Basilea (SIX:BSLN) announced strong H123 results, including revenues for Cresemba, and in August submitted a new drug application (NDA) to the US FDA for Zevtera. The company continues to engage in discussions with potential (in-licensing and acquisition) partners with the aim of re-filling the clinical development pipeline to bolster its portfolio of anti-infectives. Total Cresemba- and Zevtera-related revenue was CHF80.5m in H123 and grew by 57.2% from the previous year. We increase our valuation for Basilea to CHF797.8m or CHF66.6 per share (from CHF785.0m or CHF65.7 per share previously), largely driven by reduced net debt, foreign exchange considerations and rolling our model forward.

Cresemba payments continue to support revenues

Basilea’s lead product Cresemba continues to impress, with the antifungal therapy bringing increased milestone and royalty payments. The company received multiple milestone payments of CHF30.6m (versus CHF2.2m in H122) based on in-market sales from established markets. Cresemba royalties increased by 27% from the prior year to CHF36.7m, highlighting increased market penetration. We expect Cresemba sales to continue to drive top-line revenues with the recent launches in Japan and China, which management believes represent 25% of the global potential.

Next key catalyst: US regulatory decision on Zevtera

In August 2023, Basilea announced that it had submitted an NDA for Zevtera to the US FDA. Approval in the US will allow it to address the majority of the anti-MRSA market opportunity as the country represents more than 80% of the global antiMRSA antibiotics sales. Management expects a decision from the FDA in Q224, representing a major catalyst in our view. Basilea is also seeking a commercialisation partner for Zevtera in the US, which it aims to secure ahead of the regulatory decision.

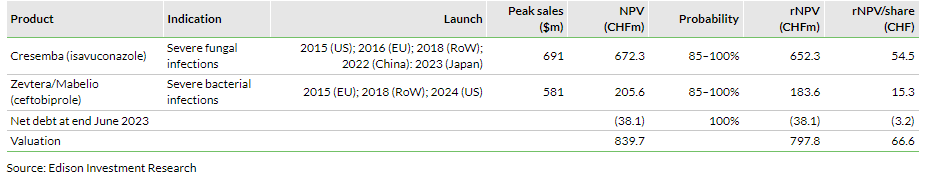

Valuation: CHF797.8m or CHF66.6 per share

We adjust our valuation for Basilea to CHF797.8m or CHF66.6 per share, from CHF785.0m or CHF65.7 per share previously. The adjustment was mainly driven by the combined effects of improved net debt of CHF38.1m at end June 2023, foreign exchange changes and rolling our model forward. Based on Basilea’s H123 results, we have made minor alterations to our FY23 estimates, although our long-term assumptions are unchanged.

Sustained success for Cresemba

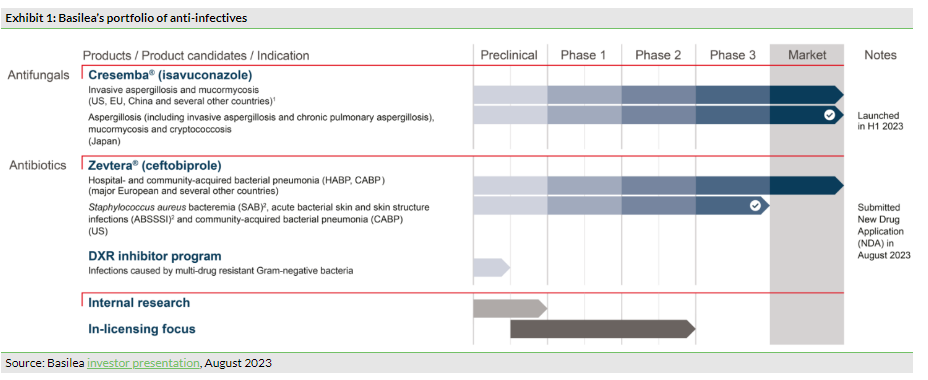

Heading Basilea’s portfolio of products is Cresemba (Exhibit 1), an intravenous and oral antifungal therapy for the treatment of life-threatening, invasive mould infections. Cresemba has been approved in 73 countries, is marketed in 67 countries and has orphan drug designation in the US, Europe and Australia. Sustained market appetite is driving continued sales momentum. H123 saw the successful launch of Cresemba in Japan, which we expect will contribute to a material sales push in H223. Additionally, we note that the company is planning to submit paediatric study data to EU regulatory authorities, which could extend Cresemba’s market exclusivity by two years to October 2027 in this region; the submission is planned for H223. A paediatric label extension is also planned for the US, with the potential to extend market exclusivity in the US by six months to September 2027.

