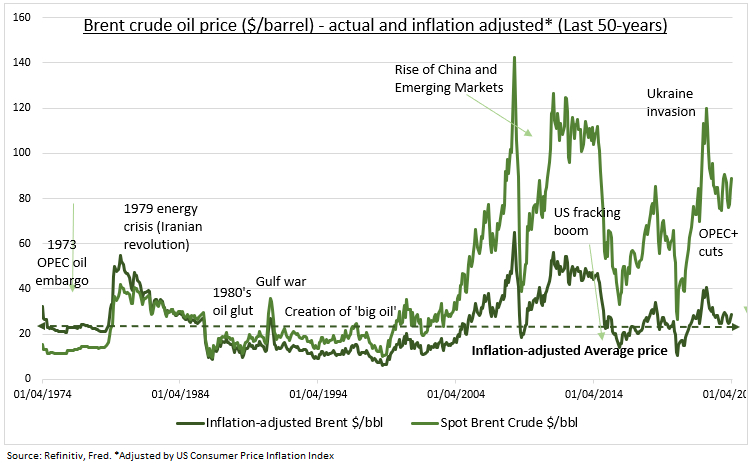

COMEBACK: Brent oil is near a six-month high $90/bbl. and the market is slipping into a deficit. Oil equities (NYSE:XLE) have started leading all sectors up. OPEC+ is maintaining its big supply cuts even as demand picks up. And geopolitical tensions and investor ‘inflation hedge’ demand add to the mix. It’s a recipe for a grind higher in prices and in inflation concerns, for now. But uniquely among commodities, oil prices may ultimately self-adjust. As OPEC+ unity frays and supply cuts relax. Whilst oil stocks may need a broader turnup in their profits outlook. Macro worries are lessened by falling energy intensity and low inflation-adjusted prices (chart).

OPEC: Yesterday’s oil cartel monitoring meet saw no change to its tough supply curbs. OPEC+ is holding back 3.66mbpd. from the market. With Russia and Saudi making an extra 2.2mbpd of voluntary cuts through June. This is equal to 5.5% of est. 2024 oil supply of 103mbpd. And offsetting surging non-OPEC supply, led by the US that is now by-far the world’s largest producer. This is driving the market into a fundamental deficit. As demand is being revised up with US growth exceptionalism and China’s incremental stimulus. A geopolitical risk premium is also rebuilding with latest surge in Mid-East tensions and Ukraine attacks on Russian refineries.

BIG OIL: Higher Brent, an M&A rebound, and shareholder friendly cash-return policies, made energy the top performing US sector in March and the 2nd best this year. Marathon Petroleum (NYSE:MPC) is among the top ten US stock gainers this year. Exxon (NYSE:XOM) up 2x the S&P 500. This has narrowed the sector 13x forward P/E valuation discount to the tech-laden S&P 500 to 40%. And widened the US valuation premium to Europe’s energy majors to 60%. Further sector gains will likely need to see a turnaround in the weakening earnings outlook. As 25-year low natgas prices and a depressed refining crack spread have offset the oil price recovery until recently.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Big oil makes a comeback

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.