Fixed income as an asset class is looking bullish as Fed Chairman Powell prepares to give a widely anticipated speech this Friday (Aug. 23). The central banker is expected to drop clues about the outlook for monetary policy for the rest of the year — clues that are forecast to favor higher bond prices and lower yields.

Going into the Jackson Hole meeting, the crowd’s anticipating that the Federal Reserve will start cutting interest rates next month. Key factors that are animating market sentiment: forecasts of slower US economic growth and ongoing disinflation. Meanwhile, the technical profiles for several key slices of fixed-income markets suggest the rally will continue, based on proxy ETFs through Tuesday’s close (Aug. 20).

Although bonds had a mixed start to the year, I wrote in February, by early June the odds looked skewed in favor of a rebound.

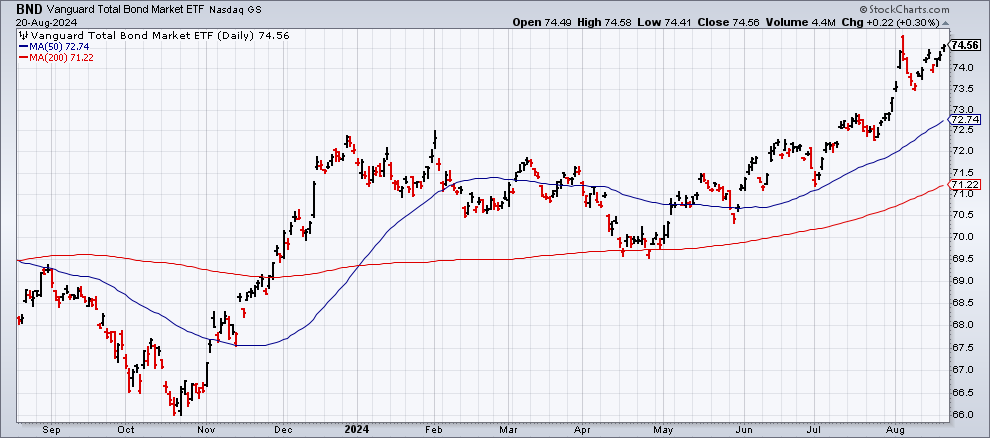

Fast forward to current conditions and the rally is in full bloom. For a quick recap, let’s start with a broad measure of investment-grade bonds via Vanguard Total Bond Market (NASDAQ:BND). The fund has been in a solid uptrend since May and the persistence of the 50-day moving average holding well above its 200-day counterpart suggests that the trend remains resolutely positive.

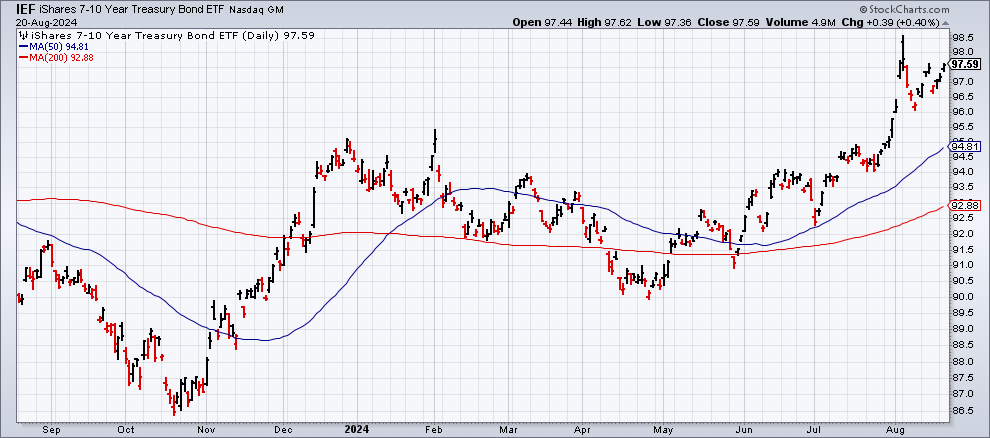

Focusing on mid-term US Treasuries (IEF) paints a similar profile.