Milestone and royalty payments drive revenues in H123

As recorded in Basilea’s FY22 results, sales of Cresemba meant the company achieved profitability sooner than expected, and this positive newsflow has continued throughout H123. In the first half of the year, Basilea reported a CHF20m milestone payment from partner Astellas for strong sales in the US (accounted in FY22 as milestone payment was based on FY22 sales), three further milestone payments totalling US$27.5m from Pfizer (NYSE:PFE) triggered by sales across Asia-Pacific, China and Europe, along with an additional CHF5m from Asahi Kasei Pharma for the launch of Cresemba in Japan. We note that the company expects about CHF33-34m in milestone payments in FY23, out of which CHF30.6m has already been recognised in H123. It is our opinion that, collectively, these milestone payments covering various regions highlight the commercial success of the antifungal therapy worldwide. Furthermore, Basilea also received CHF36.7m in Cresemba-associated sales royalties, marking a 27% year-on-year increase. In our view, this reflects impressive progress and demonstrates that Cresemba is playing an effective role in addressing an important medical need.

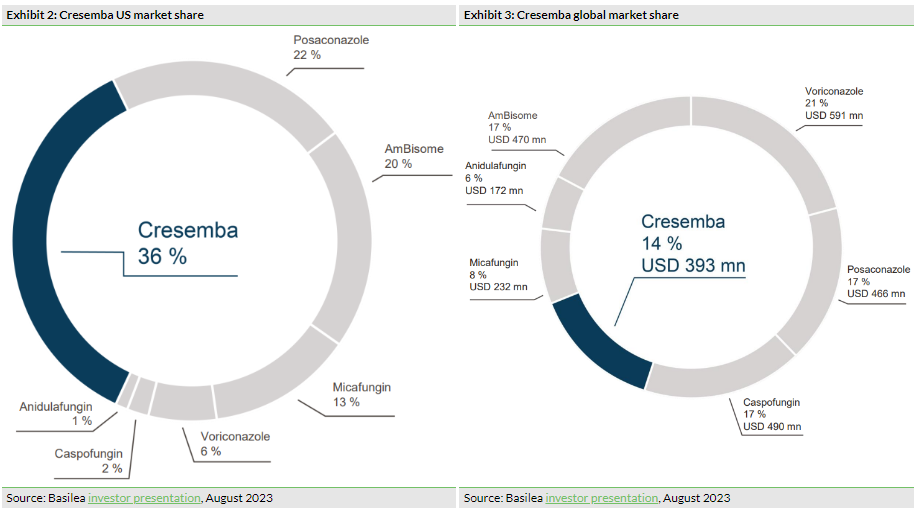

Cresemba market share is growing

In terms of value, Cresemba has become the market leader in the US (Exhibit 2). We note that it has a market share of 36% (according to IQVIA data, March 2023, as cited by Basilea) compared to competitor best-in-class antifungal therapies posaconazole, voriconazole, AmBisome, anidulafungin, caspofungin and micafungin. This has increased from 31% at end FY22, representing encouraging growth, in our view, as the US remains a key market. In terms of global sales, Cresemba has captured 14% of this wider market (according to IQVIA, March 2023, as cited by Basilea), up from 12% at end FY22 (Exhibit 3). We anticipate that this trend will continue through H223, as the company sees increasing contributions from China and Japan, for which Cresemba gained regulatory approvals in FY22. Management believes that these regions represent c 25% of the global market opportunity for Cresemba.

Approval of Zevtera in the US represents a key focus

Zevtera (ceftobiprole) is an intravenous antibiotic medication that has demonstrated rapid bactericidal activity against various Gram-positive bacteria such as Staphylococcus aureus (including methicillin-resistant strains, MRSA) and Gram-negative bacteria. While Zevtera is already marketed in selected countries in Europe, Latin America, the Middle East and North Africa, and Canada, the approval of Zevtera in the US is a key strategic priority for Basilea. This could represent a potentially lucrative commercial opportunity, as the global MRSA treatment market is predicted to be worth c $5.5bn by 2030 and with the US accounting for the majority of global anti-MRSA antibiotics by revenue (c 85%, according to IQVIA, March 2023).

