- Bitcoin and Ethereum rallied yesterday after the better-than-expected CPI report.

- Increasing demand suggest a possible attack of the ATH for Bitcoin.

- Similarly, Ethereum may bulls now have their eye fixed on the $3300 level.

- Invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Bitcoin rallied yesterday along with other risk assets after the US Bureau of Labor Statistics released a better-than-expected inflation report for April.

If the bulls maintain their momentum and continue the upward movement, this could signal the end of the correction and a potential push towards the historical high, currently just below $74,000.

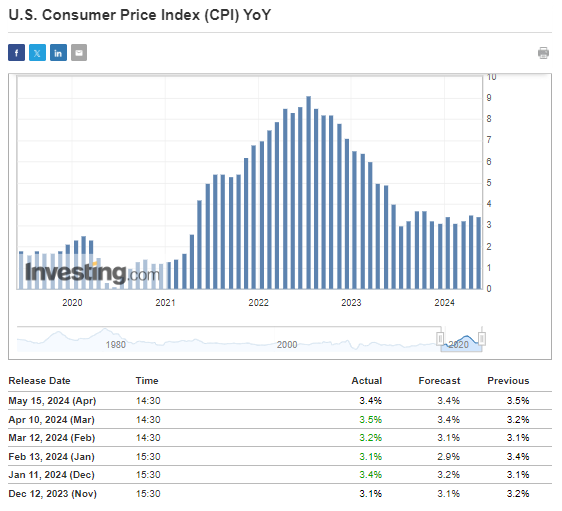

Market Rejoices Over Inflation Data Break

It is relatively rare for markets to respond so positively when final readings align closely with market expectations. However, this reaction is notable in the broader context of the last four inflation reports, which consistently exceeded forecasts. This latest report breaks that trend, contributing to the market's enthusiastic response.

Figure 1 Inflation data from the US

The market is clearly optimistic that, although the inflation target remains distant, we will not see a return to an upward trend in the near future. This also delays the possibility of extreme scenarios involving further interest rate hikes by the Fed. Currently, the probability of a first 25-basis-point cut in September has slightly increased and is now just above 50%.

Bitcoin Technical View: Clear Buy Signal After CPI Report

Since the beginning of April, Bitcoin's price movements have been within a broad corrective pattern, forming a wedge formation. Yesterday's surge in demand broke through the upper limit of this formation, signaling a potential continuation of the long-term uptrend.

Figure 2 Technical analysis Bitcoin

Currently, buyers are testing the local supply zone around the $67,000 price area. Breaking through this zone could pave the way for an attempt to reach the historical highs, with a potential pause near $70,000.

A negation of this bullish scenario would occur if the price falls below the support level around $63,000. This would provide sellers with the opportunity to test the lows formed in late April and early May.

Ethereum Technical View: $3300 Next?

Similar to Bitcoin, Ethereum also experienced a demand surge in response to the US data.

However, Ethereum is in a slightly different position, as we have yet to see a clear technical signal indicating a change in the current trend, and it remains much further from its historical highs.

Maintaining the uptrend will depend on the defense of strong support at $2900 and breaking above the local trend line, which could open the way to at least $3300.

There is an ongoing discussion about whether Ethereum will follow Bitcoin's path and see ETFs based on its spot price approved for trading. The first applications have already been filed, but signals from the SEC suggest a high probability of rejection.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $9 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - claim your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.