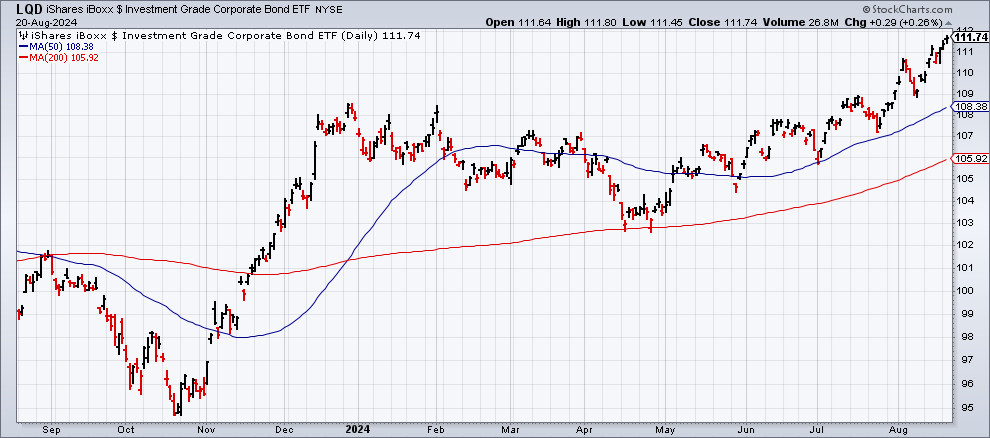

Ditto for investment-grade corporates—a proxy fund (LQD) rose to its highest level in more than two years in yesterday’s trading.

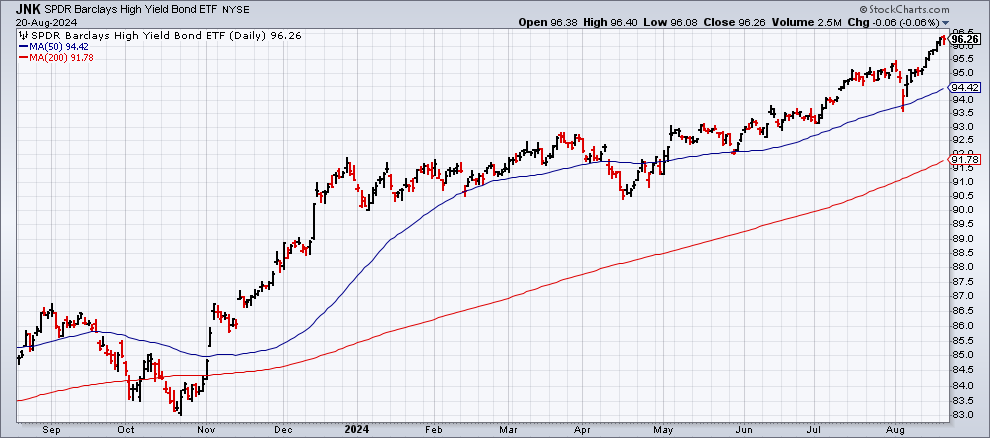

The long-running uptrend for below-investment-grade bonds (JNK) has been rallying too, extending the current leg of a multi-year run that started in late-2023.

What might derail the bond market’s momentum? The two obvious factors on the shortlist are a reflationary revival and/or stronger-than-expected economic growth. For the moment, both scenarios appear to reflect relatively low probabilities, based on data published to date.

US growth for the third quarter, for instance, is currently expected to post a modestly softer rise vs. Q2, based on the median nowcast (as of Aug. 13) for an estimate compiled by CapitalSpectator.com. Meanwhile, consumer inflation through July still reflects a disinflationary trend.

That leaves Fed Chairman Powell’s Friday speech at the central bank’s Jackson Hole Symposium as a possible joker in the deck. Many (most?) analysts are expecting relatively dovish comments, based on macro conditions.

“I don’t think that the Fed has to fear inflation,” says Tom Porcelli, US chief economist at PGIM Fixed Income. “At this point, it’s right that the Fed is now more focused on labor versus inflation. Their policy is calibrated for inflation that is much higher than this.”