US NDA submitted to the FDA for Zevtera

Post-period, in August 2023, Basilea announced that it had submitted an NDA for Zevtera to the US FDA. This came after a minor delay with one of the company’s contract manufacturing organisations requiring additional time to adapt its quality control systems prior to FDA inspection, a prerequisite for NDA review. We note that the FDA previously granted qualified infectious disease product (QIDP) designation to Zevtera, and hence the NDA is eligible for priority review (ie within eight months of submission). Therefore, Basilea expects a decision from the FDA in Q224, on track for a potential launch date for Zevtera in H224. We also note that Basilea plans to commercialise Zevtera in the US with a licensing partner, which management hopes to have signed before the regulatory decision. Furthermore, if approved by the FDA, the QIDP designation enables up to 10 years of market exclusivity in the US, representing a potentially lucrative opportunity, in our view.

Supported by three Phase III trials for three indications

For Zevtera, Basilea is seeking FDA approval for three indications: Staphylococcus aureus bacteraemia (SAB), acute bacterial skin and skin structure infections (ABSSSI) and community-acquired bacterial pneumonia (CABP). Hence, the IND submission is supported by positive results from three Phase III clinical trials: the ERADICATE study for SAB, the TARGET study for ABSSSI, and a Phase III study in CABP. In our view, these trial outcomes contribute to a strong data package for Zevtera in these indications, and we believe that the outcome of the regulatory decision could represent a significant catalyst for the company.

Valuation

Our valuation for Basilea increases to CHF797.8m or CHF66.6 per share, from CHF785.0m or CHF65.7 per share previously, mainly due to the combined effects of reduced net debt to CHF38.1m at end June 2023 (CHF46.7m at end-FY22), foreign exchange changes and rolling forward our estimates. Our long-term assumptions for Basilea are unchanged.

Exhibit 4: Basilea Pharmaceutica valuation

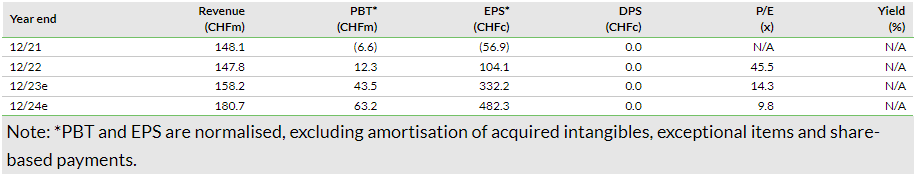

Financials

In H123, Basilea reported revenue growth of 47.3% y-o-y to CHF84.9m, mainly driven by higher revenue related to Cresemba and Zevtera sales. Total Cresemba- and Zevtera-related revenue stood at CHF80.5m in H123, 57.2% y-o-y growth, and was primarily associated with CHF36.7m in royalty income from Cresemba (27.0% y-o-y growth) and CHF30.6m from milestone payments (versus CHF2.2m in H222). Other revenue (including R&D reimbursements from BARDA) declined to CHF4.4m in H123 from CHF6.5m in H222, as the Zevtera Phase III study concludes, indicated by the recent NDA submission.

While cost of goods sold was down 33.0% y-o-y in H123, operating expenses excluding COGS decreased by 28.0% y-o-y in H123 to CHF38.0m. The decline in operating expenses was mainly driven by reduced R&D expenses, down by 42.2% y-o-y, reflecting decreased clinical activities related to the Zevtera Phase III programme and discontinuation of the oncology clinical programmes in FY22. SG&A expenses recorded a moderate increase of 5.9% to CHF16.5m in H123 (versus CHF15.6m in H122). All these developments resulted in Basilea reporting an operating profit of CHF36.9m in H123, compared to an operating loss of CHF10.0m in H122. Cash flow from operations for the period was CHF21.9m, contributing to cash and cash equivalents and restricted cash of CHF112.9m at end H123. At 30 June 2023, Basilea’s debt position stood at CHF151.1m including 2027 convertible senior unsecured bonds and a senior secured loan.

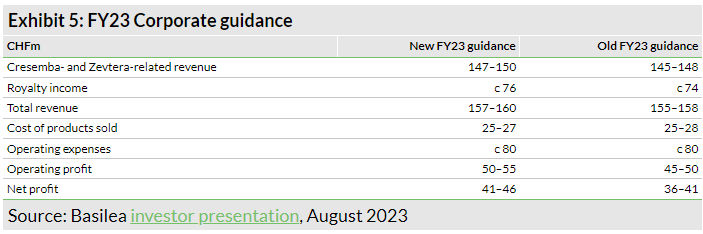

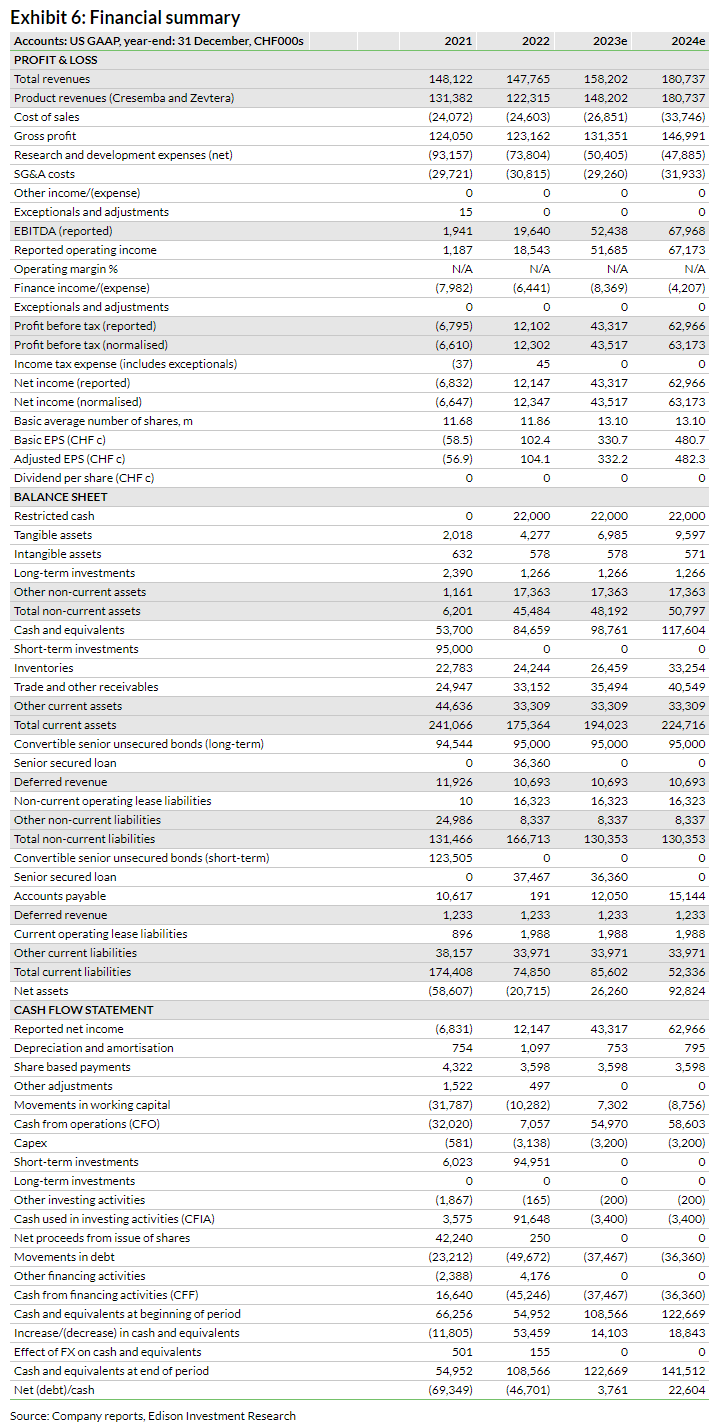

Along with the H123 results, Basilea has provided revised guidance for FY23. It now expects revenue to grow by 20–23% to CHF147–150m in FY23 (versus CHF145–148m previously). Operating profit and net profit guidance for FY23 is CHF50–55m (CHF45–50m previously) and CHF41–46m (CHF36–41m previously), respectively. Based on the new guidance, we have made minor adjustments to our estimates. We have slightly increased our revenue estimates for FY23 to CHF158.2m from CHF156.7m previously. Additionally, we have slightly adjusted our R&D estimate to CHF50.4m from CHF51.7m previously, resulting in operating expenses (ex-COGS) of CHF79.6m, in line with management guidance of c CHF80m. These changes translate into an operating profit of CHF51.7m in FY23 and net profit of CHF43.3m in FY23, again in line with company guidance. Similar to FY23, we have slightly revised down our FY24 R&D estimate to CHF47.9m from CHF49.1m previously, which is reflected in improved operating profit and net profit estimates of CHF67.2m and CHF63.0m from CHF66.0m and CHF61.8m previously.

For the full Edison report click here

-----------Disclaimer------------

|

General disclaimer and copyright This report has been commissioned by Basilea Pharmaceutica and prepared and issued by Edison, in consideration of a fee payable by Basilea Pharmaceutica. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services. Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations. Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors. Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest. Copyright: Copyright 2023 Edison Investment Research Limited (Edison). Australia Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument. New Zealand The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision. United Kingdom This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document. This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person. United States Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. |

|

London │ New York │ Frankfurt 20 Red Lion Street London, WC1R 4PS United Kingdom |

|