- Valuing Boeing stock, a Herculean task, given vast number of moving parts

- It’s difficult to make case that stock is cheap going forward

- Focus now on management, execution — neither look good enough

It seems fitting that, after Wednesday’s second quarter earnings report, Boeing (NYSE:BA) stock rose 0.11%. Essentially, the results didn’t change the market’s assessment of the stock at all.

Source: Investing.com

That makes some sense — and not just because the news from the quarter was mixed. This is a huge company attempting a massive turnaround in a volatile environment. Inflation, macroeconomic concerns, and supply chain delays, all are affecting results at the moment, and none of those trends are likely to abate soon.

In that context, a single quarter doesn’t really change the story. Either Boeing’s turnaround succeeds, and Boeing stock rises — or it fails, and the stock sinks. So far, it seems tough to bet on success — though that might change.

Trying To Value Boeing Stock

Let’s be honest: it’s pretty much impossible to figure out precisely what Boeing stock is worth right now. Even in normal times, Boeing isn’t exactly an easy stock to value. Of course, the last few years for Boeing have been anything but normal times.

The pair of MAX 737 crashes in 2018 and 2019 led to the pause of that entire program. The novel coronavirus pandemic brought worldwide air travel to a halt. Amid the recovery from the pandemic, cost inflation, and supply chain challenges have impacted results.

Even Boeing’s defense business, theoretically less sensitive to those fluctuations, has stalled out after years of solid growth.

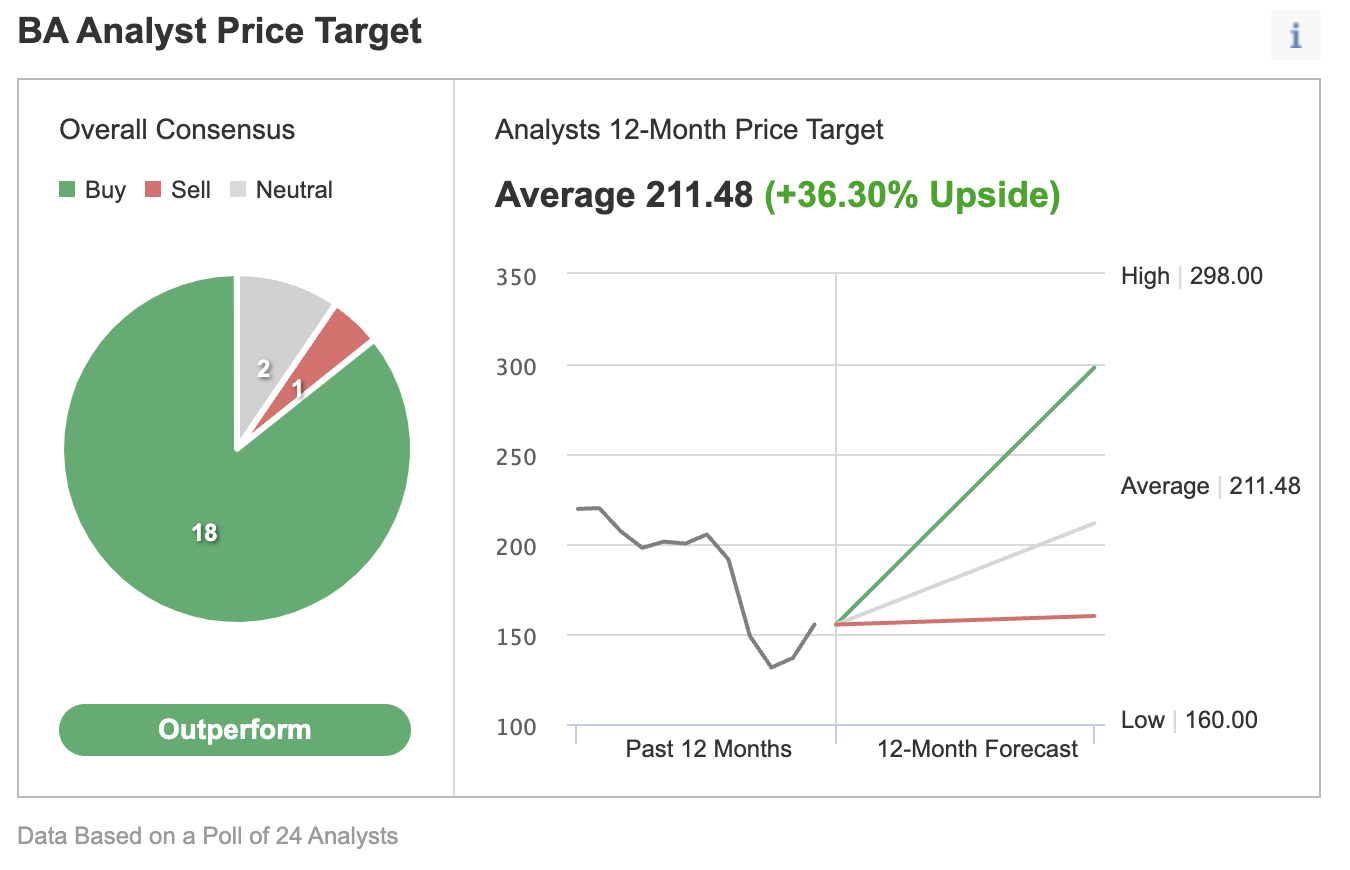

Trying to value this company fundamentally requires significant guesswork — even for Wall Street analysts. Price targets on Boeing stock range from $160 to $298.

Source: Invesing.com

But we do know that if Boeing can recapture former glory, there’s real upside in the stock. In 2018, Boeing generated adjusted earnings per share of $16.01. A 20x multiple on those earnings would lead the stock to almost exactly double from Wednesday’s close. A return to the early 2019 peak — before the second MAX crash — would result in 182% upside.

Mitigating Factors

The question is if Boeing can recapture those past earnings any time soon. It’s a long way from doing so.

Indeed, Boeing posted an adjusted loss in Q2, a loss that was worse than analysts expected. Free cash flow was the ‘good’ news in the quarter — but only because Boeing was barely in the black ($0.1 million).

But there are signs that a recovery is on the way. Boeing’s 787 Dreamliner has had its own regulatory issues, but chief executive officer David Calhoun said after Q2 that the line would return to deliveries soon. The MAX had a strong showing at the Farnborough Air Show this month, with more than 200 orders and commitments, per the Q2 call.

The Starliner spacecraft program, used to transport crew to the International Space Station, has had problems, too, but Calhoun says Starliner is back on track.

As for the weak earnings, they’re understandable. Supply chain problems are real. Rival Airbus (OTC:EADSY)) also reported earnings on Wednesday, and the French manufacturer cut its delivery outlook for the year, citing its own supply chain issues. The biggest problem is that engines simply aren’t available.

Boeing results look weak right now — but they’re going to get better.

Can Boeing Recover?

The question is if they are going to get good enough to support real upside from current levels. That seems like a difficult bet to take.

Some of the problems affecting Boeing right now clearly are external. But there’s also an absolute laundry list of missteps that begins with the two 737 MAX crashes. The Dreamliner was halted by regulators in 2020 — but its problems date back to 2013. The Starliner has seen cost overruns now nearing $700 million.

It’s difficult to escape the impression that there are structural problems here – problems that were papered over by strong demand pre-pandemic and a lack of competition outside of Airbus. Both of those benefits may change.

Travel spending is robust now, but there’s clearly pent-up demand from the pandemic and a shift of consumer dollars away from goods to experiences. That demand will exhaust itself at some point — while a recession potentially looms.

Meanwhile, China’s state-owned COMAC (Commercial Aircraft Corp of China) is nearing certification of its narrow-body C919. The C919 looks like the first step in a challenge to the Boeing-Airbus duopoly.

Over time, some of the current challenges facing Boeing will ameliorate. Backups at engine suppliers will clear and inflationary pressures will abate. But new challenges are on the way.

And, at this point, investors have to bet that Boeing management can rise to meet those challenges. That’s a tough bet to take. Calhoun was chairman of the board of directors when the problems with the MAX and the Dreamliner occurred. He gave a vote of confidence to former CEO Dennis Muilenburg in October 2019 — and led the board in firing Muilenburg barely two months later. Calhoun has been CEO since and, thus, has been in charge for the delays and cost overruns across multiple divisions of the company.

Execution here needs to improve. Calhoun says that it is. Investors had better believe him if they’re going to put their hard-earned money into Boeing stock.

Disclaimer: As of this writing, Vince Martin has no positions in any securities mentioned.