmund, a leading football club, placed third in the Bundesliga in 2020/21, DFB Super Cup winners in 2019/20 and DFB-Pokal winners in 2020/21. The club has qualified for the Champions League in nine of the last 10 seasons.

Sustainable investment

Football is the largest and most popular sport in the world, with expanding global consumer interest, which feeds increasing interest from corporate sponsors and media owners. Borussia Dortmund’s consistent domestic success and regular participation in international club competitions have enabled it to develop its brand and fan following, driving long-term revenue growth from multiple sources, while increasing the predictability of that revenue. In contrast to the majority of its sporting peers, its success has been achieved with a net positive cash inflow from its investment in the playing squad.

FY22: More optimism as the fans return

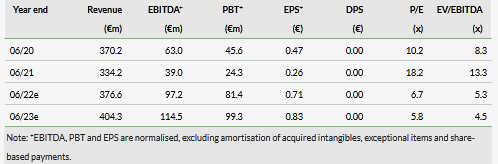

The expectation of a phased return of fans to the stadium, with full capacity from H222, drives a new air of optimism for the coming year, which should increase numerous revenue streams (attendance, catering and advertising), profitability and cash flow. Management guides to FY22e revenue excluding transfers of €374m, yoy growth of c 12%, EBITDA of €92–97m (FY21: €39.0m) and a net loss of €12–17m (FY21: loss of €73m). Our new FY22 estimates are in line with guidance, and we forecast further growth in FY23: revenue to €404m (+7%) and EBITDA €114m (+18%). The October 2021 equity raise with gross proceeds of €86m and a significant post year-end player transfer should restore the company to its typical net cash position.

Valuation: Asset backing and low relative multiples

The share price has been weak due to uncertainties around the effects of COVID-19 restrictions and the recent equity raise. This has resulted in the share price trading at an FY22e EV/sales of 1.4x, which is below its long-term average of 1.6x, and a little above its own recent low multiples (1.0–1.3x). It continues to trade at a significant discount of 59% to our asset-backed sum-of-the-parts of €11.56/share.

Click on the PDF below to read the full report: