BoE to remain on hold

It is widely expected that the Bank of England’s MPC will vote 8-1 in favor of no change in interest rates or adjustment to target asset purchases. With the next Inflation Report only a month away, it’s unlikely that we will get any real clarity from meeting minutes. The BoE meeting minutes should express cautious over events in China/EM and lower prospects of a Fed hike in 2015. Current market expectations for a BoE hike feels excessively bearish at late 2016. A view which has been essentially driven by a larger trend of overdone downsides risks to growth. This view has proliferated despite BoE claims that global worries will not halt the banks current strategy. With UK economy moving forward at a reasonable pace (balanced by strong industrial production but weak PMI service data) and tight labor markets already generating wage growth we should see steady transmission into inflation. In addition, the weaker GBP should ease BoE members concerns over importing deflation. We remain constructive on the GBP in the current environment, anticipating that incoming information will pull in expectations for a rate hike. GBP/USD bullish momentum should continue with traders immediately focused on 1.5330 (200d MA) and 1.5367 (09/23/2015 high) before uptrend extension to 1.5659 (09/18/2015 high).

Swiss unemployment increases

After disappointing inflation data earlier this week, the seasonal adjustment unemployment rate printed this morning at 3.4% in September from 3.3% the month before. While we cannot consider the labour market to be in danger, the abandoning of the floor, coupled with global turmoil did create some downside pressures for the job market. It is clear that the Swiss economy is steadily declining and GDP concerns are growing, especially when we realize that the EU accounts for almost two thirds of Swiss exports. Indeed, European growth is still at stake. Nevertheless, the recent EUR surge should provide a boost to the Swiss economy in the coming months, as there are some lags for an economic change to be correctly reflected in the economy.

The next SNB meeting will be held in December. We do not think that the Swiss National Bank is ready to cut interest rates. This would only serve to even further punish investors under the current declining economic conditions. It is also clear that the SNB is closely monitoring the European Central Bank monetary policy. By constantly dropping hints that quantitative easing will be increased, Draghi will force the SNB to react and therefore to defend the Swiss Franc. We think the SNB’s first move will be to lower the target account balance to which negative interest rates are being currently applied. For the time being, only accounts in excess of CHF 10 million are being targeted.

Last but not least, as the IMF mentioned the global outlook remains weak, the CHF is reclaiming its safe haven status despite the economic Swiss difficulties. The USDCHF is targeting 0.9600 against the backdrop of a constant delayed Fed rate hike.

AUD/USD - Failed To Test Resistance At 0.7280

The Risk Today

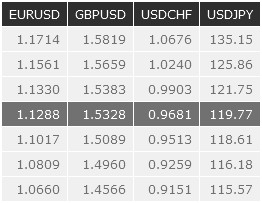

EUR/USD has moved sharply higher and is now targeting hourly resistance at 1.1330 (21/09/2015 high). Support can be found at 1.1087 (03/09/2015 low). Stronger support lies at 1.1017 (18/08/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We remain in a downside momentum.

GBP/USD has gained momentum. Hourly resistance can be found at 1.5383 (22/09/2015 low). Hourly support can be found at 1.5087 (05/05/2015 low). Stronger support can be found at 1.4960 (23/04/2015 low). In the longer term, the technical structure looks like a recovery. Strong support is given by the long-term rising trend-line. A key support can be found at 1.4566 (13/04/2015 low).

USD/JPY is moving sideways. The pair is still moving around the 200-day moving average. Hourly support is given at 118.61 (04/09/2015 low). Stronger support can be found at 116.18 (24/08/2015 low). Hourly resistance can be found at 121.75 (28/08/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF has broken the symmetrical triangle. The pair now targets hourly support at 0.9528 (18/09/2015 low). The pair still holds below hourly resistance at (25/09/2015 low). In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).

Resistance and Support: